This article was submitted by Michael Stark, market analyst at Exness.

The euro hit four-month highs against various currencies this morning as news from the EU’s summit remains fairly positive. Participants in relevant markets generally consider agreement likely this week; if a covid relief fund is agreed, the euro would be set for more gains in most of its pairs.

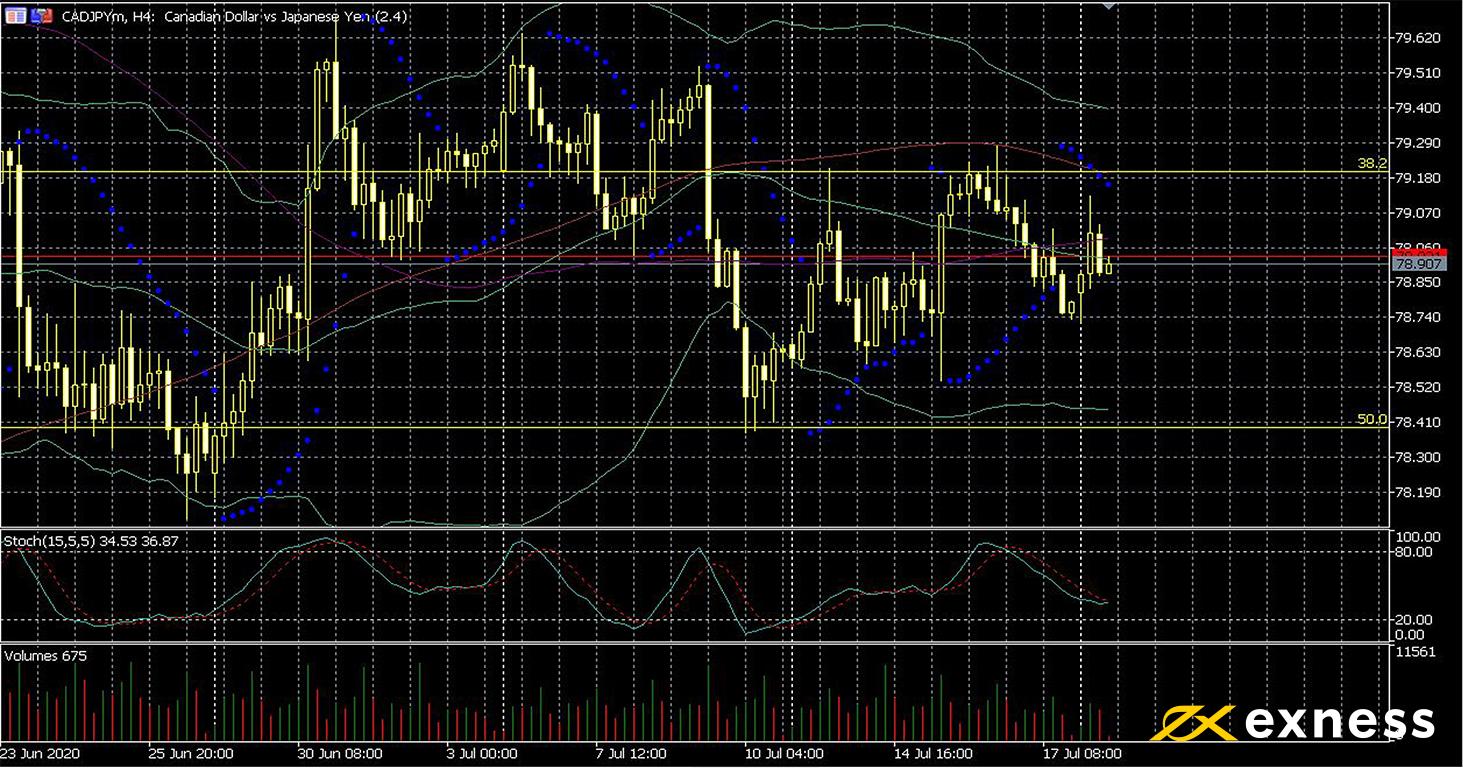

Central banks were fairly inactive last week, with the BoC and the ECB issuing unsurprising ‘wait and see’ statements in general, although there was some focus on continuing corona-related uncertainty. The BoC reiterated its commitment to provide stimulus for an ‘extended period’.

The central banks of South Africa, Turkey and Russia meet this week: the SARB is expected to cut its repurchase rate 0.25% to 3.5%. Meanwhile the CBRF could cut either 0.25% or 0.5% from its key rate, currently at 4.5%, according to variations in the consensus at the time of writing.

The most important regular data this week are Japanese and Canadian inflation tonight GMT and Wednesday respectively. Gfk consumer confidence is also due from Germany and the UK on Thursday.

Earnings season is in full swing in the USA: a number of major companies release their earnings reports this week, including IBM, Coca-Cola, United Airlines, Microsoft, Tesla, GlaxoSmithKline, Deutsche Bank, Amazon and Intel. Traders should prepare for volatility among American indices and possibly others as well over the next few days.

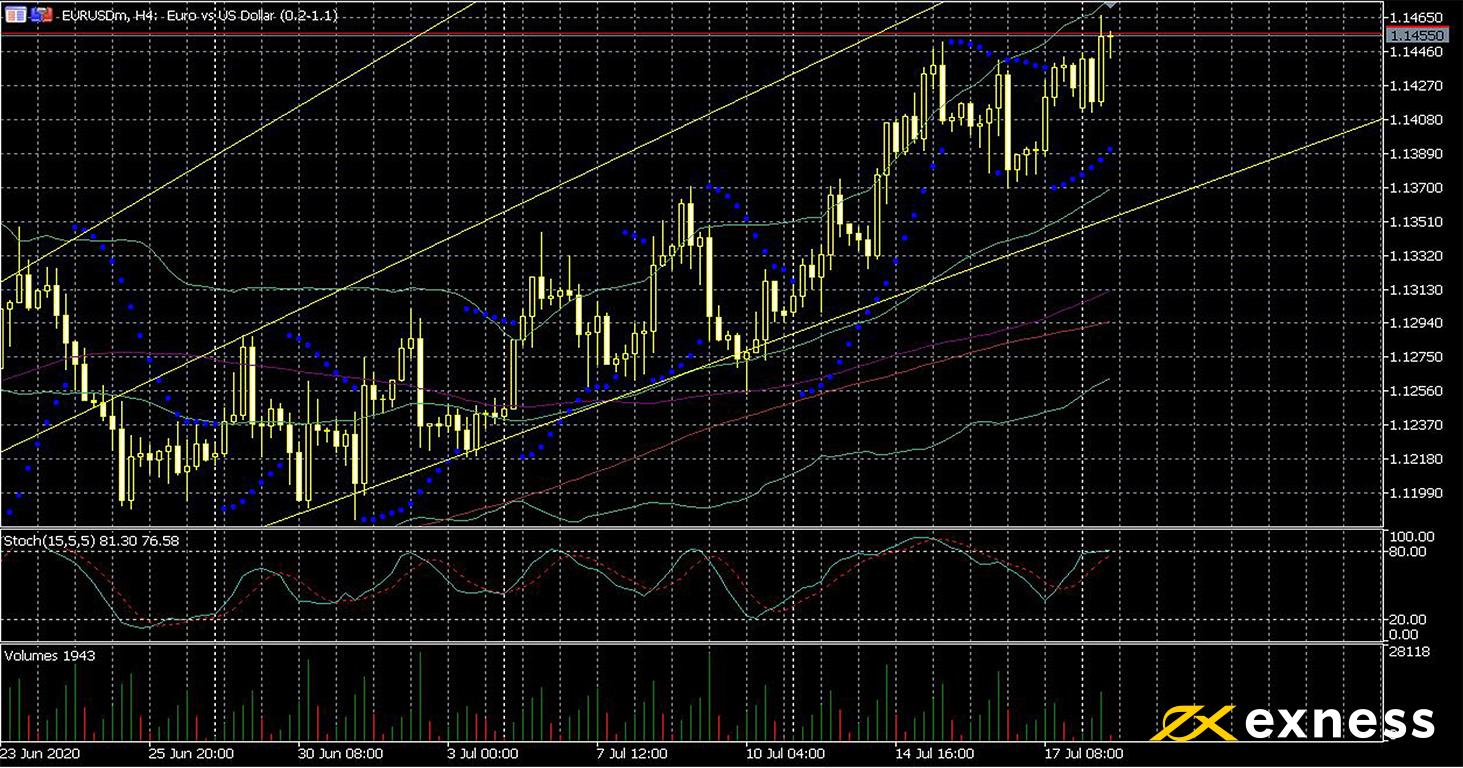

Euro-dollar, four-hour

The euro has shown considerable strength recently due mainly to expectations for an agreement this week on the anti-covid package of financial aid to struggling nations of the EU. The main sticking point so far has been the reluctance of the so-called ‘frugal four’ – Austria, Denmark, the Netherlands and Sweden – to accept €500 billion of grants to southern nations like Italy and Spain which have faced immense impact from covid-19.

A compromise seems possible, likely in the form of cutting the grants to less than €400 million, but questions remain around eligibility and enforcement of any pledges made by recipients. In the fairly unlikely event of a breakdown of negotiations, the euro has a long way to fall.

On the technical side of things, euro-dollar’s current uptrend seems to be quite healthy although it has now moved into overbought. Moving averages are positive and buying volume remains high. The 50 SMA from Bands which is now around $1.137 could be the limit of any retracement from overbought and the source of a new upward wave. This of course depends on the news from Brussels.

Apart from the critical EU summit, Germany is the focus of regular data from the EU, with confidence on Thursday and PMI on Friday. The USA’s weekly initial jobless claims on Thursday might play a role on the chart here but otherwise there’s no data from the USA this week likely to be important.