LeapRate Exclusive… LeapRate has learned via regulatory filings a number of further not-yet-disclosed details about Playtech’s 2017 acquisition of Forex and multi-asset market maker and white label provider Alpha Capital Markets (formally ACM Group Limited).

And, that the “$150 million” deal which saw Playtech buy ACM last year is likely to be completed at a much lower value.

Playtech closed the acquisition of ACM in October 2017. The company still operates as a separate unit within Playtech, but organizationally has been combined with FX clearing and liquidity provider CFH Group (which Playtech acquired in 2016 for $120 million) and Retail FX arm Markets.com to form the Financials division of Playtech, named TradeTech Group.

The deal to acquire ACM was a somewhat complicated one, with most of the consideration to be paid to ACM’s shareholders (led by Lebanese businessman Tony Afram) deferred to 2020 in an earnout-style transaction – so getting a better handle on ACM’s financials are key to properly understanding the acquisition. The deal was structured as follows, with Playtech paying:

- an initial up-front payment of $5 million;

- two staged interim payments based on 1 x EBITDA of 2017 and 2018; and

- contingent consideration based on 5.2 x 2019 EBITDA, minus the initial payment and 2017 and 2018 payments, with the total consideration capped at $150 million.

The deal was widely covered as a $150 million acquisition, based on the consideration cap referred to above, but it does look like the eventual price will probably be a lot lower. We explain…

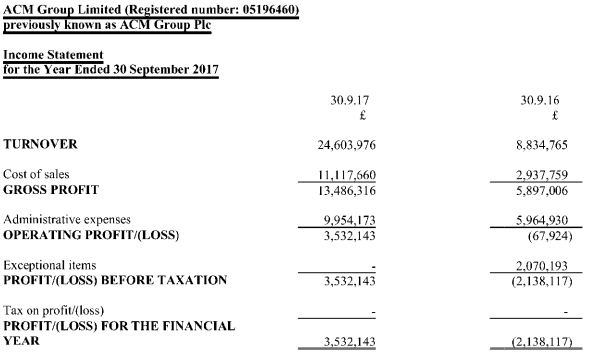

The filings show that ACM’s Revenues for 2017 were £24.6 million (fiscal year ended September 30, 2017, which is useful because that date is just a few days before the sale to Playtech closed). EBITDA for 2017 was £3.5 million.

While both Revenues and Profits were much improved at ACM over 2016 (Revenues £8.8 million, EBITDA loss £68,000), the full year figures indicate that ACM’s business actually slowed somewhat in the second half of 2017. We had reported that first half Revenues at ACM were £12.9 million (making 2H-2017 Revenues £11.7 million, down 9% from 1H), and first half EBITDA was £1.8 million.

With the GBPUSD now at about 1.33, in order to reach the full $150 million consideration level ACM will need to generate EBITDA in 2019 of £21.7 million – which was roughly its run-rate level of top-line Revenues at the time of the deal. Basically, management will need to increase EBITDA by more than 6 times the current run rate of £3.4 million, to reach the $150 million cap.

If revenues and profitability remain roughly where they have been at ACM (and as noted, they have actually been declining), the acquisition will be completed when all is said and done at about £18 million, or USD $23 million. Effectively, the entire deal value is tied to the company’s EBITDA in 2019. While 2019 is still a long way away, ACM’s management led by CEO Muhammad Rasoul still have a lot of work to do in order to maximize the value to be paid out to the company’s (former) shareholders.

ACM was controlled by Lebanese businessman Tony Afram, who owned more than 75% of the company’s stock. Mr. Rasoul and the other senior management members of ACM were minority shareholders.

ACM’s 2017 income statement follows: