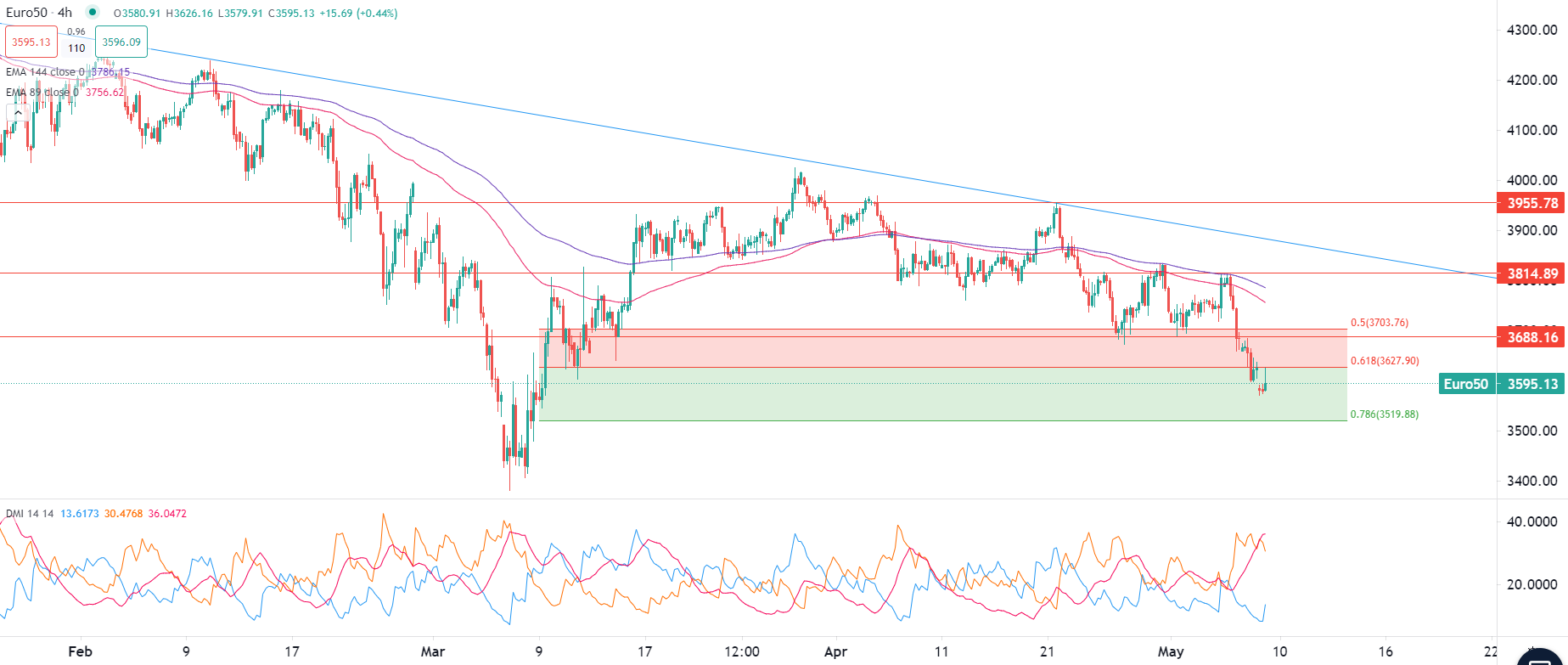

European Shares

European shares lagged at market open at the beginning of a new week, with most benchmarks holding last week’s losses as market sentiment remains “risk-off”. Cash continued to move out from stocks and treasuries to safer havens like the US dollar, as investors still digest monetary tightening as well as the worsening virus situation in China where restrictions are already having an impact on oil demand. Energy shares are then likely to remain volatile, especially after the G7 pledged to put a ban on Russian oil exports, which will put further pressure on black gold. Meanwhile, investors may have a particular focus towards President Putin’s speech in Russia for Victory Day today, where details about his plan regarding Ukraine invasion may be provided. The short-term outlook for stocks remains blurry and, with the absence of any bullish drivers, the downside risk prevails.