FOREX

The US dollar continues to lose ground to other major currencies, dropping to $1.17 against the euro for the first time since September 2018. A sense of anticipation is growing amongst investors that the Fed could adopt an even more dovish monetary policy. With several American states struggling to contain a resurgence of the coronavirus and a swift economic recovery looking increasingly less likely, many market operators now expect the Federal Reserve to provide an outlook entailing further easing measures when it meets later this week.

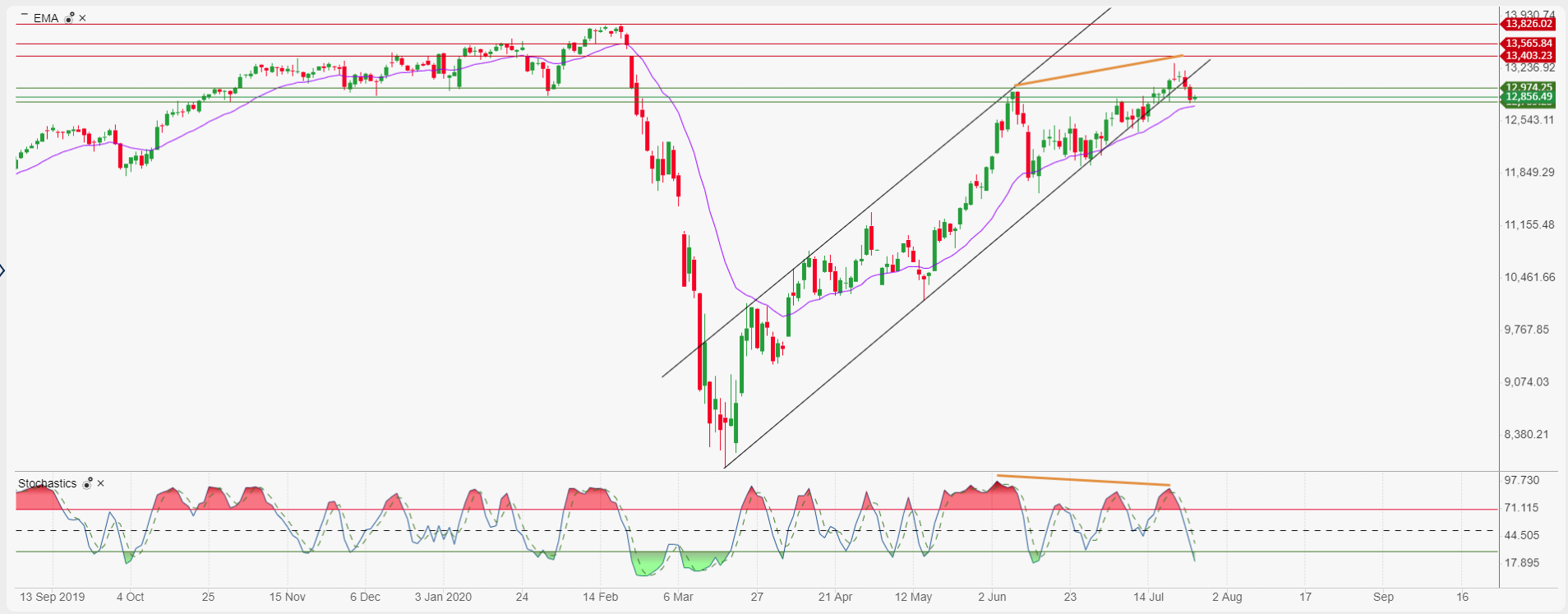

EURUSD chart

Ricardo Evangelista – Senior Analyst, ActivTrades

GOLD

Gold has climbed to its highest price ever, surpassing the peak reached in summer 2011. Precious metals have started the new week with even more strength than the previous one, which was already starkly positive. Bullion climbed by 1.5% on the weakening dollar and on growing tensions between the US and China, which could slow down the recovery in the US. In this uncertain scenario, investors are filling their portfolio with gold to be protected not only from a stock correction, but also from the risk of further greenback declines. In other words, gold in this phase is seen as insurance from turbulence on currencies markets. While currencies can all be printed, the finite nature of gold and silver makes them better stores of value at these times of uncertainty.

Gold

This week has also started with a strong rally for silver, which skyrocketed to $24, confirming investors’ huge appetite. This is in part coming from growing use of silver from the so-called green sector but is also related to the strong recovery of gold and the whole precious metal sector, which is seen as insurance in case of a new storm or high volatility in stocks and currencies markets. Despite all this, we should remember how quick this rally was for both gold and silver. This could mean that, once a correction arrives, it could be significant. But for now at least, there are no signals of inversions.

Silver

Carlo Alberto De Casa – Chief analyst, ActivTrades