On Tuesday, the U.S. Securities and Exchange Commission (SEC) brought charges against 11 brokers, one of which also practices as an investment adviser, for extensive and longstanding failure to keep electronic communications on point.

SEC acts against 11 firms neglecting electronic communications

In acknowledging the oversights, these firms forked out a combined $289m to pay their respective penalties as per the outline below.

- $125m penalty payable by Wells Fargo Securities LLC, together with Wells Fargo Clearing Services LLC and Wells Fargo Financial Network LLC.

- BNP Paribas Securities Corp. and SG Americas Securities LLC each paying penalties of $35m.

- BMO Capital Markets Corp. and Mizuho Securities USA LLC each paying penalties of $25m.

- Houlihan Lokey Capital, Inc. received a $15 million penalty.

- Moelis & Company LLC and Wedbush Securities Inc. each paying penalties of $10m.

- SMBC Nikko Securities America, Inc. received a $9m penalty.

Don’t miss out the latest news, subscribe to LeapRate’s newsletter

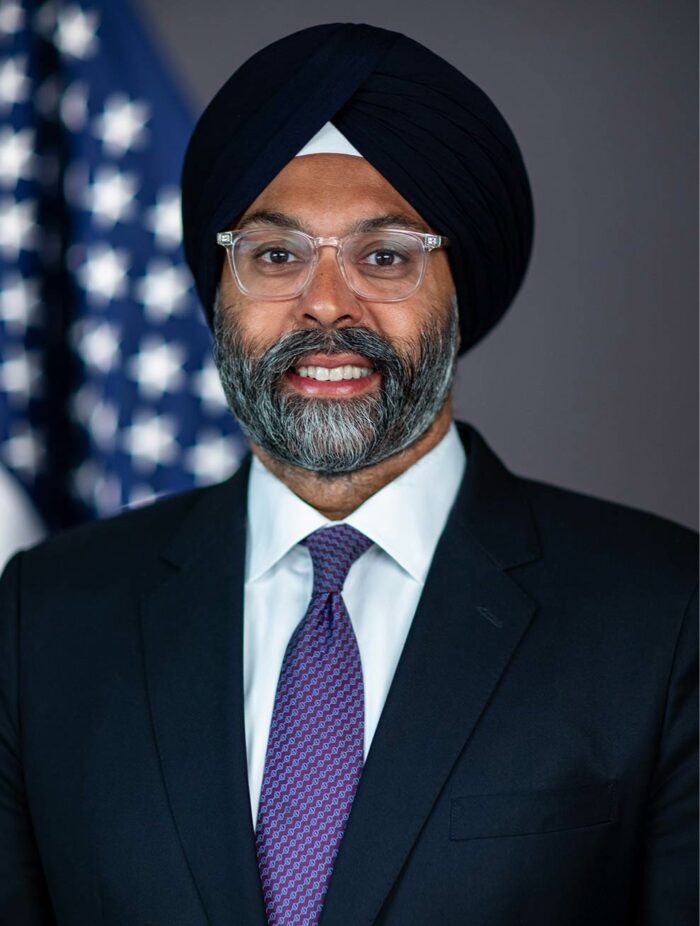

Gurbir S. Grewal Source: SEC

Director of the SEC Division of Enforcement, Gurbir S. Grewal, pointed out that firms should first get their houses in order through self-reporting, cooperating, and remediating than wait and see what happens when they come under SEC’s radar. Grewal stated:

Compliance with the books and records requirements of the federal securities laws is essential to investor protection and well-functioning markets. To date, the Commission has brought 30 enforcement actions and ordered over $1.5bn in penalties to drive this foundational message home. And while some broker-dealers and investment advisers have heeded this message, self-reported violations, or improved internal policies and procedures, today’s actions remind us that many still have not.