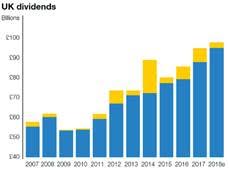

UK dividends surged 7.1% to a record £30.7bn on an underlying basis, according to the latest Dividend Monitor from Link Asset Services. Soaring mining dividends, and a weaker-than-expected drag from exchange rates help explain the impressive figures, though growth was broadly spread across a wide range of sectors.

- Underlying dividends (excluding specials) surged 7.1% to record of £30.7bn

- Headline dividends dropped 2.1% year-on-year to £32.6bn owing to sharply lower special dividends than a year ago

- Dramatically stronger mining dividends and lower-than-expected exchange-rate penalty explained the strong performance

- Underlying growth forecast raised to 6.9%, bringing a total £94.1bn for the full year

- Headline growth forecast raised to 3.2% bringing the total to £97.8bn for 2018, a new record

Source: Exchange Data International, Link Asset Services

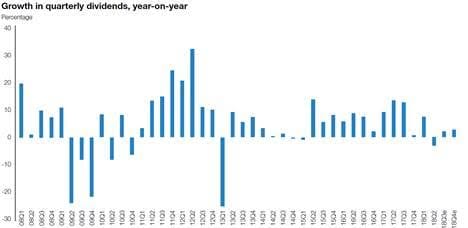

On a headline basis, which includes special dividends, the total fell 2.1% to £32.6bn however, as the exceptionally large specials paid in the second quarter of 2017 were not repeated. This was the first headline decline since Q1 2015.

The big story was in mining. Headline payouts jumped 95% (underlying +82%), up £2.3bn, driven sharply higher by Glencore, Rio Tinto, Anglo American, and Mondi, the last of these in the form of a special. Together these four alone paid out over £1.9bn more than in Q2 last year, and accounted for the lion’s share of the overall dividend growth from UK plc year-on-year. Among the other larger sectors, the strongest performance came from insurers, where rising profits boosted payouts from nine-tenths of the companies in the sector, both the large and small alike. For example, Aviva hiked its payout by almost a fifth and promised a share buyback in a bid to deploy part of a surplus cash pile of £2bn. Overall, three-quarters of sectors raised their payouts. Dividends from the banks and oil companies fell slightly, mainly due to exchange-rate factors which weighed on dividends from Shell, BP and HSBC that have failed to grow for three years in dollar terms.

Source: Exchange Data International, Link Asset Services

The top 100’s dividends fell 3.9% year-on-year in the second quarter to £27.3bn. This was mainly due to the big special dividend National Grid paid last year, though exchange-rate effects and the timing factors also played a role. Adjusting for all this, the top 100’s dividends were actually 14.3% higher, with the mining sector making up two-thirds of this increase. Mid-cap payouts rose 6.4% to £4.3bn, boosted by higher special dividends. Underlying growth was a more muted 4.5%.

Rising dividends were matched by rising share prices, leaving the prospective 12-month yield on equities unchanged 3.9%.

Link has increased its forecast for underlying growth significantly from 2.9% to 6.9%, bringing a total of £94.1bn for the full year (excluding special dividends). A little over half the increase in the forecast reflects the newly weaker pound, plus Link has pencilled in a touch more from the mining sector and elsewhere.

Meanwhile, special dividends are likely to be lower than Link’s initial estimate, taking its new headline dividend forecast up to £97.8bn, an increase of 3.2% year-on-year and a new all-time record.

Justin Cooper, Chief Executive of Link Market Services, part of Link Asset Services said:

UK plc’s profitability is on a firmer footing, and though there are still points of weakness, overall, profits now comfortably cover dividends. Balance sheets are also getting stronger. This is giving companies more headroom to return cash to shareholders.

The miners really stand out, boosted by the recovery in commodity prices after several years of pain for companies in the sector. Many mining companies have adopted dividend policies that link payouts more explicitly to volatile profits, so we can expect their dividends to be much less predictable than in the past.

The miners might be digging deepest, but the rest of UK plc is coming up with the dividend goods too. Three-quarters of sectors saw growth on the back of improving profits, and income investors are set for another record year in 2018.