The following article was written by AMarkets, a St. Vicent & the Grenadines (FSA) regulated global forex broker established in 2007.

Summary:

- 2017 was “absurdly good”, 2018 is shaping up no worse.

- The dollar will remain under pressure in the face of Trump’s massive tax reform coupled with the Fed’s unchanged policies.

- EM-currencies should manage another rally up.

- Gradual liquidity withdrawal is likely to lead to a rise in volatility.

One of our fellow analysts dubbed 2017 as “absurdly good” and there could not be a better way to describe the year. After all the “horrors” of 2016 — from Brexit to Donald Trump’s election win — the public anticipated a much more difficult time, a very turbulent year at least, and the end of the world at most. Yet neither came to pass. Rather, what we saw was a year of ultrastable markets.

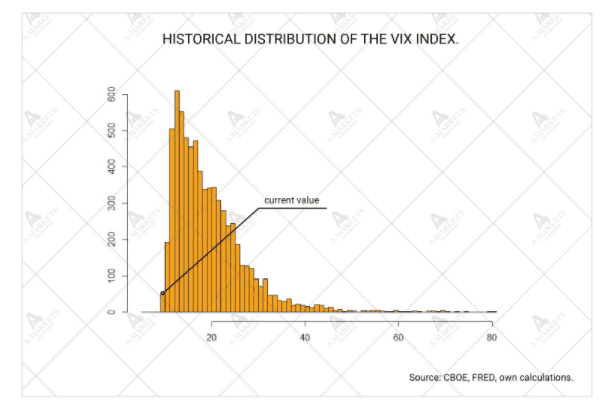

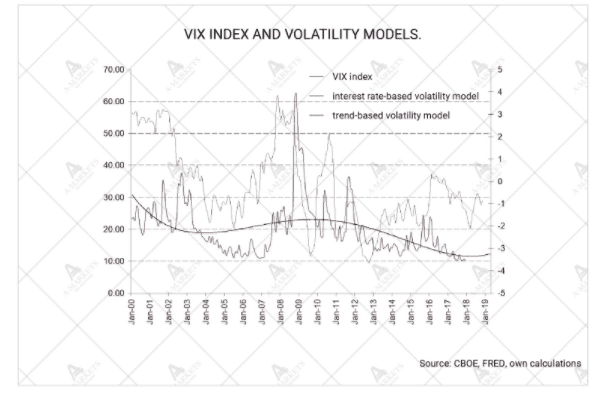

Interestingly, it’s not just the Volatility Index (VIX) that is at its lows. The same is true for nearly every asset class, with commodities (specifically oil) being the only notable exception. Other than that speculative fluctuations are getting boringly insignificant. This is a direct result of the abundance of global liquidity. The main central banks’ aggregate balance sheet has been growing continuously since the 2008 financial crisis and will only reach its maximum at the end of H1 2018. It gets truly interesting after that.

We have repeatedly stated that the key moment of 2018 is the point when policymakers switch from supplying liquidity to withdrawing it. Predicting just how exactly this is to affect the market is complicated, but clearly, implications are going to be negative. We estimate that the effect will be muted through the year and will only manifest itself as a correction, not a change of the trend. This is probably not much, but it’s a start: there have been no significant pullbacks in nearly three years.

Theme 1. A weaker dollar.

Expect a weaker U.S. dollar to be the main theme of 2018. The key moment here is Trump’s fiscal budget request for the year. If—or should we say when— fully passed, the reform will be the new president’s first real legislative victory. It is commonly perceived as a positive for the dollar. But that is not exactly so in the current environment.

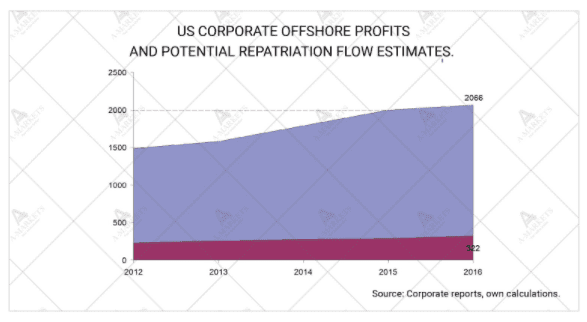

The first argument traditionally put forward in favor of dollar support is capital repatriation. Technically, the potential cash flow does look massive — there is currently an estimated $2.1 trillion in untaxed revenues sitting offshore. However, examining the structure of the funds one discovers that a portion of these cannot be easily transferred. Importantly for the FX market, much of that amount is already held in dollars, or de facto converted into dollars via derivatives. Take out those two blocks and what is left is just about $1 trillion.

Next, we played out various scenarios for the tax environment (since they haven’t been finalized yet). Turns that out than on average companies might want to return up to $300 billion. Assuming that it takes over 2 years to repatriate that amount, there should be no noticeable effect on the dollar. This factor simply gets lost among other, more important ones, such as the relative rate of monetary tightening.

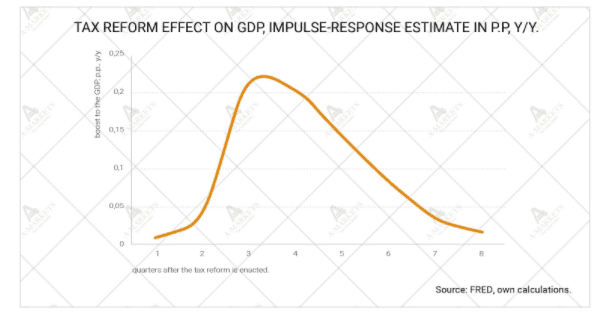

Another argument supporting a possible dollar rally is the positive effect of the tax reform on economic growth. Well, the program that is being reviewed by the Congress doesn’t look very promising. Yes, the Republican Party did initially promise a strong Reagan-esque approach, but the fact is, what we’re looking at now is a Bush-style tax-cut bill. And yes, the GDP is going to get a boost somewhat mechanically (by 0.2% annually over the next two years, according to our estimates). But that’s not enough to make the FOMC raise rates faster.

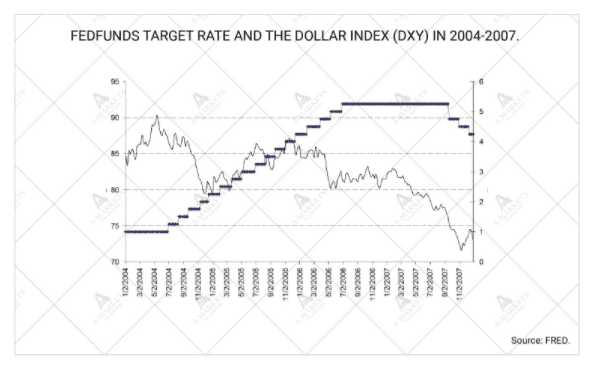

Now onto the most important thing. If the Fed acts on expected lines and other central banks begin tightening (or at least begin talking about tightening), the dollar may weaken noticeably against the main currencies. Going forward with the analogy of the Bush tax cuts times, let us remind you that between 2004 and 2006 the Fed raised the federal funds rate 17 times in a row, each time by 25 b.p. So what was happening with the dollar? From the moment of the first hike and until the federal funds rate reached the cycle’s high of 5.25%, the dollar index went down from 90 to 80 points, or lost about 10%. The greenback has failed to materially strengthen in this tightening cycle as well.

Theme 2. Europe and EMs carry on rebounding.

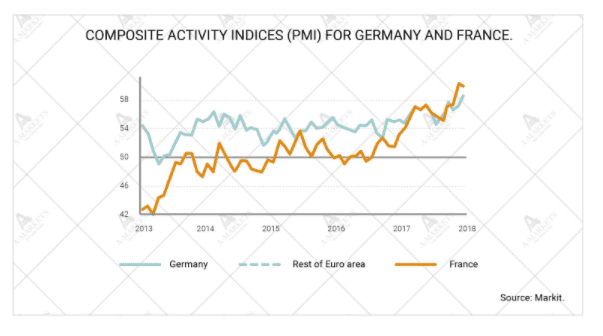

The dark shadow of the global financial crisis finally retreated in 2017. It took ten years, and we are finally witnessing solid growth across the world economy. While this was more or less expected for the United States, the growth in Europe came as a true surprise. Nearly all of the continent’s key economies are running full speed. And though 2018 is unlikely to see growth as rapid, Europe has certainly proved that she is capable of springing a pleasant surprise.

We have already mentioned that the next step for the ECB is inevitably the normalization of monetary policy. In the face of such strong economic activity, the issue of exiting QE is particularly acute. Team Draghi have already published their plan for tapering QE, aiming to end the program in September. Nevertheless, let us recall how flexible the language of the bank’s statement was—it allowed for easy rescheduling. Sure, back then the officials were insuring themselves against unforeseen problems, but the option to adjust timing can work both ways.

That, of course, doesn’t mean the ECB is going to rush. The bank’s mandate is to keep inflation close to, but not above 2%. What we’re pointing out here is how extremely dovish the markets’ expectations are. Current pricing assumes a single rate hike by the ECB in 2019. And that has proven sufficient to take EURUSD to the 1.2 mark. Yet there’s still plenty of room for speculation. Why wouldn’t one bet on earlier tightening? Or speculate on two whole hikes over the course of 2019? That would easily send the euro to 1.25.

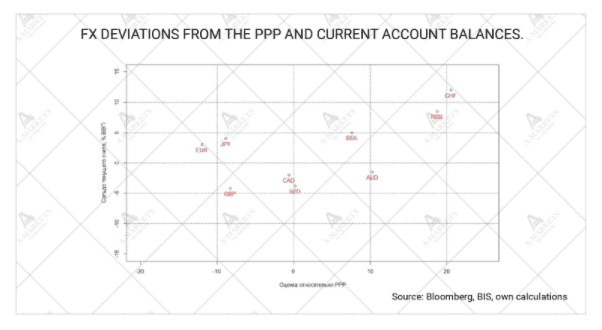

On top of that, the European currency is fundamentally undervalued. The eurozone maintains a healthy current account surplus of about 4% of GDP, while the euro is trading at a discount of 15% to the PPP. The only thing needed to redress the imbalance is higher rates. But that’s precisely the story that the two preceding paragraphs are telling. Conditions for removing that remaining obstacle are gradually taking shape.

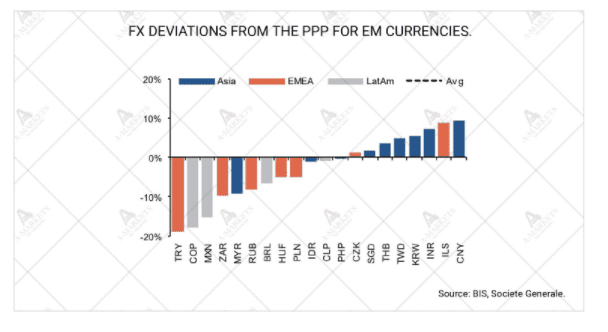

That said, the euro isn’t even the region’s best currency. We also still like the Czech crown, 2017’s top trade (speaking of top-performing currencies, the Polish zloty doesn’t look that attractive to us anymore). EURCZK has been steadily sliding down since the Czech National Bank’s intervention policy ended and has all chances to reach the 23.80 mark. The Russian rouble is yet another obviously underpriced asset. Investors are being super cautious about the potential new U.S. sanctions against Russia. But as the prospects of the sanctions become clearer, we expect USDRUB to fall down to the 54-55 area.

And there are, of course, some good trade ideas outside of Europe too. The Turkish lira and Mexican peso are the most undervalued currencies in the EM universe. We do not bother dealing with the former because of its systematic and dangerous current account deficit. But the peso is a different story. The renegotiations of NAFTA are likely to be fruitful. Canada and Mexico will likely prove ready to make some concessions to save the trade zone, which should keep Donald Trump satisfied for a while. If this scenario unfolds, USDMXN will quickly return below the 18 mark. But one has to be aware that this is largely a political trade, not a purely economic one.

Theme 3. Eventual normalization of volatility

Nearly every analyst has noted the abnormally low volatility throughout 2017. We repeatedly mentioned it over the year, and the markets are starting 2018 with just that. What’s happening is, of course, an anomaly, and volatility will revert to higher levels. The reason for suppressed vols lies in the massive amount of liquidity injected into the markets by the central banks over the past 10 years.

However, even under the most conservative scenario, there will simply be no new liquidity created in 2018. And, at worst, Q4 will see the first liquidity withdrawal in years. We got a small taste of that in 2015, when the People’s Bank of China urgently shrunk its balance in an effort to thwart capital outflows. The policymakers also allowed the yuan to weaken by 2%. Markets went in a tailspin, and most analysts explained that by referring to the unexpected CNY weakness. But the fact is, the liquidity absorbed from the Chinese system was a way more significant factor.

Central banks of developed countries are surely aware of the risks involved in exiting QE. Moreover, there is no need for them to act as abruptly and sharply as the Chinese policymakers did in the aforementioned example. Still, a risk is a risk, and the problem is that the markets are not absolutely effective. They cannot discount a loss of liquidity as soon as it happens without gaining some critical mass first.

It is too early to predict just how hard the shake-up will be, but one of our main strategic points is that 2018 should see an end to the markets’ absurd stability. We expect the VIX to rally over the 20 level before consolidating in the 15-16 area, in lieu of the current 10. Our general strategic view is therefore to favor risk in H1 of the year, and gradually move away from it through buying volatility in H2.

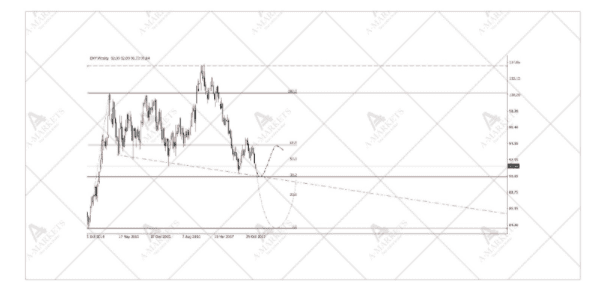

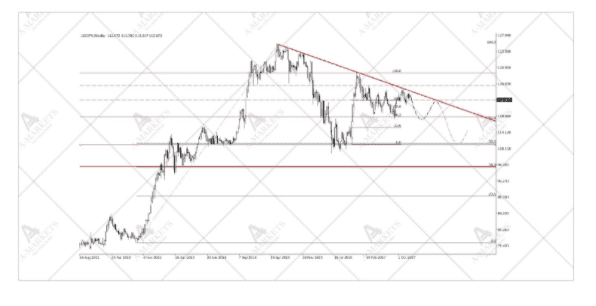

DXY

Let us start with the good ol’ dollar. Since the current Fed tightening cycle started, the greenback index has already fallen by 10 figures, from 102 to 92. A weaker dollar through the first few quarters of a tightening cycle isn’t something unusual, although this time the fall is a more pronounced and prolonged one. From the technical viewpoint, the DXY has to manage to stay above the 89.62 mark at all costs. Going lower would allow for another move down by about 5% to 84.7. Fundamentally, that’s quite possible. Nevertheless, from the price dynamics point of view, the main scenario is for the DXY to test the lower end in the 90.5 area before some strengthening in Q2-Q3 2018.

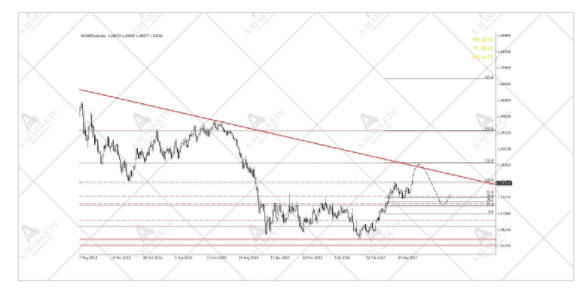

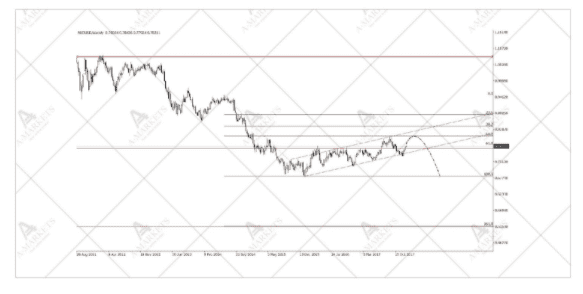

EURUSD

Ideally, the EURUSD rally should stop just above the 1.22 mark. There lie both the targets of the Vth wave and the multi-year downward trend. There is a possibility, however, that the unit won’t stop there. There is a strong momentum in the euro and if should there be meaningful fundamental support, the currency could be strengthening throughout the entire year. Again, the main scenario is for the EURUSD to top out within the 1.22-1.262 region, which would be viewed as a false breakout. But, as is the case with the DXY, there is a feasible alternative scenario of a pronounced weakness of the dollar and a EURUSD rally to 1.3.

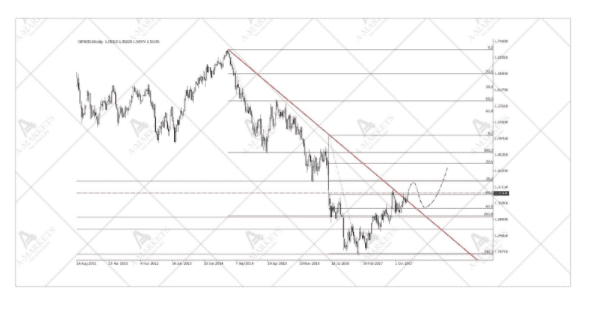

GBPUSD

The pound appears to have already broken its downward trend, having bottomed out just below the 1.2 mark. We expect the sterling to continue its rise against the dollar for a few more weeks before starting to lose steam in Q2 and Q3. But that’s for the GBPUSD, where we always have to adjust for the DXY technical outlook. Now, the British currency is looking up in most crosses, which is normally a signal of a true end of trend, in this case a downward one. The strength of the sterling is evident in many units, including GBPAUD and EURGBP.

EURGBP

Continuing the discussion on sterling, we have to say we still view the currency as fundamentally unattractive. Britain’s current-balance deficit remains too large and requires a further economic rebalancing (and, of course, a lower exchange rate). That said, it is technically unreasonable to ignore the positive tendencies across the pound pairs. The EURGBP has failed to break above 0.9 twice within the past two years, and likely to continue trading sideways, albeit in a wide range. Targets for 2018 lie at the lower end of that range at 0.838.

USDJPY

Since ZIRP began, the yen has returned to its long-standing trend. The Japanese currency has been appreciating ever since the dollar went off the gold standard in 1971. And in the recent years, despite the BoJ’s best efforts, the JPY just won’t weaken. We believe that USDJPY will follow the DXY route: down in Q1, and then up. However, there are now certain conditions for yen strengthening, both technical and fundamental (specifically, the BoJ could consider raising the 10-year yield target). As is the case with sterling, yen crosses are also likely topping out, although this has yet to be confirmed.

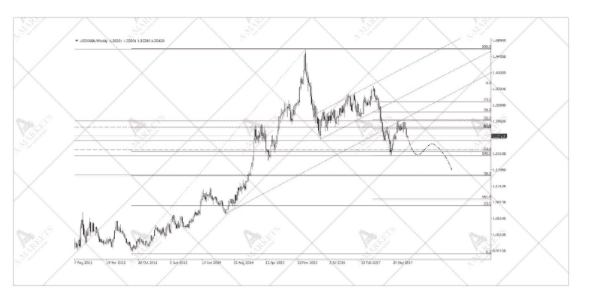

AUDUSD

The Australian dollar is slowly losing support as the Chinese economy slows down. The AUDUSD is firmly looking south. It is currently correcting upwards, trading within a narrow ascending channel. But from a broader viewpoint, it’s really going sideways accumulating potential for another wave down. We expect the Australian dollar to be the outsider in 2018 and depreciate against all liquid currencies (aka the G10). AUDUSD should at least retest the 0.68 level, and at most revisit the old target of 0.52. We also like the long position in GBPAUD, and a short one in AUDCAD.

USDCAD

By the end of the year the Canadian dollar finally regained ground and did what it was expected to: it leaped up and strengthened, catching up with the oil prices. USDCAD fell to the 1.25 mark, and is likely to continue its trip down to 1.212. The loonie is one exception where we don’t see much potential for the USD even in the middle of 2018. The Canadian currency was so depressed until recently that it has too much cathing up to do (as long as the oil prices remain high). At the very least, there’s still the target around 1.162. It can be achieved quite quickly if, say, there’s news that NAFTA remains intact.

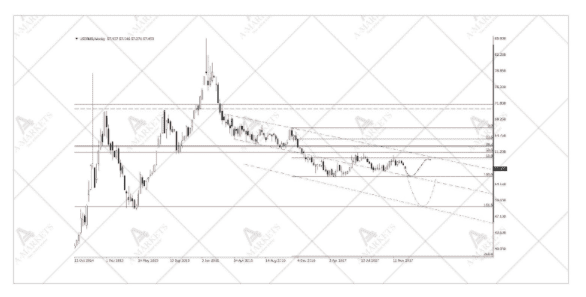

USDRUB

The rouble remains pressurized by the Ministry of Finance. If not for Russia’s new budget rule, the rouble would have likely followed in the loonie’s footsteps and demonstrated significant strength going into year-end in 2017. Unfortunately, the fiscal authority is limiting RUB’s appreciation. One needs to understand, however, that the Ministry of Finance is only absorbing the part of the foreign currency inflow that is directly related to high oil prices. If the commodity remains expensive, speculators will sooner or later discover an undervalued asset and unleash a flood of hot money. There is no one standing in the way of speculative flows, and USDRUB will eventually move to a lower equilibrium. As a conservative estimate, USDRUB should at least test the 55 area in H1 2018. A very rich, but not an unreachable target lies at 48.7.

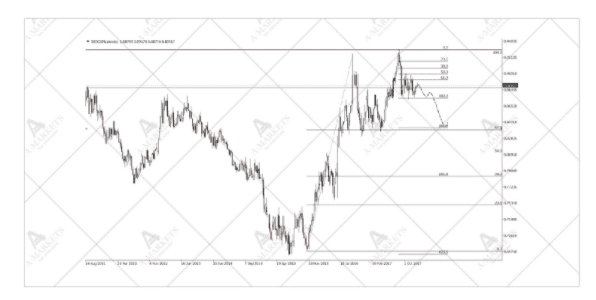

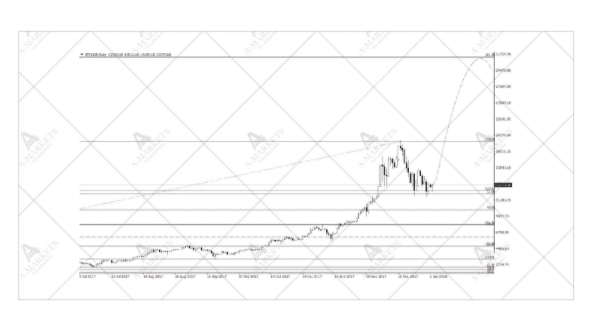

BTCUSD

First and foremost, in 2018, just like in 2017, we deeply believe that cryptocurrencies are a Ponzi scheme and encourage to invest into something else. Other markets, of course, take more time and effort to make money, but profiting elsewhere is way more stable midterm. Then, admittedly, the Bitcoin is clearly going through every basic technical level. Given the price dynamics, the rally is not over yet and it is simply consolidating before a leap up to 31700. Though of course proving any of that scientifically is not possible. This is only an estimate obtained by the means of technical analysis. And third, just as we anticipated, the focus in the crypto segment has somewhat shifted from the Bitcoin to its lesser-known cousins. For instance, Ethereum showed the best performance for 2017, while Ripple’s market cap has caught up with Ethereum. Panic buying of 2nd and 3rd tier assets is a typical sign of a mature bubble.

Author – Nick Korzhenevsky, senior analyst with AMarkets Company. The anchorman of a TV program “Economics. Day rates”.