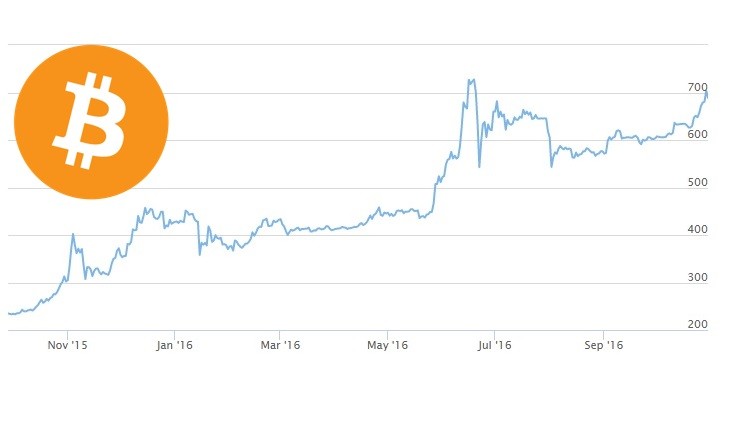

Bitcoin prices have been on a three month tear since early August, trading from the mid-$500’s up to above $700. As at the time of writing, the USDBTC pair was at $704, marking the first time Bitcoin has been above $700 since mid June.

Ignoring the aforementioned June price spike around the time of the Brexit vote, Bitcoin has been steadily rising since January, when it traded at about half the level it does now.

So what gives?

1. China

Well, a good portion of the ‘blame’ belongs to China, and the Chinese Yuan which has been slowly but steadily moving in the other direction – down. Although not as dramatic a price change, the USDCNH rate has continued to march upward from 6.2 early this year to about 6.8 now, a decline in the value of the Yuan of about 10%.

China and Chinese investors play a very important role in Bitcoin. With their currency losing value abroad, Chinese have been major players in bidding up Bitcoin as both a way to keep their store of value and to move their wealth out of the country.

2. Credibility

Another factor is simply time. The longer Bitcoin hangs around and remains relevant, the less worried investors become that it is just a passing fad. And, the more mainstream investors become interested in it.

The time-credibility equation is working very much in Bitcoin’s favor, especially as new cryptocurrencies pop up as the latest flavor every month or so, yet don’t really put a dent in Bitcoin’s lead.

The latest in the long line of quasi-imitators is now ZCash, which just launched last week promising fully anonymous and untraceable transactions. Sounds great, but also promises that big businesses and financial institutions will keep a distance because of the lack of transparency issue.

So, will Bitcoin stay above the $700 line this time for good? Or, are we still seeing up and down Bitcoin price cycles which may never end?

The US election should provide another test of Bitcoin’s viability as a safe haven non-governmental currency. We’ll see…