This article was submitted by Michael Stark, market analyst at Exness.

This week’s data so far have revealed the biggest ever contraction in eurozone-wide GDP and the lowest German trade surplus in 20 years. Despite Asian shares having started positively this week, all major European indices are in the red so far. Oil has also retreated somewhat this week from three-month highs, with Brent currently testing $40.

There wasn’t any significant activity from central banks last week, with the three main meetings not revealing any new information. This week’s big news in this area is the Fed’s meeting tomorrow night. No change from 0-0.25% is expected, but the FOMC’s comments in the context of Friday’s unexpectedly strong NFP could be key for the dollar and correlated instruments like gold.

The most important releases of regular data this week include American inflation tomorrow afternoon GMT. Traders also have their eyes on Australian consumer confidence and Chinese inflation in the wee hours tomorrow. Finally the UK’s trade deficit is expected to improve slightly on Friday morning.

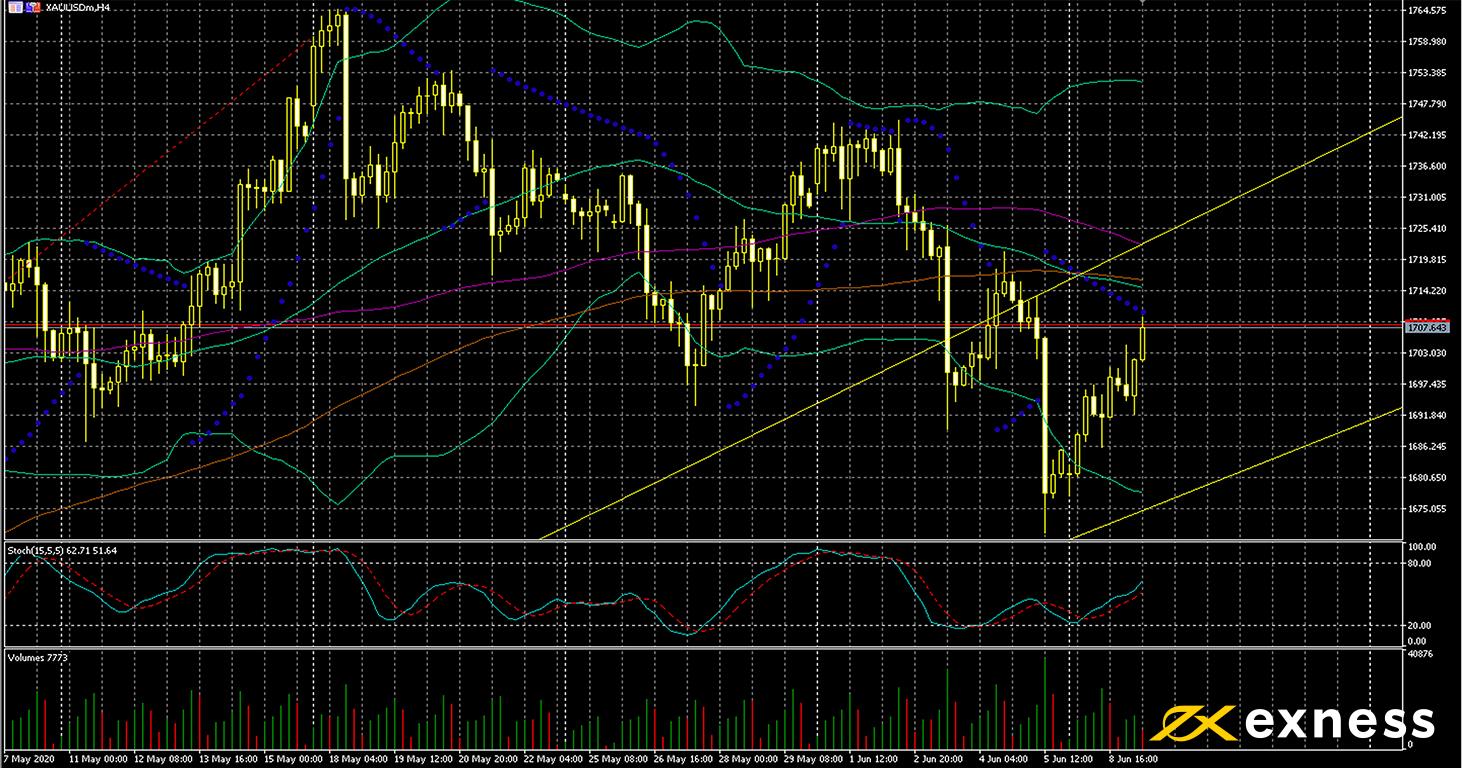

Gold-dollar, four-hour

Gold has been fairly volatile though without a clear direction over the past six weeks. Having reached a new high around $1,760 in mid-May, price fell as confidence in stock markets increased and indices like USTEC continued their strong recoveries. Fundamental factors including tension between the USA and China over Hong Kong and widespread rioting in the USA have not yet had a clear impact on gold. If this situation changes and traders start shifting their attention somewhat away from shares, it’s possible that gold could retest its recent high.

From a technical perspective, the uptrend on the higher daily chart is clearly still active. We can observe a fairly strong bounce from the 50% Fibonacci area (the fan is based on the daily chart) in the aftermath of Friday’s relatively good NFP. High buying volume around this time could suggest ongoing gains driven by medium-term new buyers, although this should be accepted only with caution given that Volumes here applies only to this particular symbol, XAUUSDm. Moving averages are still in the process of reconfiguring, with the angle of the 50-200 crossover insufficient to be considered a death cross.

This week’s critical release for gold is the FOMC’s meeting tomorrow night GMT. American and Chinese inflation earlier tomorrow could also be key. There’s still no clear indication of a second wave of covid-19 infections and generally risk sentiment is recovering somewhat, but these factors should be watched closely over the next few days.

Key data points

Bold indicates the most important releases for this symbol.

- Wednesday 10 June, 1.30 GMT: Chinese annual inflation (May) – consensus 2.7%, previous 3.3%

- Wednesday 10 June, 12.30 GMT: American annual core inflation (May) – consensus 1.3%, previous 1.4%

- Wednesday 10 June, 12.30 GMT: American annual inflation (May) – consensus 0.2%, previous 0.3%

- Wednesday 10 June, from 18.00 GMT: meeting of the Federal Open Market Committee

- Thursday 11 June, 12.30 GMT: initial jobless claims (6 June) – consensus 1.55 million, previous 1.87 million

- Thursday 11 June, 15.00 GMT: American 30-year bond auction – previous 1.342%