The following is based on research by Colin Cieszynski, Chief Market Strategist at CMC Markets Plc (LON:CMCX).

For more of Colin’s research see CMC Markets’ website.

Colin Cieszynski, CMC Markets

Just ahead of the Super Bowl final on 5th February between the New England Patriots and the Atlanta Falcons, Colin Cieszynski assess how traders can expect global markets to behave following the landmark event, and crucially, the result.

Within this special report Colin Cieszynski focuses on:

- American football ‘touching down’ in London, particularly with rumours rife around New York Jets owner becoming US ambassador

- The historic relationship that exists between the Super Bowl winner and market returns over the rest of the year

- The likelihood of market rally in the event Atlanta are victorious, and why a New England win could ‘de-flate’ the market

The NFL in the UK

American football has become increasingly popular around the world, particularly in the UK where the number of regular season games being held each year in London is set to grow to four from three with games to be held at Twickenham Stadium and Wembley Stadium this year.

With the games becoming more popular and the Jacksonville Jaguars coming back for the fourth year in a row the potential of London possibly gaining a permanent NFL team has become a hot topic of discussion.

Moving an existing team could face political roadblocks. The last attempt to move an existing team out of the US failed miserably. A bid to move the Buffalo Bills to nearby Toronto ran into a lot of opposition from several groups including one led by Donald Trump, and eventually the team stayed in New York State.

The attractiveness of London for a potential expansion team, however, appears to be growing, and the path clearing. Los Angeles, formerly the number one expansion destination, is now off the list of candidates with two teams moving there, the Rams and Chargers. Meanwhile the Oakland Raiders are looking to move to Las Vegas striking another US destination off the list. I suspect a potential expansion to London could be twinned with another international city most likely Mexico City or Toronto.

On the other hand, the NFL could be content with providing a wide number of its teams with an opportunity for a UK trip each year. Rumours the owner of the New York Jets is a candidate for US ambassador to the UK which could keep talk of the NFL in London hopping for several years to come.

The Super Bowl and the Stock Market

Because the NFL’s Championship game, the Super Bowl, occurs early in the year it has long been studied by analysts and traders looking for any signs of whether the result has had any impact on market sentiment and if there is a relationship between the Super Bowl winner and market returns over the rest of the year.

For a time between the 1970s and the 1990s, there appeared to have been a correlation between teams from the original NFL winning and positive years for the Dow, when a big bull market coincided with a big winning streak for NFC teams.

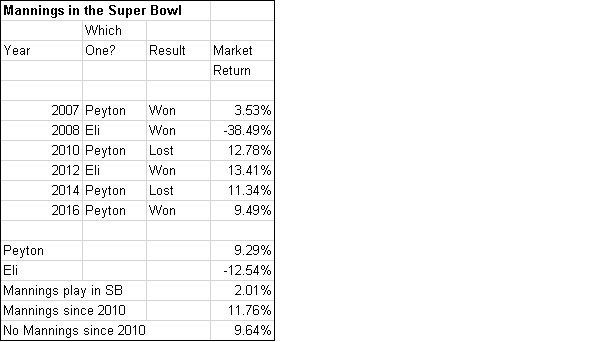

Although this relationship has disappeared in the 21st Century, comparing market returns following the 50 Super Bowls to date has uncovered some interesting results that traders may want to consider when deciding who to cheer for.

Peyton Manning and the Denver Broncos: Short Term Gain, Long Term Pain?

To think that at this time a year ago, things looked really bleak for the stock market. Stocks plunged at the start of 2016, bottomed out shortly after the Super Bowl, and rallied for the rest of the year, soaring to all-time highs, an incredible turnaround.

Source: CMC Markets

The markets have responded favourably in the past to Denver winning the Super Bowl and to Peyton Manning winning the Super Bowl. The combination of both winning the big game powered the Dow from 16,204 the Friday close before the game to a year-end close of 19,762 a huge 21.95% gain.

Source: CMC Markets

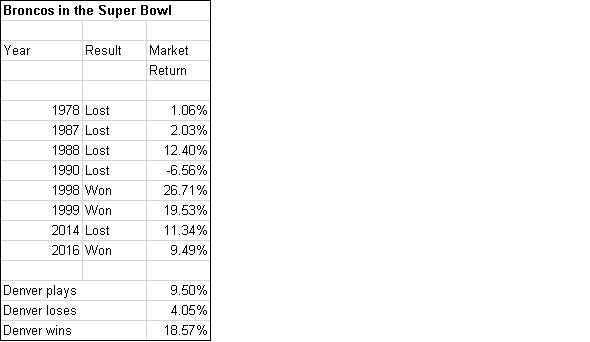

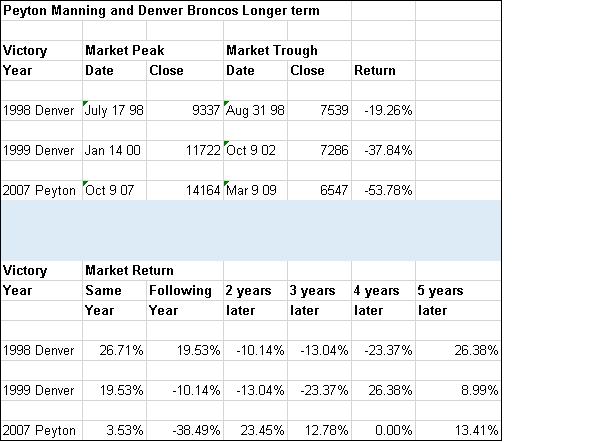

The longer term outlook of their big win, however, is stormier. The big rallies following Denver’s two wins in 1998 and 1999 coincided with the peak of a big bull market and followed by a three year bear market. Also, although 1998 ended up being a positive year, within the year the market plunged nearly 20% over the course of about six weeks so it was quite the ride that year as well.

Similarly, Peyton Manning’s one Super Bowl win in 2007 was followed a by a bull market peak a few months later but the start of a big bear that ran from late 2007 to early 2009.

At the start of 2017, the Dow rallied up to 19,999 and so far has been unable to breach the 20,000 barrier. With a new President coming in, one has to wonder if the positive market reaction to last year’s result could have been last call before another bear market comes long?

Source: CMC Markets

The above table shows the big bear markets that followed Denver’s two wins with John Elway at Quarterback. It also shows that a big bear market followed Peyton Manning’s first Super Bowl win. Could his career be bookended by a big bear market following his last Super Bowl win?

New England and Bill Belichick are back again, while Atlanta is relatively new to the field

This year’s matchup between the New England Patriots and Atlanta Falcons has mixed signals about what direction the market may move this year, but it suggest that there is a high potential for volatility and a potentially big move in one direction or the other.

The Atlanta Falcons have a short Super Bowl record. They lost their one appearance in 1999 which coincided with nearly 20% gain for the market but also the peak of a bull market. Markets have tended to react positively to appearances by NFC South teams with an average return of 16.9% over the four previous times a team from that division has made the big game and no meaningful difference between whether they won or lost.

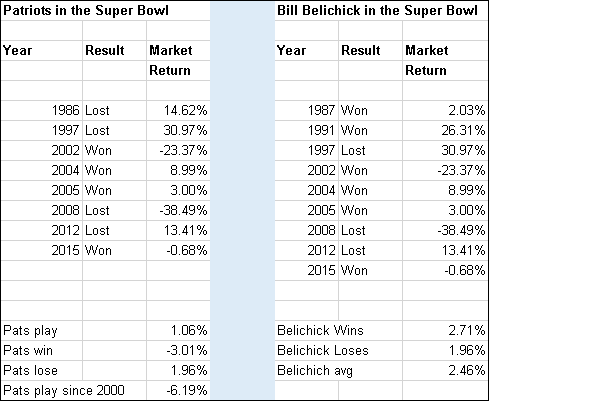

The New England Patriots and their coach Bill Belichick (who author George R.R. Martin refers to as “Evil Little Bill”), are very well known to traders. Their multiple appearances in the Super Bowl have coincided with a number of major moves in the markets over the years.

Source: CMC Markets

Looking at the averages, one might think that having New England or Bill Belichick in the big game is no big deal. A look at the year by year results shows that this could be a huge deal since the averages mask big swings in both directions.

For New England, just being in the big game could be a bearish sign as the market has dropped 6% on average in years where the Patriots have played in the Super Bowl since the turn of the century. During the Tom Brady dynasty years, the Patriots have won four of six times so far while the market is tied 3-3. Two of the years the Patriots have made the big game, 2002 and 2008 have coincided with major bear markets, an ominous sign.

Markets have also been volatile in years where Bill Belichick has coached in the big game both with New England and the New York Giants. Following his coaching appearances, the market has finished up 30% once, down 30% once, up 20% once and down 20% once.

Conclusion: What Super Bowl matchups could mean for the market in 2017

Based on the volatile reaction by markets to seeing New England and Bill Belichick in the Super Bowl, combined with the short-term positive, long- term negative reaction to last year’s win by Peyton Manning and the Denver Broncos, it looks like we could be in for a highly volatile for the markets this year. The bull market of recent years could be due for a setback. While signs are mixed over what direction the market may finish the year, there is a strong possibility of a 20% plus move this year.