FOREX

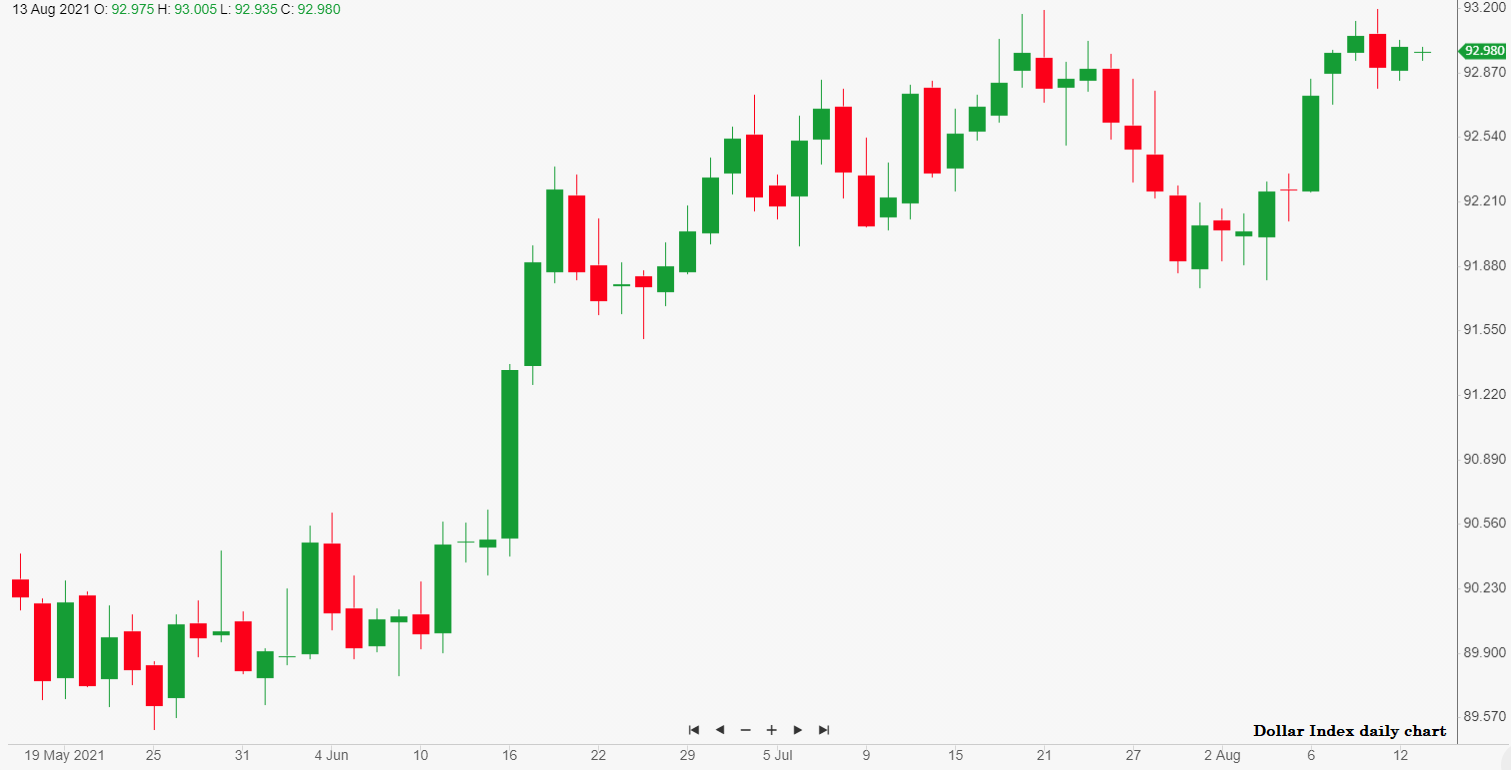

The US dollar is trading flat but holding on to the previous session’s gains, following the release of producer prices data which surprised to the upside. The greenback has been on a rollercoaster ride so far this week. It dropped on Wednesday, after the release of consumer prices data, which read at a mere 0.3% month-on-month in July and disappointed dollar bulls but then recovered most of the lost ground on Thursday, after producer prices data showed the steepest annual increase in over a decade. Inflation matters because, alongside the state of the labour market, it weighs heavily on the Federal Reserve’s decision on whether to bring forward the beginning of the tapering to as early as September. Investors have been analysing employment and inflation data carefully and their expectations on the Fed’s next moves have been the main factor behind the performance of the dollar over the last few months.

Ricardo Evangelista – Senior analyst, ActivTrades