The following article was written by AMarkets, a St. Vicent & the Grenadines (FSA) regulated global forex broker established in 2007.

Summary:

- Developments in Catalonia have finally triggered some volatility, but this is not a systemic disruption.

- The ECB is leaning to the dovish side which has finally pushed the euro lower.

- The Fed is on track for another rate hike this year. The new chair debate is of a muted importance.

- EM currencies are in the middle of a corrective move lower, yet now reversal here just yet.

The market has run out of patience on Catalonia. After ignoring the issue for a whole month, investors have finally woken up to the regional risk. While we do not believe it will balloon into a problem like Greece back in 2011-2012, there are disturbing signs. The main reason for concern is the extremely strained relationship between Madrid and Barcelona. Spanish prime minister Mariano Rajoy has responded to the Catalan referendum in a very aggressive manner. Of course, this had to be the hardball politics. But the (ex?) head of the Generalitat Puigdemont is put into a position where he barely has anything to lose.

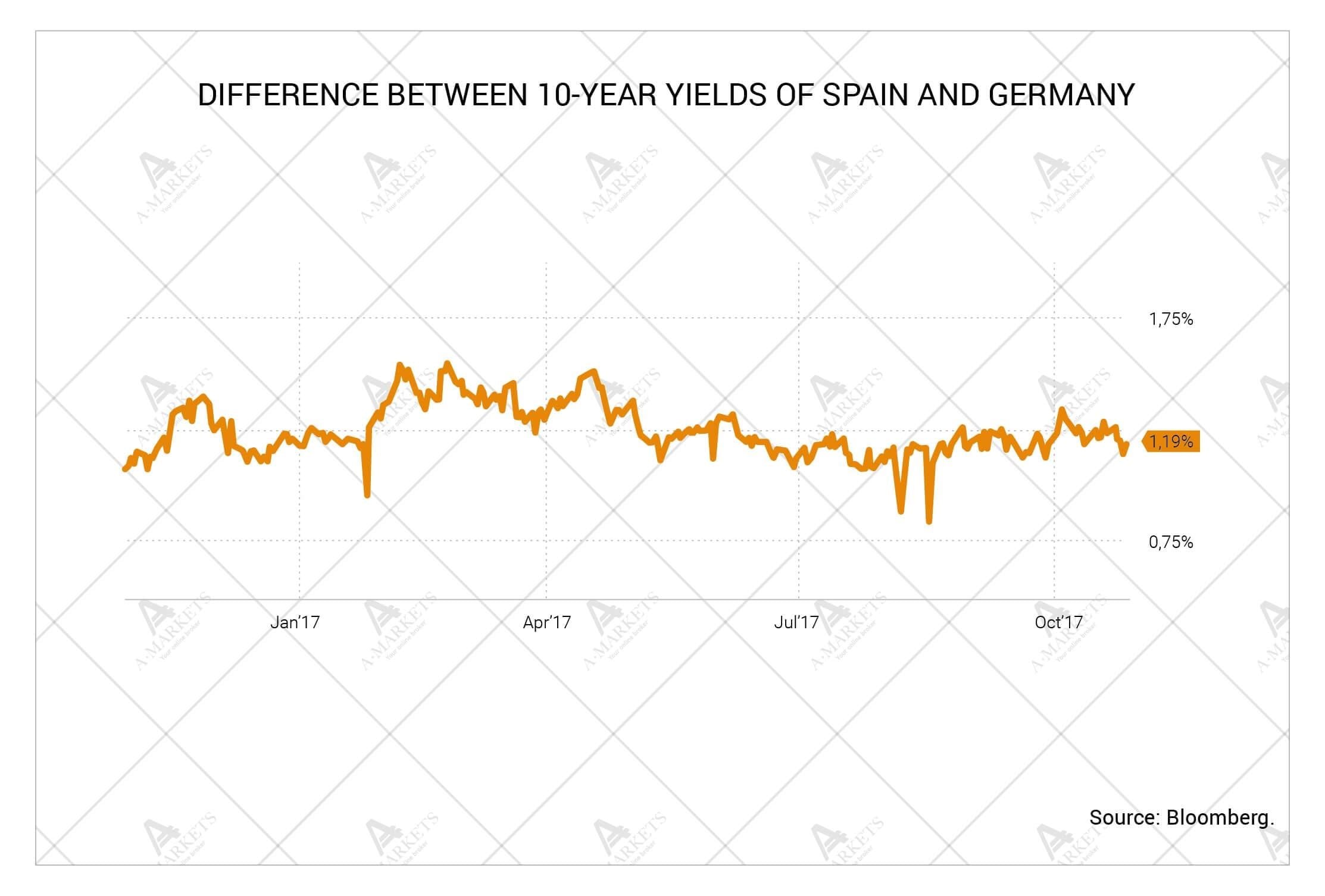

The developments will be important to the market, but not disruptive. Should the standoff continue, volatility is going to remain heightened (my modern terms), and the Spanish debt market might fall under some limited pressure. But we do not believe this will be a major issue though, for two reasons. First, the European Commission has stated that Madrid is the only partner for any dialogue. This means that a theoretically independent Catalonia will immediately be out of the EU and the eurozone. This is not exactly the will of the people and the aim of the uprising. This is also the principal difference to the Greece situation: Spain is not going anywhere, the problem is localized to a single region, albeit a large one.

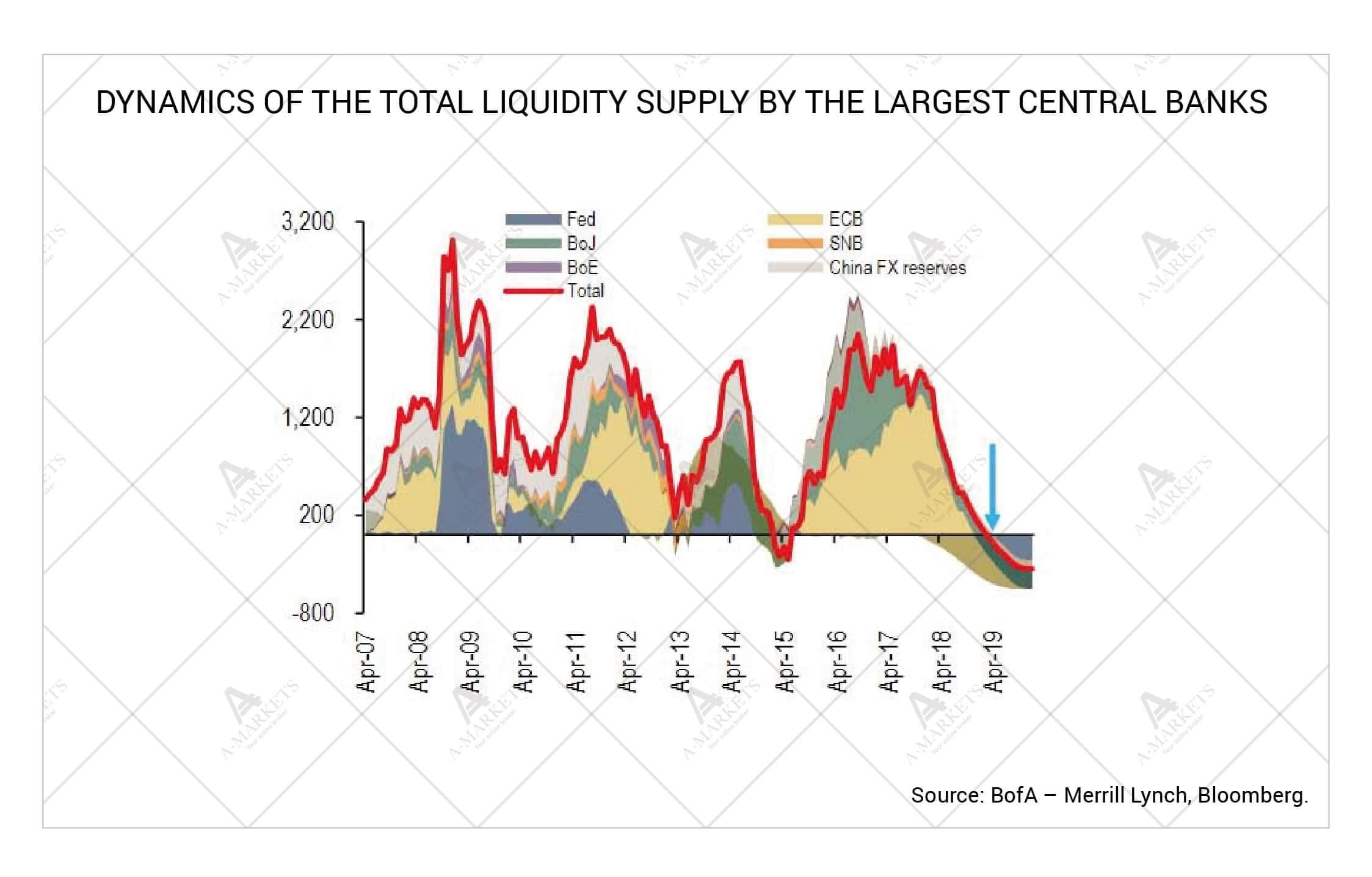

Second, the monetary policy of the ECB is set to remain highly accommodative. The central bank has finally laid out the details of how it’s going to wind up the QE, and it looks more like a continuation of the program, not the ending of it. Balance sheet expansion will continue through next September at the pace of 30 bln euro per month. Apparently, Mario Draghi has decided to fully utilize all the spare capacity. Purchasing 270 bln worth of paper over the course of 2018 implies that the ECB will have bought all the debt that was eligible. During the press conference, Mr. Draghi and Mr. Constancio both specifically stressed that the reinvestments will run long after that.

Just as a reminder, the ECB entirely absorbed corporate bond issuance this year, and bought a little more debt than the companies issued. The picture is similar to the government paper. Under this environment, it is highly unlikely that we are going to see any spread widening. And Madrid will become the main beneficiary of the QE. Certainly, had there been no central bank buying, Spanish debt would have already suffered quite a bit, and we would be seeing entirely different yields across the curve (and probably across peripheral markets). The speculation would be that without Catalonia the central government might not have enough budget revenues to pay off its debts. Yet the printing press is up and running, and speculative shorting in this market is useless.

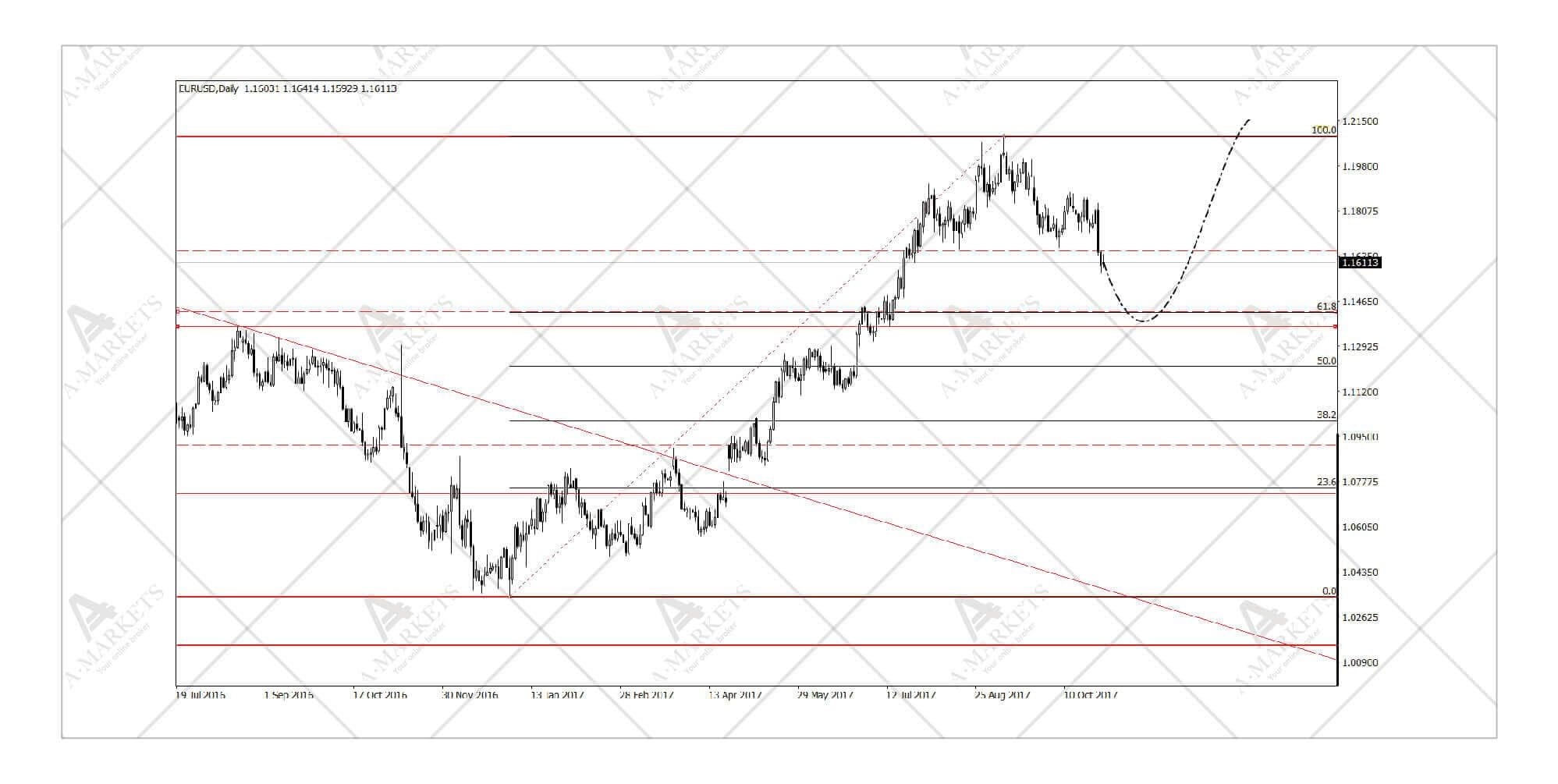

One way where we do see the influence is the EUR. While the central bank is likely to purchase all the Spanish debt that investors don’t want anymore, it is not present in the currency market. And once foreigners sell the paper, they are normally converting all the proceeds into other currencies, chiefly into the dollar. The euro is already seeing some selling pressure. EURUSD collapsed from 1.18 to 1.16 over the course of a couple of days, and this is likely a sustainable move. We have long expected the FX to converge with the rates market. The combination of a dovish ECB and a resurgent Catalonia is a good reason for the EUR to return to lower levels, where it really belongs.

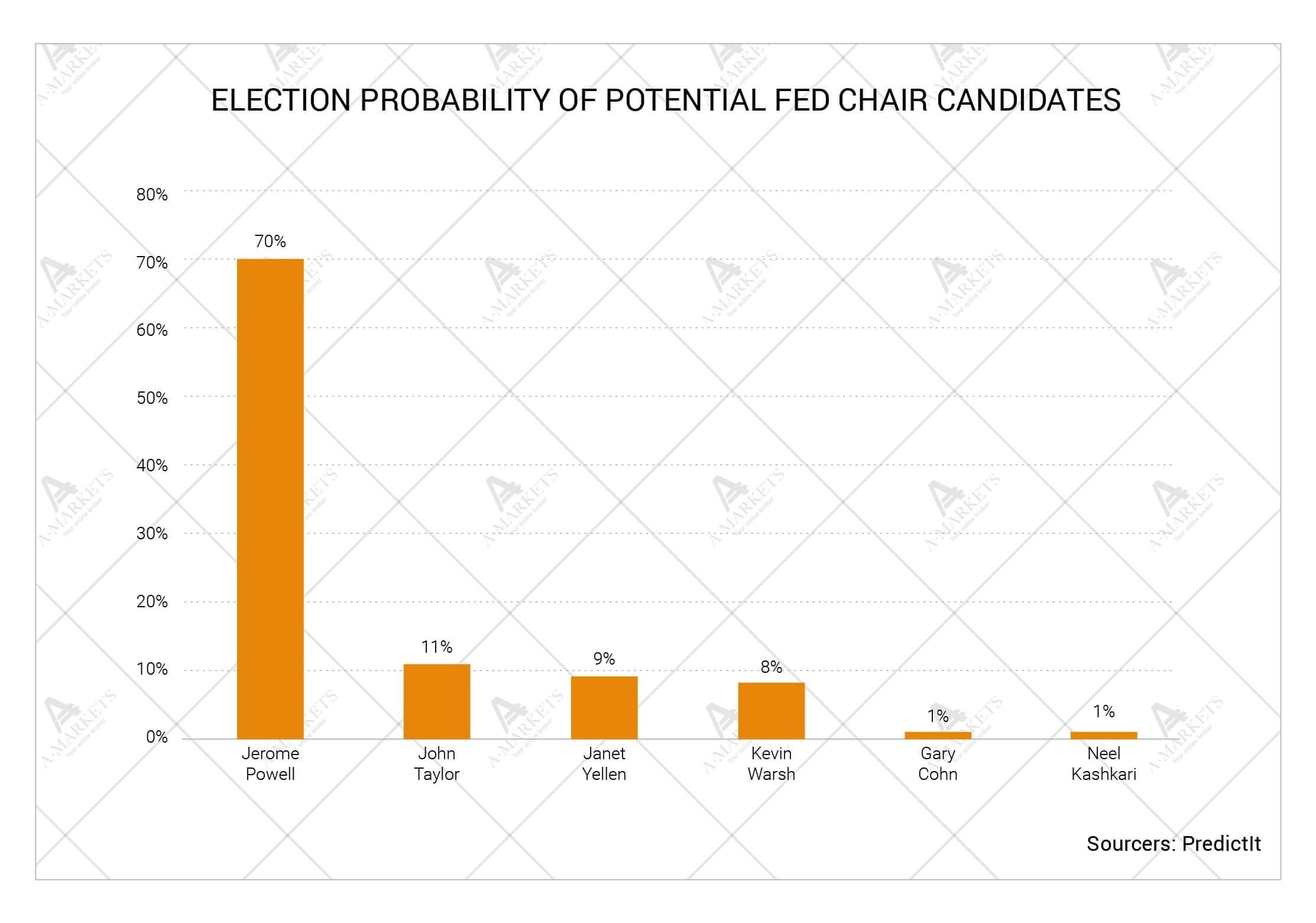

The other major issue is the Fed chair succession. The White House has communicated that the candidate will be announced this week (this has not happened at the moment of writing) before president Trump leaves for his Asian tour. The market views Jerome Powell as the likeliest successor, and we would generally agree. Also, to our judgment, Kevin Warsh has a much better chance than betting markets currently suggest. Admittedly, there were reports that he had dropped out of the race, but this information remains unconfirmed. Lastly, there are numerous reasons to believe that Janet Yellen will not continue her tenure.

We believe the three likeliest candidates are Jerome Powell, John Taylor, and Kevin Warsh. All of them are hawks, with John Taylor leading the pack. Therefore, whoever is approved by the Senate in January, the Fed’s tightening plans will remain on track. The risk is that the new head will push for ever faster policy normalization. But there is another fact of a truly outstanding importance: Donald Trump has the chance to hire the entire FOMC. The only president that appointed more people to the Fed was Woodrow Wilson, who actually signed the Federal Reserve Act in 1913. Because of the latest resignations and previous vacancies, Trump now can fill four seats on the Board, out of seven existing.

So the truly significant question is who will be picked for these slots. Judging by the president’s favorites for the chair, these might as well be hawkish policymakers, and that is something all the traders need to watch. A faster QE unwind or aggressive rate hikes can be damaging to the markets once the economic background is not as stellar. Also, USD shortages in the global system have been occurring over the past 3 years. So far this had to do with the changes in banking regulations after the 2008 crisis. However, if the FOMC turns excessively hawkish next year, it might add to dollar supply issues, and therefore, trigger dollar appreciation.

The theme of the FOMC succession is going to be more important near-term than the actual Fed meeting. It is taking place this week, and likely to prove quite boring. The next move on the rates will most probably occur in December, once the committee has more information on how balance sheet wind down affects markets. Strategically it would be wise to wait until longer-term yields shift higher before pushing up the short end of the curve. The governors will want to avoid yield curve inversion as it dramatically alters incentives of the financial sector. Also, the phenomenon has historically served as the flashing sign that always indicated an upcoming recession, and the Fed wants to be very careful when it comes to market expectations under ZIRP.

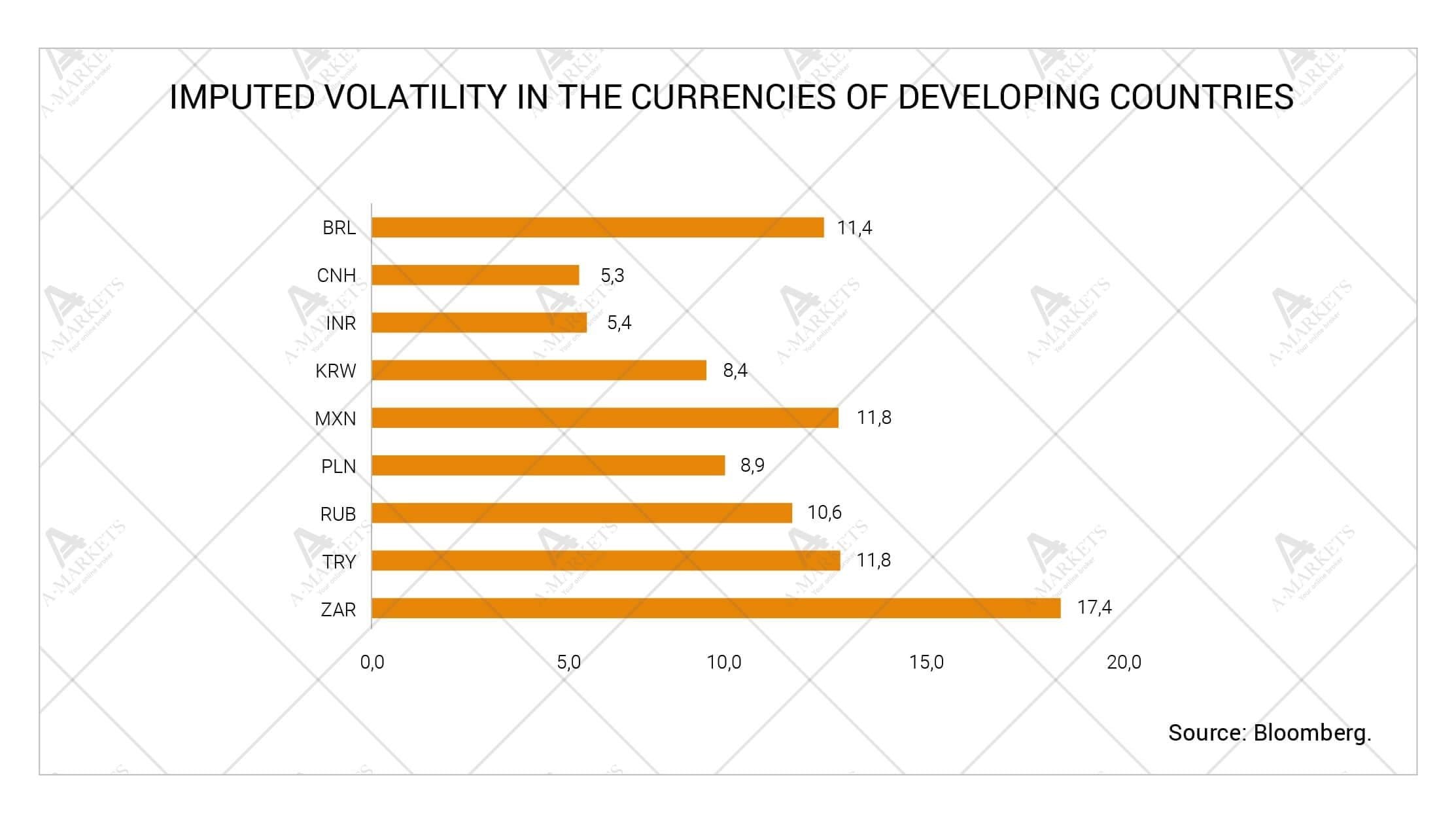

Beyond the Fed and the ECB (or the dollar and the euro), the world has not really changed much. Emerging market currencies finally went into a localized corrective mode, which was long overdue. We expect this to be a mild and very slow drift down. The main cause that is keeping investors away from risk is short-term uncertainty surrounding Spain and the Fed. These could have been ignored, say, two years ago. But EM assets have gone a long way up and are currently trading at very rich levels. The trade-off between risk and potential gains is keeping real money at bay. Once prices correct lower buyers are very likely to return.

One significant change that occurred last month was the shift in the Bank of Russia policy stance. BoR announced that it was moving from moderately tight to neutral monetary policy. From the practical viewpoint, this means that the terminal rate might prove lower than previously thought, and that market yields are firmly headed south. If the central bank remains in a mode of slow successive cuts of 25 bp, this nearly guarantees a low-volatility regime for the rouble. Even if some capital outflow occurs, most foreign investors will want to hold onto their existing RUB positions. They are also willing to keep the exposure in the face of the potential introduction of further sanctions. If one assumes the toughest scenario – a complete ban on investing in the Russian government debt, it makes sense to preserve the portfolio in its current shape and volume. It is one of the safest and yielding much higher than most other assets. And there is the option to hold onto your paper, as any sanctions would only affect new bond issues and new investments.

In the commodities universe, we are still witnessing firm demand. As October was approaching its end, the demand shifted from industrial metals complex to the energy sector, and primarily oil. In previous editions of this publication on several occasions, we mentioned the historical relationship between copper and crude. “Dr. Copper” is usually the first asset to go up as the real sector of the global economy heats up, and oil gets the relay second. We expect the current leg up to stop around $62/barrel, as industrial metals are exhibiting signs of exhaustion (and they are normally leading in this respect as well).

Last but not the least, a few words on the current market dear – the cryptocurrencies. The segment survived through October without any major events and generally keeps on going up. As it is normally the case in an illiquid and underdeveloped market, price trends are generally strong and volatility’s high. Earlier we gave our estimates as to how high this is going, and there is clearly space for this bubble to balloon. As a quick reminder, from a technical viewpoint, Bitcoin targets levels around $7130. Can it higher? Absolutely. But this party will not last, and we keep on warning our valued customers to lock in any profits and put their greed to rest.

EURUSD: going to where it belongs.

We will sell bounces into the 1.1655 area targeting 1.144, stop-loss at 1.1710.

The euro has finally peaked and went into a full-speed corrective mode. The main driver behind this development is the fundamental deviation of the exchange rate from its equilibrium levels. In practice, this means that the difference between U.S. and German yields have become so large that the capital is diverted away from the European markets, and the euro is suffering from the outflow. Analysts at Goldman Sachs have done an excellent job of studying historical relationship between rates and FX, and we strongly recommend those interested to get familiar with the research.

We simply want to point out that the news flow was rather what pushed the EUR over the tipping point, but not a real issue for the common currency. Once the market balances out, the Spanish theme will fade away, and speculations on eventual ECB policy tightening shall resurface. Before then, though, EURUSD will likely make another leg lower. The 1.141-1.144 area is a very strong attractor, with multiple targets positioned there. The price activity will then be indicative of whether the underlying uptrend has chances to reemerge.

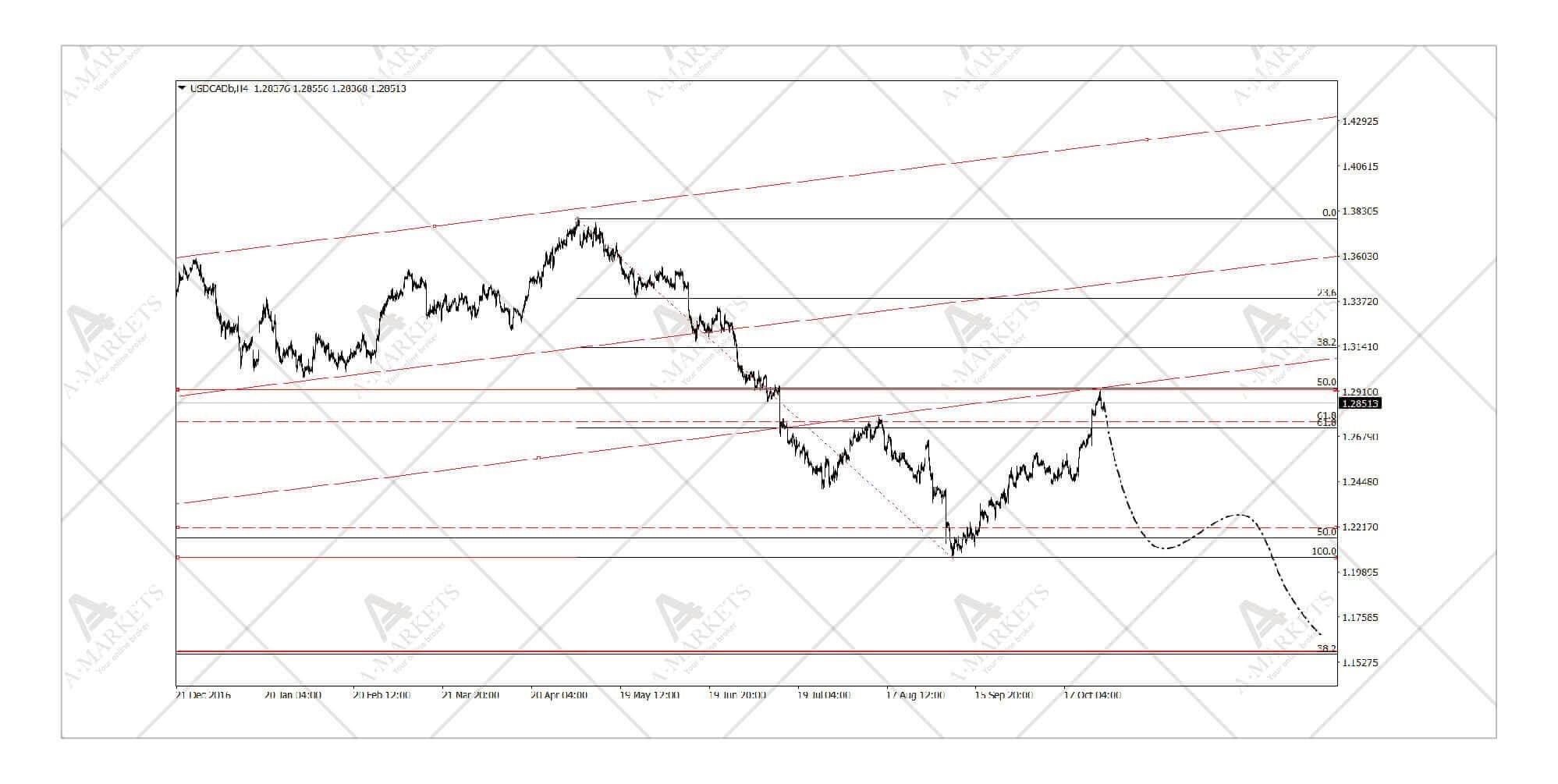

USDCAD: wildly diverged from oil.

We sell USDCAD at the market (ref. 1.2855) targeting 1.221, stop-loss at 1.293.

The Canadian dollar has performed quite poorly. The loonie has basically acted as a regular EM currency pressurized by the strength of the U.S. dollar. USDCAD has tested the 1.29 mark which is slightly above the corrective target outlined in the previous edition of the publication. Generally, however, current developments go against normal price activity, and we expect them to reverse. Fundamentally, levels slightly below 1.2 would be appropriate, and once the general corrective period ends, the unit will likely return to the lows of the year.

Yes, by the “general corrective period” we are also referring to the move down in EURUSD. The latter surely has room to go lower, but EURCAD also looks fragile. Therefore, we are inclined to sell USDCAD at the spot, not really seeing much upside from here. Another advantage of getting exposure to the loonie is a very tight stop with a fairly remote target. The risk/profit ratio seems very attractive.

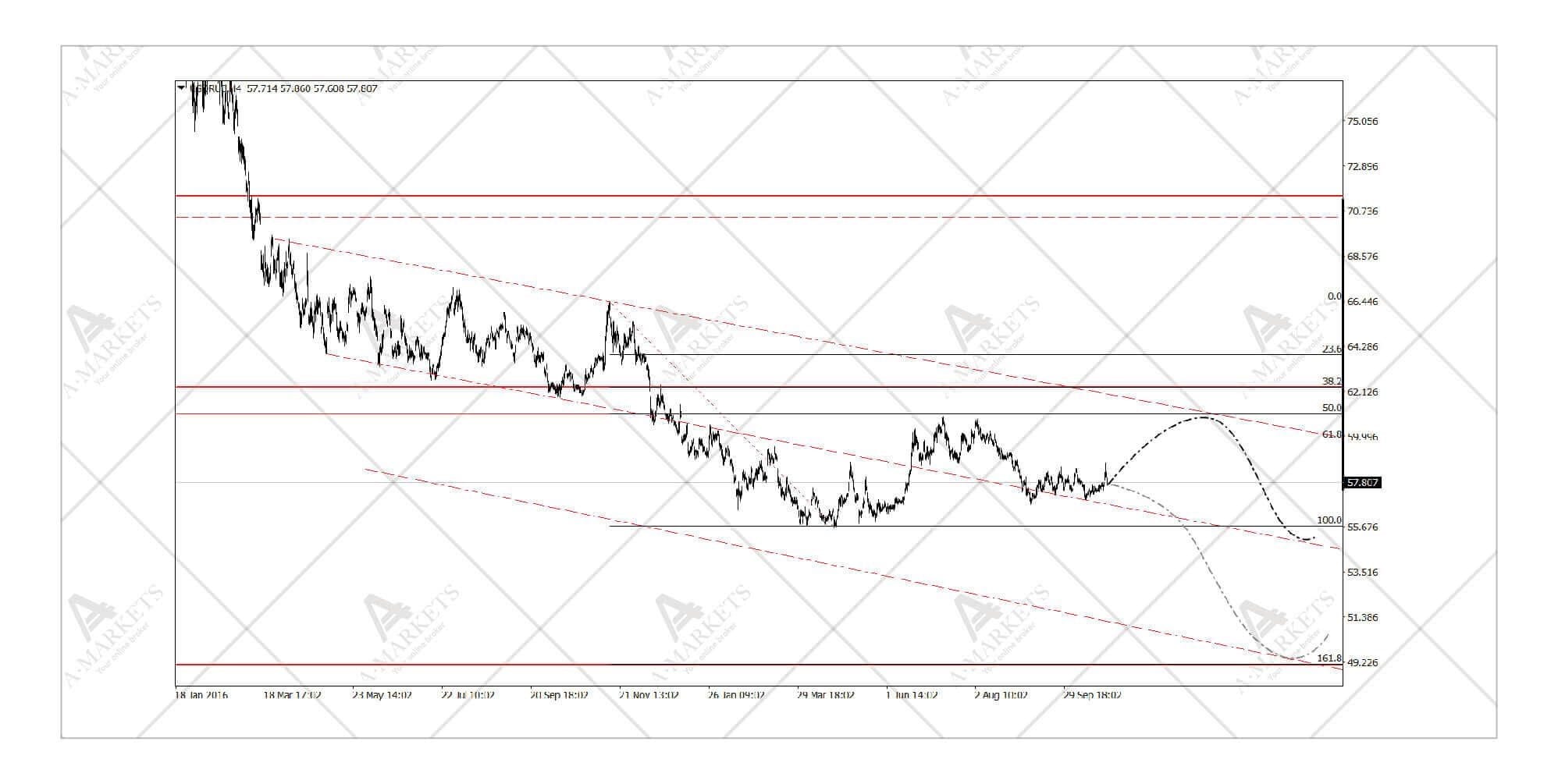

USDRUB: same story of relative underperformance to oil.

We sell USDRUB at the spot (ref. 57.9) and go short Brent oil (UKOIL, ref. 60.24), targeting UKOIL*USDRUB at 3220.

Just like the Canadian dollar, the Russian ruble has massively underperformed and been completely ignorant to the strong rally in crude. The currency is poised to regain part of the ground unless oil prices retrace lower. A barrel of oil is currently worth around 3500 rubles, which is nearly two standard deviations above the mean (calculated using data from 2014 to present). Given that fiscal and monetary stability in Russia is currently a top priority, the market is highly unlikely to remain at the current levels.

There is, of course, the scenario where oil prices simply give up a part of their recent gains. This, in our view, would not affect the ruble, just it like the crude hasn’t done on its way up. Taking on this synthetic position also implies going long a high-yielding currency, and, therefore, can be carried over a longer time period. We estimate that the market will return to normal levels of around 3200 rubles per barrel by the end of January. Also, on a note, we do not assign a stop-loss to this position. Regular risk management says that the order would need to be placed around 3660. However, this is a trade of statistical arbitrage in a fairly stable asset. The highest level ever achieved was 4200, and we would rather add to the position should the deviation grow larger.

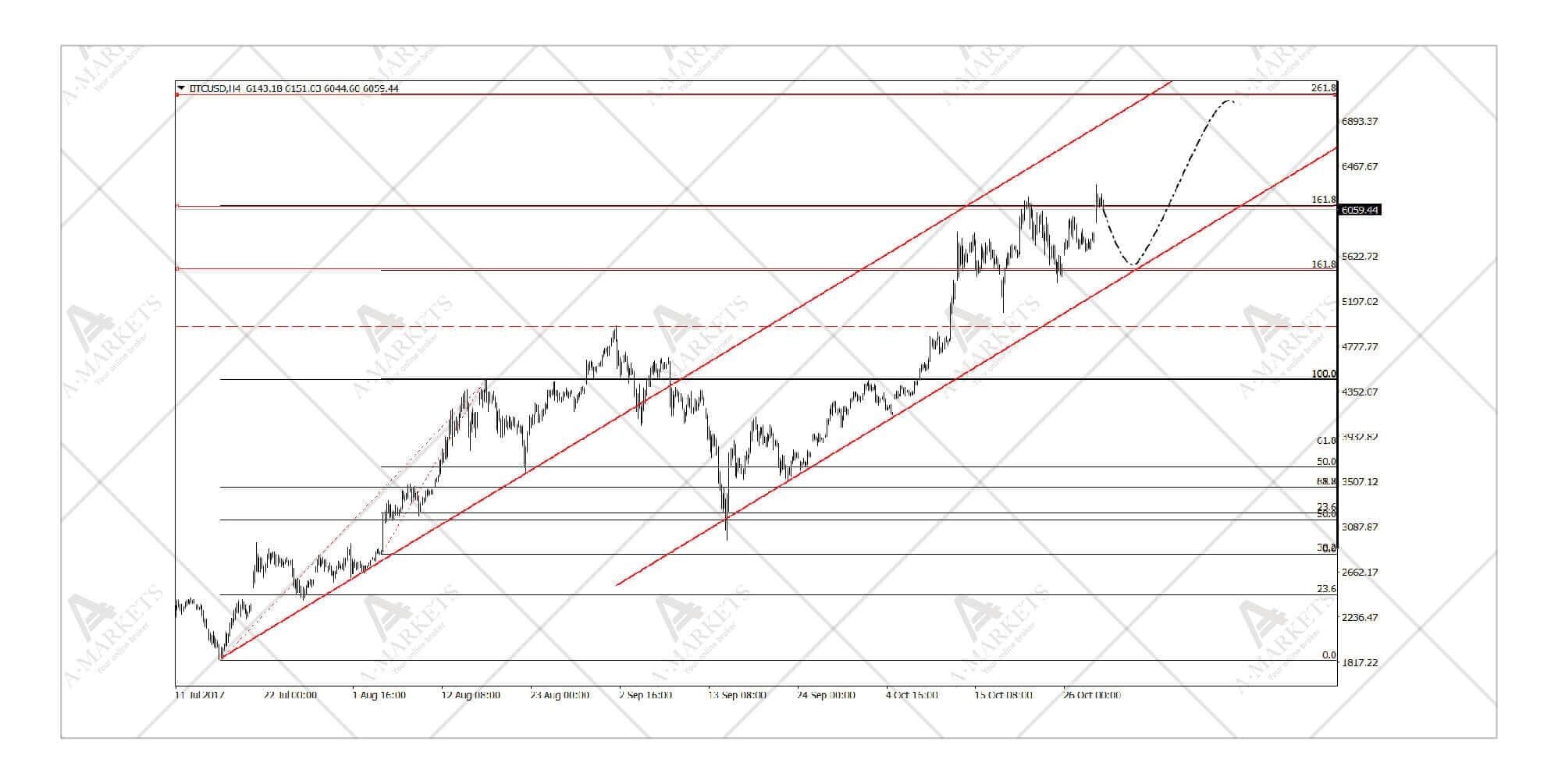

Bitcoin: first “target” attained, higher levels still achievable.

We hold off on trading any cryptocurrencies. Any “analysis” on the issue should be taken with a grain of salt.

This is just a quick update to the technical picture provided in our September issue. As expected, the Bitcoin followed a fairly simple pattern distorted by very high volatility. We are not getting tired of explaining that this is a peripheral market with very low information efficiency and extremely underdeveloped infrastructure. Anyone trading cryptocurrencies should be aware of the fact that they are taking on a typical casino bet.

Having said that, there is a clear hunger among the general audience with regards to where this whole thing is going. Historically, asset bubbles have peaked at the value of above 1 trillion USD in current prices, and this is probably the best guide to this whole euphoria. This, of course, does not guarantee there will be more buying in the segment. And if it happens, whether the buying will be limited to the most liquid units (Bitcoin, Ethereum) or will mostly go into the least known names. All in all, another leg higher in the Bitcoin itself would be targeting $7130 if it happens. We should also say that our fair value estimates currently produce a very large interval, but all of them lie under $300.

[pt_view id=”66ab208es1″]