The Hong Kong Securities and Futures Commission

Who are the Hong Kong Securities and Futures Commission?

The Hong Kong Securities and Futures Commission – also known as the SFC – is an independent body charged with regulating the securities and futures sectors in Hong Kong. The SFC is a statutory body that was established in 1989, primarily as a response to the stock market crash of 1987. The futures and securities markets had largely been unregulated until 1974, when legislation was introduced to regulate the market for the first time. Following the crash of 1987, the Securities Review Committee released a report that recommended establishing an independent statutory body that would regulate the financial services sector in Hong Kong. It was officially established in 1989 and has been undergoing a number of reviews and improvements since then. The SFC is funded through fees and transactions levied on trading conduct within the region, allowing it to operate without the need for government funding.

Regulatory areas and powers

As part of its statutory powers, the SFC has a fairly broad range of regulatory powers to regulate the securities and futures market in Hong Kong. This includes both investigative and disciplinary powers, which enable it to fulfil its regulatory function. The SFC’s primary responsibility is to maintain, promote and encourage fairness, efficiency, transparency and competitiveness in the security and futures sector in Hong Kong. As such, its work typically includes developing and enforcing market regulations, investigating breaches of regulations, licensing and supervising financial services companies, supervising market operators (exchanges, clearing houses, brokerages, etc.), authorising investment products, overseeing takeovers and mergers, and helping spread public awareness about the financial sector. Additionally, it also has a role in developing SFC guidelines.

The types of financial services firms it regulates include brokers, advisers, managers and intermediaries dealing with the following financial instruments and products: securities, futures contracts, foreign exchange trading, automated trading and margin financing.

How to check if a broker is regulated by the Hong Kong Securities and Futures Commission

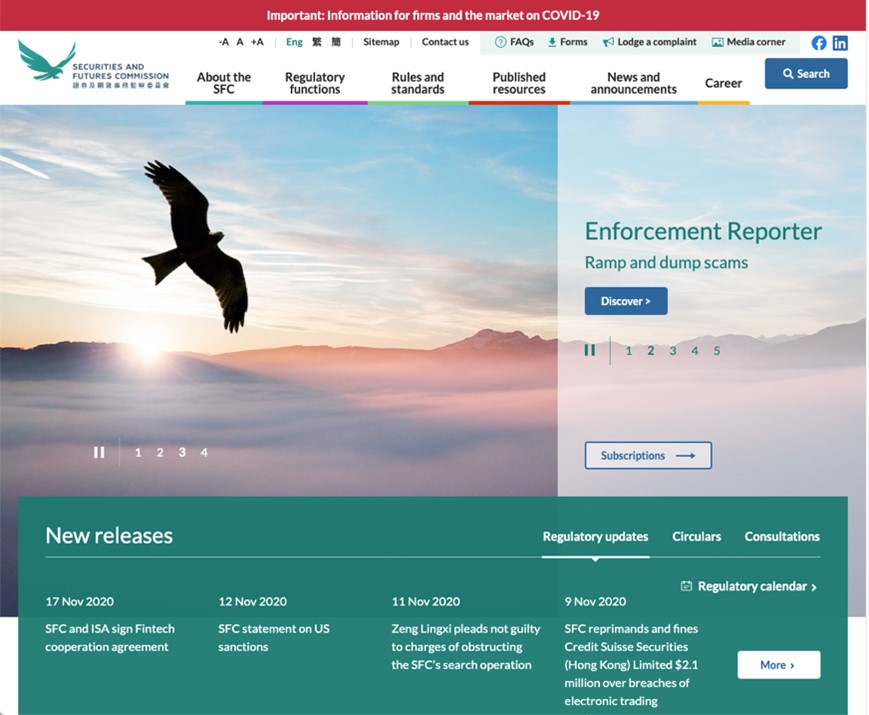

If you want to check whether a financial services company or individual is regulated by the SFC, you can firstly look for their licence number on their website or corporate documentation. If you can’t find this, you can then use a search facility on the SFC website, which will allow you to find individual companies. Additionally, you can submit email or phone queries directly to the SFC using information contained on the SFC Hong Kong website.

Making a complaint

As part of the SFC enforcement scheme, individuals can make complaints about the conduct of a financial services provider directly to the SFC. This could include complaints about the activities of firms and individuals licensed by the SFC to offer financial services. Additionally, complaints can be lodged against the SFC itself. To start the complaints procedure, simply navigate to the homepage of the SFC website and click the ‘Lodge Complaint’ link located on the top right-hand corner of the page. You will then be given a number of options depending on what type of complaint you want to lodge. For complaints against corporate entities regulated by the SFC, it is necessary to fill out a complaint form that requests details about the nature of the complaint. Once completed, you can either submit it electronically via email or by post. Additionally, there is a phone line you can use to submit a complaint.