The following article was submitted by Michael Stark, market analyst at Exness.

The most important events this week for forex markets are the meetings of the Fed and the BoE on Wednesday and Thursday. Other key releases include GDP in the USA and various countries in the eurozone.

Last week’s most important scheduled event was the meeting of the ECB. The generally cautious outlook from the Executive Board led to some losses for the euro against most major currencies. Despite this, PMIs from Germany on Friday morning were unexpectedly strong, so the common currency managed to recover somewhat at the end of the week. The pound also had a boost from unusually good service PMI on Friday.

One of the biggest factors behind oil’s slump since last week has been the increasing death toll from the coronavirus in China. The virus has killed at least 80 people so far, with over 400 in critical conditions in hospitals, mostly in the Hubei province. Travel around the country is increasingly restricted, while it appears that markets are concerned about the likely economic impact of the virus.

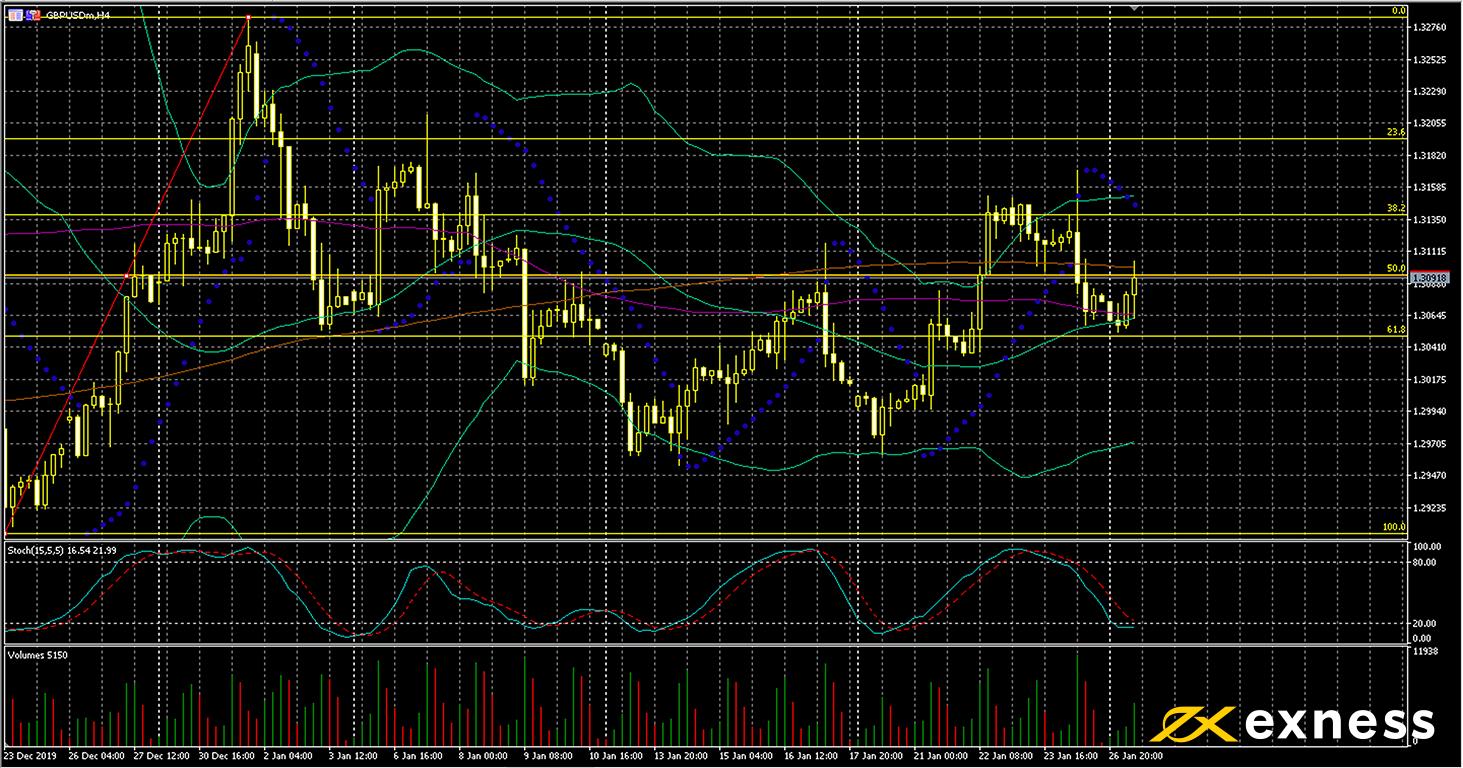

Cable, four-hour

GBP-USD has generally remained quite strong in January so far compared with the average over the past couple of years. $1.30 seems to be an important area of support on the four-hour chart. Flash PMIs from the UK on Friday morning gave the pound considerable fundamental support. Nevertheless, there remain many questions around plans for after Brexit, particularly whether the government can really negotiate a full trade trade with the EU in just 11 months before the end of the transition period.

Price is currently within the value area between the 100 and 200 SMAs. Generally there hasn’t been much clear direction this month, which makes sense with the confirmed date of Brexit on 31 January at midnight. The meeting of the Bank of England on Thursday at noon GMT is likely to spur the pound one way or the other depending whether the cut to rates materialises. A cut from 0.75% to 0.5% in the bank rate is still the consensus of most analysts. Wednesday evening’s meeting of the Federal Open Market Committee is also likely to bring some volatility for this symbol.

Key data points

- Tuesday 28 January, 13.30 GMT: American durable goods orders (December) – consensus 0.4%, previous -2%

- Wednesday 29 January, 19.00 GMT: meeting of the Federal Open Market Committee

- Thursday 30 January, 12.00 GMT: meeting of the Bank of England

- Thursday 30 January, 13.30 GMT: American quarterly GDP growth (Q4, advance) – consensus 2.1%, previous 2.1%

- Friday 31 January, 0.01 GMT: British Gfk Consumer Confidence (January) – consensus -9, previous -11

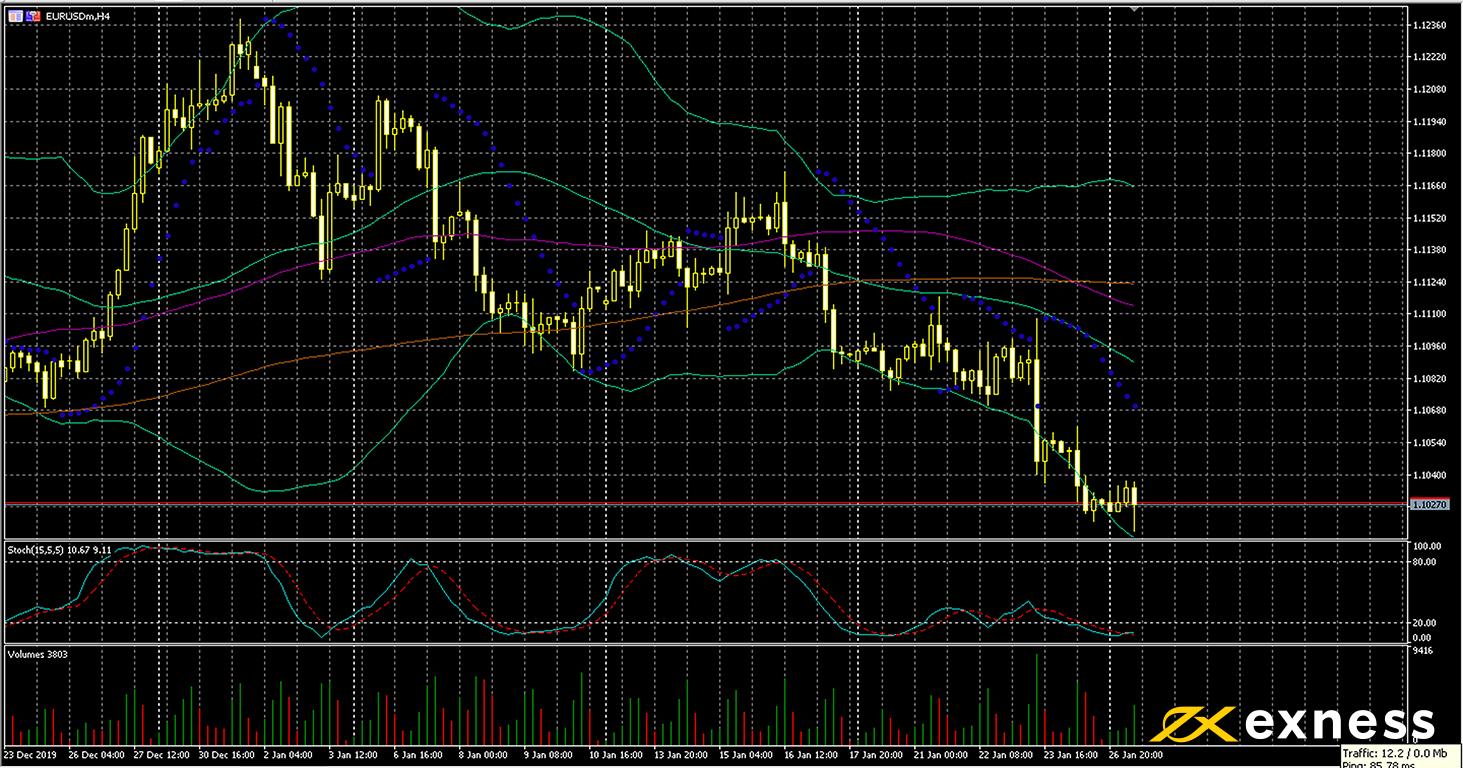

Euro-dollar, four-hour

The euro appears to have resumed its downtrend against the dollar in the aftermath of Thursday’s meeting of the European Central Bank. Despite good data last week from Germany, the eurozone’s largest economy, EUR-USD focused on the ECB’s caution. So far this week, the data from Germany has been less impressive. Ifo Business Climate for January this morning GMT was somewhat disappointing at 95.9, slightly lower than the previous release and more than a whole point lower than the consensus.

From a technical point of view it’s clear that selling saturation is in focus on this chart. That said, there’s still plenty of room for EUR-USD to fall further. Both the 50 and 100 SMAs death crossed the slower 200-period moving average last week and selling volume increased somewhat. Another big movement downward this week is not favourable unless the news from the Fed on Wednesday night is very negative.

Key data points

- Tuesday 28 January, 13.30 GMT: American durable goods orders (December) – consensus 0.4%, previous -2%

- Wednesday 29 January, 7.00 GMT: German Gfk Consumer Confidence (February) – consensus 9.6, previous 9.6

- Wednesday 29 January, 19.00 GMT: meeting of the Federal Open Market Committee

- Thursday 30 January, 10.00 GMT: eurozone business confidence (January) – consensus -0.2, previous -0.25

- Thursday 30 January, 13.30 GMT: American quarterly GDP growth (Q4, advance) – consensus 2.1%, previous 2.1%

- Friday 31 January, 10.00 GMT: eurozone annual GDP growth (Q4, flash) – consensus 1.1%, previous 1.2%

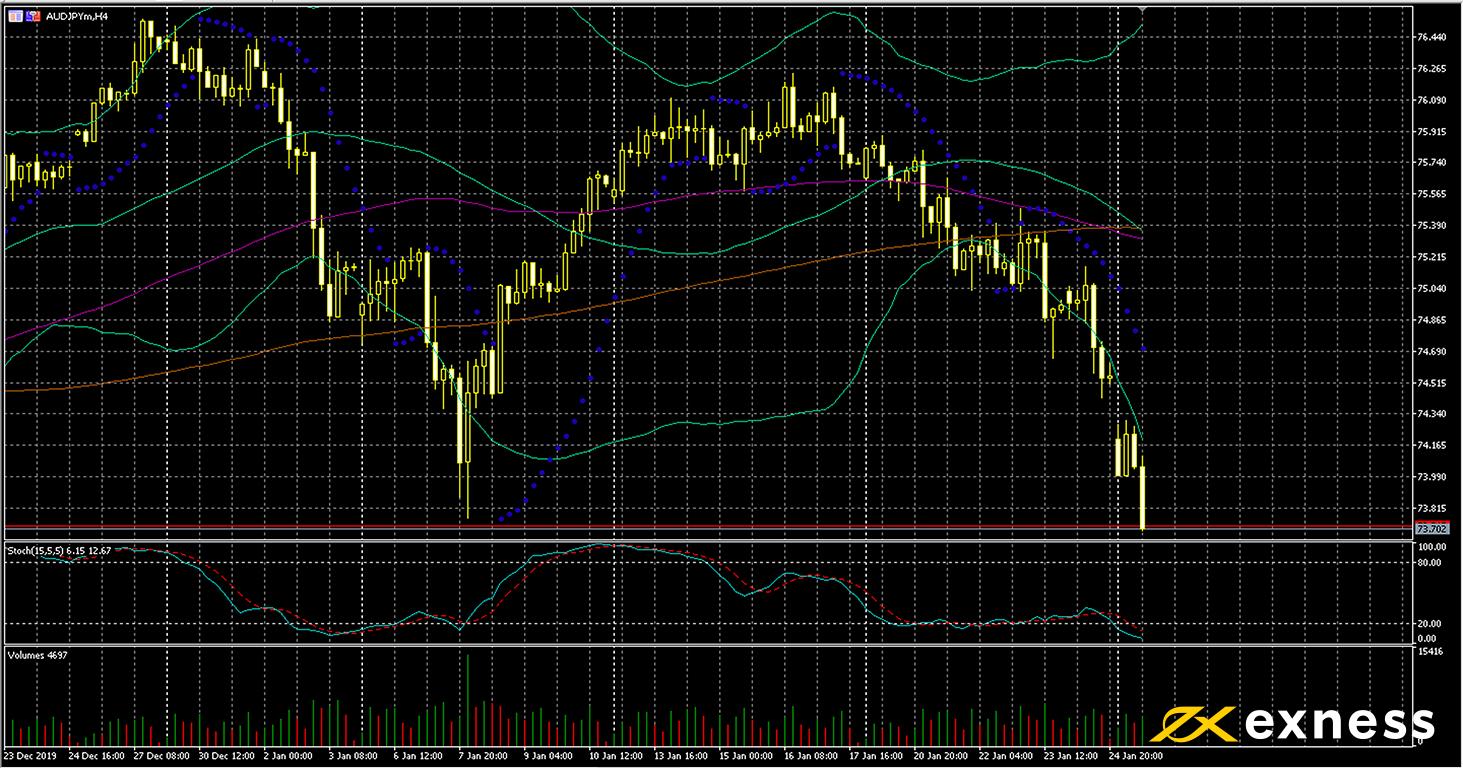

Australian dollar-yen, four-hour

The Aussie dollar has resumed its losses against the yen in earnest since last week. Despite gains for many Australian shares last week, general gloom prevails. Talk of printing money, weak growth, households not spending and so on has had a significant negative impact on AUD. The yen though, one of the most important havens, has mostly made gains as fears spread over the effect of the coronavirus on China and the outlook for growth generally. Westpac Consumer Confidence in Australia was also down last Tuesday night to 93.4.

This symbol is one of the most strongly oversold so far this week. This is likely to be the fourth successive four-hour candle to close outside Bands (50, 0, 2). The slow stochastic (15, 5, 5) is also clearly within oversold with the main line reading less than 7 at the time of writing. Selling in here would be very risky. Many traders will be waiting for the next meeting of the RBA on 4 February before committing themselves. This week’s data might still be important, particularly business confidence from Australia early tomorrow morning.

Key data points

- Tuesday 28 January, 0.30 GMT: NAB Business Confidence (December) – consensus 1, previous 0

- Wednesday 29 January, 5.00 GMT: Japanese consumer confidence (January) – consensus 40.8, previous 39.1

- Thursday 30 January, 23.30 GMT: Japanese unemployment rate (December) – consensus 2.3%, previous 2.2%

- Thursday 30 January, 23.50 GMT: Japanese annual retail sales (December) – consensus -1.8%, previous -2.1%

- Friday 31 January, 0.30 GMT: Australian quarterly PPI (Q4) – consensus 0.3%, previous 0.4%

Disclaimer: opinions are personal to the author and do not reflect the opinions of Exness or LeapRate.