Mainstream and industry press have written widely on the gradual withdrawal of banks – the traditional primary liquidity providers – from the spot FX markets over the past few years.

The typical narrative is that reduced appetite for risk, controls on capital at banks, as well as juniorization of dealer staff have all contributed to this withdrawal.

Some reports have pointed to the rise of non-bank liquidity providers, with two entering the Euromoney 10 for the first time in 2016, and increased fragility of the FX markets as results of this bank pull-back. The general consensus seems to be that

- liquidity is getting more expensive, and

- while spreads are narrow in times of normal volatility, in times of market stress dealers effectively pull away from the markets, contributing to extreme volatility and events like flash crashes.

On the other hand, the BIS survey shows that banks still account for 43% of spot turnover in USD in 2016 – down from 53% in 2004, but still the lion’s share and holding steady around 40-45% of the market since 2007.

In this research note, Pragma Research aims to contribute to this discussion by reporting data on how often banks actually “step back” from providing meaningful liquidity to the FX markets – individually and (more importantly) as a group.

Data

While institutional trading of spot FX was traditionally conducted via voice, today electronic channels account for roughly 80% of spot turnover. At banks, the bulk of this turnover is mediated by eFX systems which automatically generate prices and distribute them both through bilateral channels, in response to RFQs and RFSs, and onto anonymous platforms -ECNs. In the present dataset, Pragma Research examins both direct bilateral streams provided by banks via API to institutional FX customers trading algorithmically on those streams, and liquidity available on major ECNs, which represents the aggregation of liquidity provided by banks and other market participants.

Pragma Research data set includes the streams of seven banks, as well as data from EBS and Reuters over the two-year period from January 2015 to December 2016.

For brevity Pragma Research examins the liquidity supplied by banks in the seven most liquid pairs—GBPUSD, EURUSD, USDJPY, USDCHF, AUDUSD, NZDUSD, USDCAD.

The data shows that – at least for institutional clients trading systematically and algorithmically – acceptance rates are close to 100%.

Vanishing Liquidity

A brief look at how often banks withdraw from the market altogether, as indicated by a gap in the stream of prices they provide to customers trading bilaterally. Pragma Research could find just three events over the two-year study period when multiple banks stopped quoting during a period of high volatility – an indication that banks are withdrawing liquidity from the market. The first is the de-pegging of the Swiss Franc in January of 2015. The second is in NZD on August 24, 2015, which may be related to the equities flash crash around the New York open. The third is the British Pound flash crash in October 2016.

Banks continue to provide liquidity even in very volatile periods and only in a few extreme events do they withdraw from the market.

Widening Spreads

Banks very rarely withdraw from the market outright. However, they can still effectively withdraw from the market by making their quotes uncompetitive. In principle, when neither the client nor the bank is engaged in predatory behavior, the best avenue for trading should be bilateral, where the bank can provide the most competitive quotes to a customer without fear that customer will pick it off or run it over. If a customer engages in such behavior over time, the dealer can widen its quotes accordingly. On an ECN, liquidity providers are exposed to adverse selection from more informed traders, but can never hold its anonymous counterparty accountable, and must demand a premium through wider quotes, to compensate for that adverse selection.

With this background, Pragma Research characterizes effective withdrawal from the market by a bank when the spread on its biliateral stream is wider than the spread on the primary ECN.

In contrast to total halt of streaming prices, this definition identifies many instances in which an individual bank is considered to be effectively withdrawn from the market. However, a client may not always be able to negotiate the best tier of quotes from every bank.

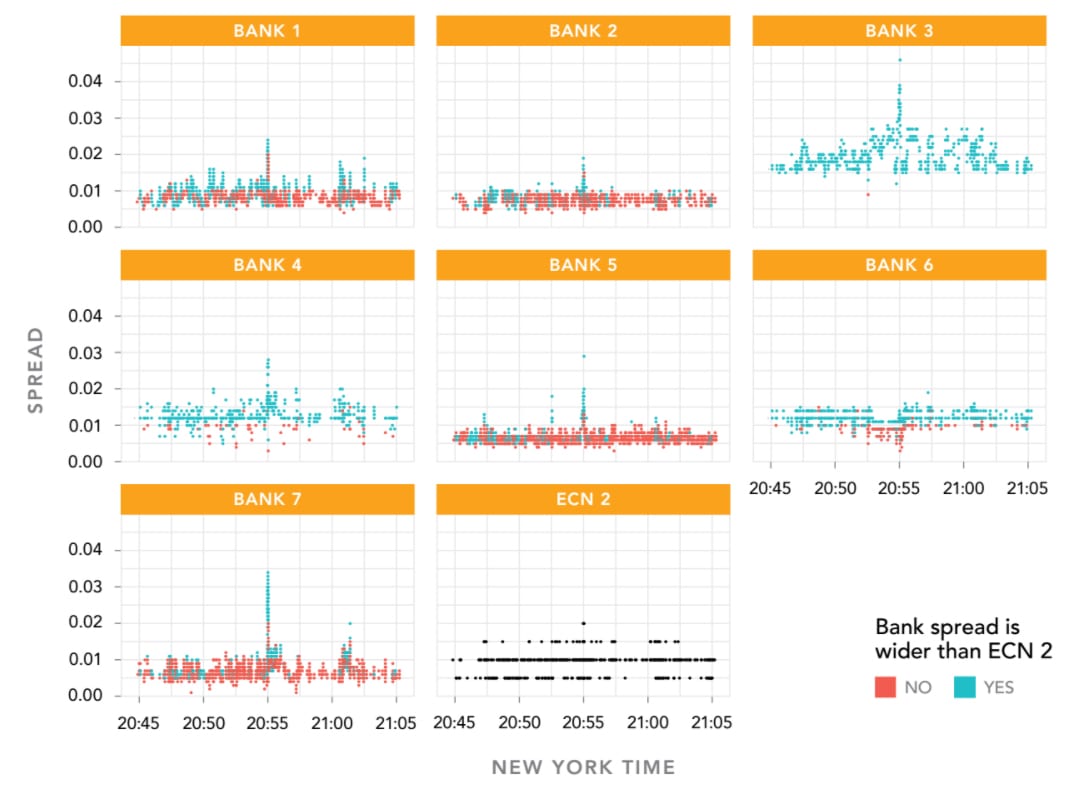

Below is an example of a sudden but relatively mild price change in USDJPY. Spreads widen everywhere at the moment of the price change.

It was also during a period of time when several banks were generally less competitive than the primary.

A more reliable metric to address the question of how often the banks are uncompetitive is to examine the banks as a group.

That is, although an individual bank may be markedly less competitive in a given currency pair than others, as a group the bank streams should be extremely competitive.

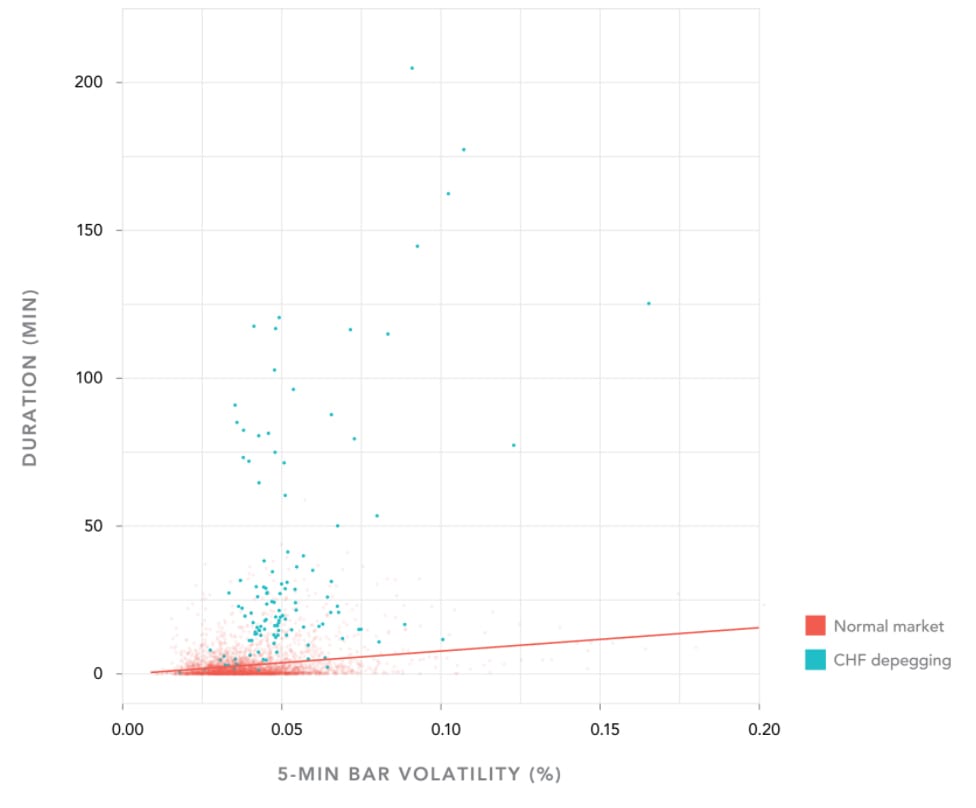

A general positive correlation between volatility and effective withdrawal from the market by the banks is observed in the figure below. However, in the more severe market dislocation – the depegging of the Swiss franc – this relationship broke down and the banks became significantly less competitive in that one pair, for an extended period from January through June of 2015.

In summary, direct bank streams – aggregated as a group – provide an extremely competitive liquidity pool through the vast majority of market conditions. However, and not unexpectedly, the Swiss event shows that certain events can still shake this formidable group.