This article was written by Luis Aureliano, a business writer and financial analyst. With over 15 years of experience in global finance and an MBA in economics and management, Luis’s areas of expertise include business, marketing, communications, personal finance, macro economics, stocks and emerging markets.

Luis Aureliano

The management of credit is one of the most important financial undertakings. It all begins with your credit card account, regardless of your limit. Unlike the federal government, most households cannot run a deficit indefinitely. The mere notion of being buried in debt is an anathema to most people. Fortunately, there are failsafe ways to help you make timely bill payments, and manage your credit card effectively. All the while, it is important to safeguard the integrity of your ID and your personal information.

What steps can you follow to secure your standing with credit ratings agencies?

For starters, credit card companies advise clients to ensure that they have the right cards for their spending needs. Frequent flyers are better suited to cards with Voyager Miles and similar programs. There are credit cards for students, low-income earners and highflyers. In fact, major banks and financial institutions recommend that clients shop around for the very best deals. You certainly don’t want to be paying a hefty annual fee to maintain your credit card account with American Express if you can’t afford to do so. Keep your payments light, by opting for zero annual fees and the lowest possible interest rate repayments. Some cards even allow 1 month or several months of interest-free payments.

Keep a close eye on your credit card statements and keep receipts

Many folks are of the opinion that receipts are an unnecessary burden nowadays. Nothing could be further than the truth. Receipts are your way of assuring that the payments that are billed to your account were indeed yours. Perform a monthly accounting cross-check to ensure that you can vouch for all billing on your credit card statement. While you’re at it, check any changes made to your credit report.

There are 3 major credit ratings agencies in the world: Fitch Group, Moody’s and S&P. Report any fraudulent activity ASAP. Equifax and TransUnion typically provide you with a credit score, and they can also be contacted in the event of unusual activity on your account. You are advised to frequently check your credit online. It is the only way that you will know whether fraudulent activity is taking place. While you’re at it, set up mobile alerts to ensure that you can act swiftly when fraud takes place.

Get your hands on a chip card as soon as possible

Why? Chip cards are the latest and greatest innovation in credit cards. They are the best way to combat fraud and skimmers (handheld devices that capture your credit card information). For now, chip card merchants are small in number, but they will rapidly grow in 2017 and beyond. These cards have to be inserted into the POS and authorization has to be attained before the card can be removed.

Soon, you won’t have to worry about swiping your card or asking whether it should be inserted – chip cards are set to become the universal norm. According to industry analysts, over 60% of retailers will accept chip cards by March 2017. By the end of the year, that number will climb as high as 90% +. The detested skimmers are widely in use at gas stations around the US, Canada and beyond.

These devices are craftily installed on distant gas pumps (those that are located away from the convenience store). A good rule of thumb is to use processing terminals that are closer to the convenience store at gas stations. It is advisable never to use a debit card at a gas station, since that money cannot be recovered once it has been stolen. Credit cards still protect you against fraud better than any other means of payment. In other words, you will have zero liability regardless.

Manage your credit score effectively

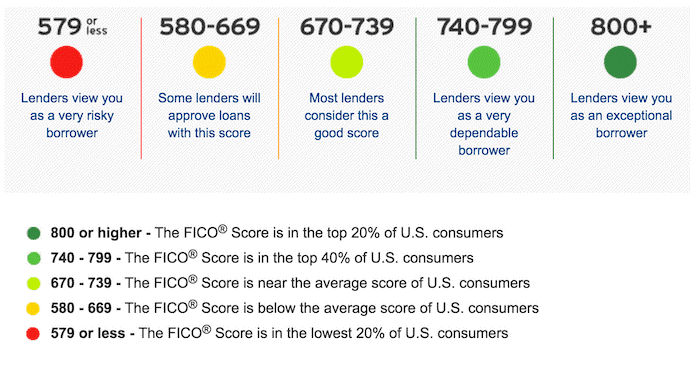

Did you know that your credit utilisation accounts for 30% of your FICO score? The less you use, the better your credit score. However, you have to strike the right balance between credit usage and not using your credit card at all. Other factors include how many credit card accounts you have, the length of time you have maintained those accounts, how many new accounts you have opened recently, and how many queries have been run on your credit.

Be careful with late payments, liens and other negative factors that will hurt your credit score. Try to maintain a comfortable distance from your credit limit – the interest repayments will be far less anyway. Your goal is always to make at least the minimum monthly repayment, or more to avoid hefty interest repayments.