FOREX

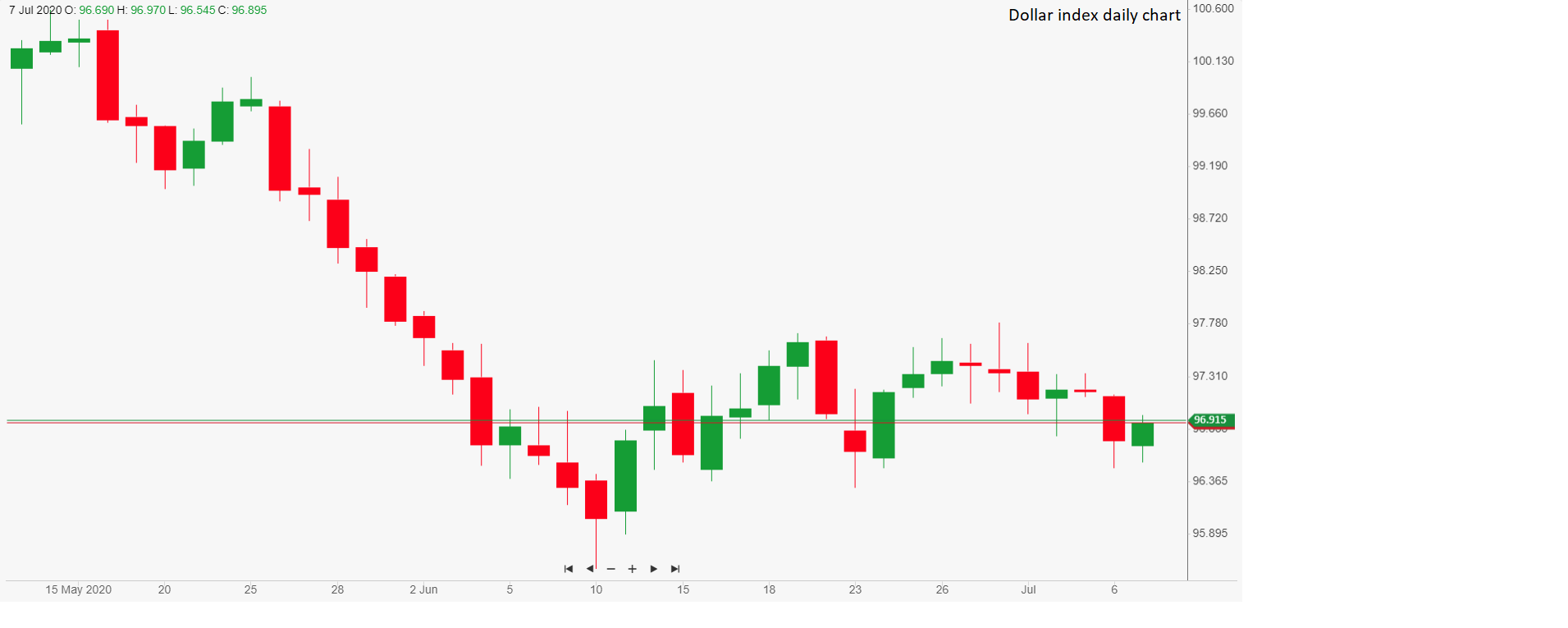

The US dollar index is recording some gains during early Tuesday trading, following the publication of disappointing German industrial data. The greenback is once again fulfilling its role of safe haven, rising whenever market sentiment edges towards risk-off, while the euro retreats. After a fall of 17.5% in April, it was widely expected that German industrial production would recover sharply. However, the increase in activity was a mere 7.8%, curbing some of the enthusiasm towards the single currency that had dominated markets on Monday.

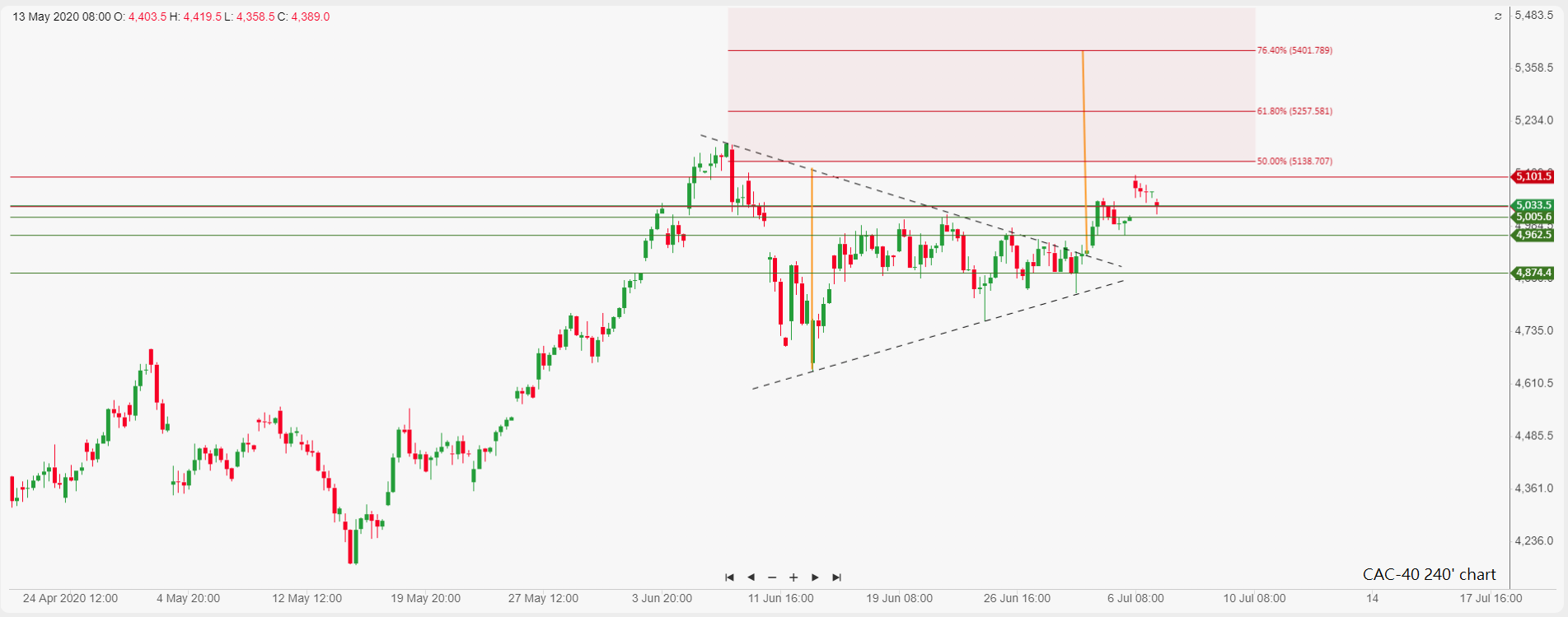

Dollar Index

Ricardo Evangelista – Senior Analyst, ActivTrades

GOLD

Investor demand for bullion remains high, with the price getting close to last week’s peak, which was the highest level seen in the last 8 years. The price has been supported by the weakness of the greenback, with the Dollar Index falling below 97 in yesterday’s trading session. A clear break up above $1,790 could open space for further rallies, while any significant correction on stocks would be another supportive element for bullion.

From a fundamental point of view, we have to remember that gold’s strong bullish momentum is massively supported by investment demand, while jewellery and industrial demand is slowing. Moreover, central banks are still buying gold, albeit at a slower pace to the last few years.

Carlo Alberto De Casa – Chief analyst, ActivTrades