European Shares

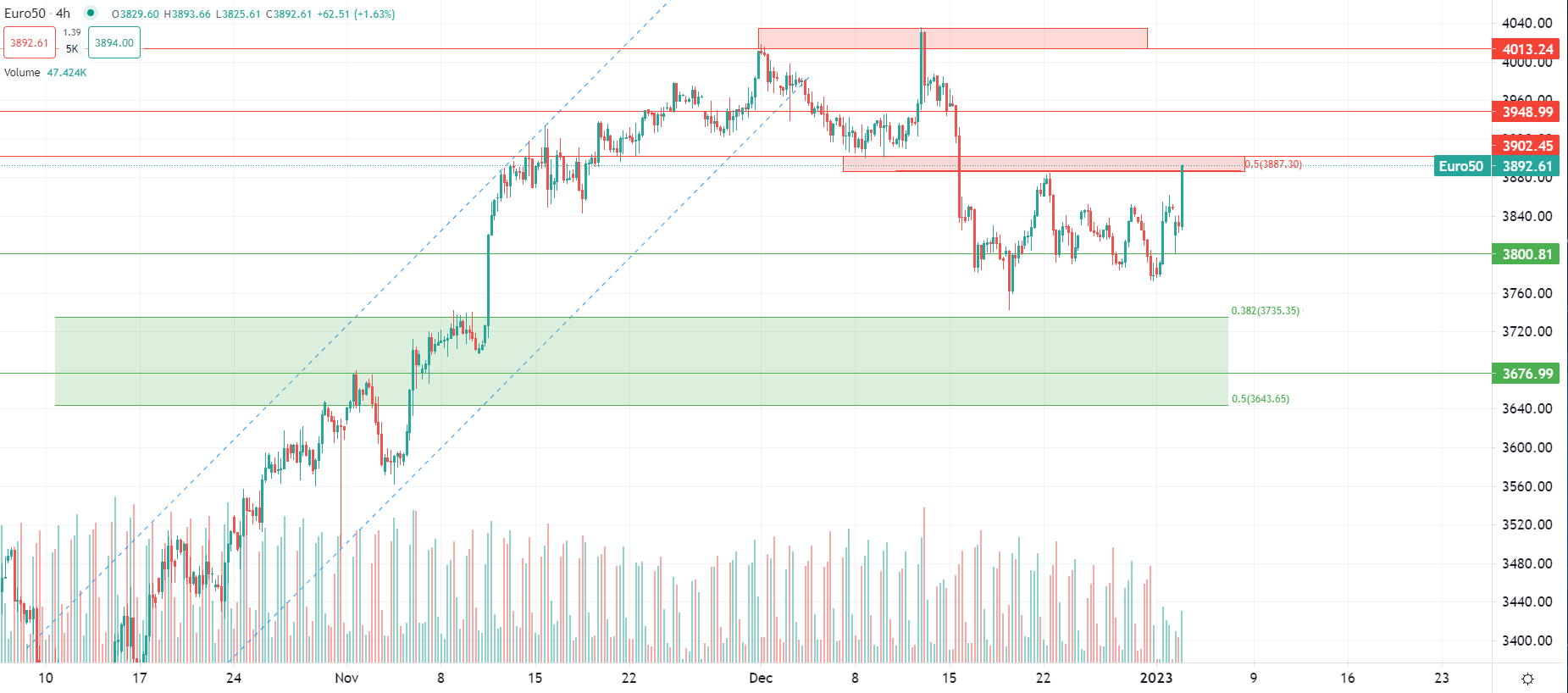

A bullish sentiment prevails in Europe for the first trading session of the year, with shares climbing significantly across all sectors from London to Milan. Investors have returned to their trading desks with some confidence about this new year, and this has pushed up the FTSE100, the DAX30 and the CAC40 indices 1.54%, 0.70% and 0.50% higher respectively. Most benchmarks are now flirting with major resistances levels, with the STOXX-50 index trading around 3,885 pts, right below the 3,890 pts / 3,900 pts significant zone.

With the lack of any major macro news today, it is however still hard to say if the current price action is being driven by real directional motivations from portfolio managers or if it is just a liquidity bull trap, covering some of last year’s short positions. Transaction volumes are on the rise, but remain unusually low for a non-bank holiday – such a high volatility environment combined with lower market liquidity is often taken as a dangerous sign by stock traders.