The following article was written by Chris Svorcik and Nenad Kerkez, of trading analysis/systems provider Elite CurrenSea.

Dear Traders,

Do you ever ask yourself what is the best method for analyzing charts? Some trading experts emphasize very simple charts whereas others show complex charts with tons of indicators.

In fact, the best approach is based on understanding the “market structure” and price patterns because it allows you to analyze the entire price chart but in an efficient way.

Today’s article explains how the best style is a balanced approach based on market structure and patterns with clear boundaries for your trading bias.

Trading Is Not Simple Nor Complex

This might sound contradictory at first but Nenad Kerkez and I (Chris Svorcik) believe that profitable trading depends on a simple yet mature outlook of the market. However, trading experts often emphasize extremes:

- Either they mention the need for complex charts with dozens of indicators.

- Or they advocate for simple methods that use oversimplified rules.

Both approaches are wrong (and dangerous).

The oversimplified style will not allow traders to really understand the chart in a proper way. Traders might also get the false impression that they can successfully trade in a matter of days.

On the other hand, complex charts and indicators only over complicate things and hide the essence of using charts: translating complex data into one quick price chart.

What is the proper balance?

Learn to Read the Market Structure

Our first focus at Elite CurrenSea is always to understand the market structure and the larger context of the chart. This can be done by analyzing the price chart with these three main concepts:

- Patterns;

- Trend and momentum;

- Support and resistance (S&R).

Most traders think that simple trading is a matter of only trading good pinbar patterns or strong S&R, but these shortcuts do not work in the long run.

The daily chart of EUR/USD showing the trend (green lines), patterns (purple lines) and potential support (moving averages).

The key to a simple yet sustainable system is to analyze the entire price chart but in an efficient way. Charts should not require hours of our attention. Traders must find a method that allows them to understand the entire technical analysis picture without getting lost in details.

This is when trading systems become important. But once again, the system must address an efficient way of understanding patterns, trend, and S&R first.

Focus on Understanding Patterns

The most important aspect for our trading styles is based on patterns, even more so then trend and support and resistance. Price patterns really reveal the true intentions of the chart.

Understanding price patterns will allow you to see how price moves impulsively and correctively and how these patterns repeat over time and on various levels.

Patterns are like a language and the market is communicating with us via this language. The main question is: can traders understand it?

As you know or can imagine, learning a language takes time. But once you understand more words and phrases, your ability to interact increases.

The same is valid for the price charts and financial markets. Learning the language of charts does take time and effort. It’s not a simple process but is doable with persistence (like with languages).

The first step is to identify and recognize patterns. Then the second step is to actually trade these patterns.

This takes dedication, persistence, and time to learn and cannot be done overnight. But with experience, traders can simplify the charts. The same process is valid when you are learning to read a chart of a terrain or weather. At first, it seems confusing but once you have experienced it, it will become easier.

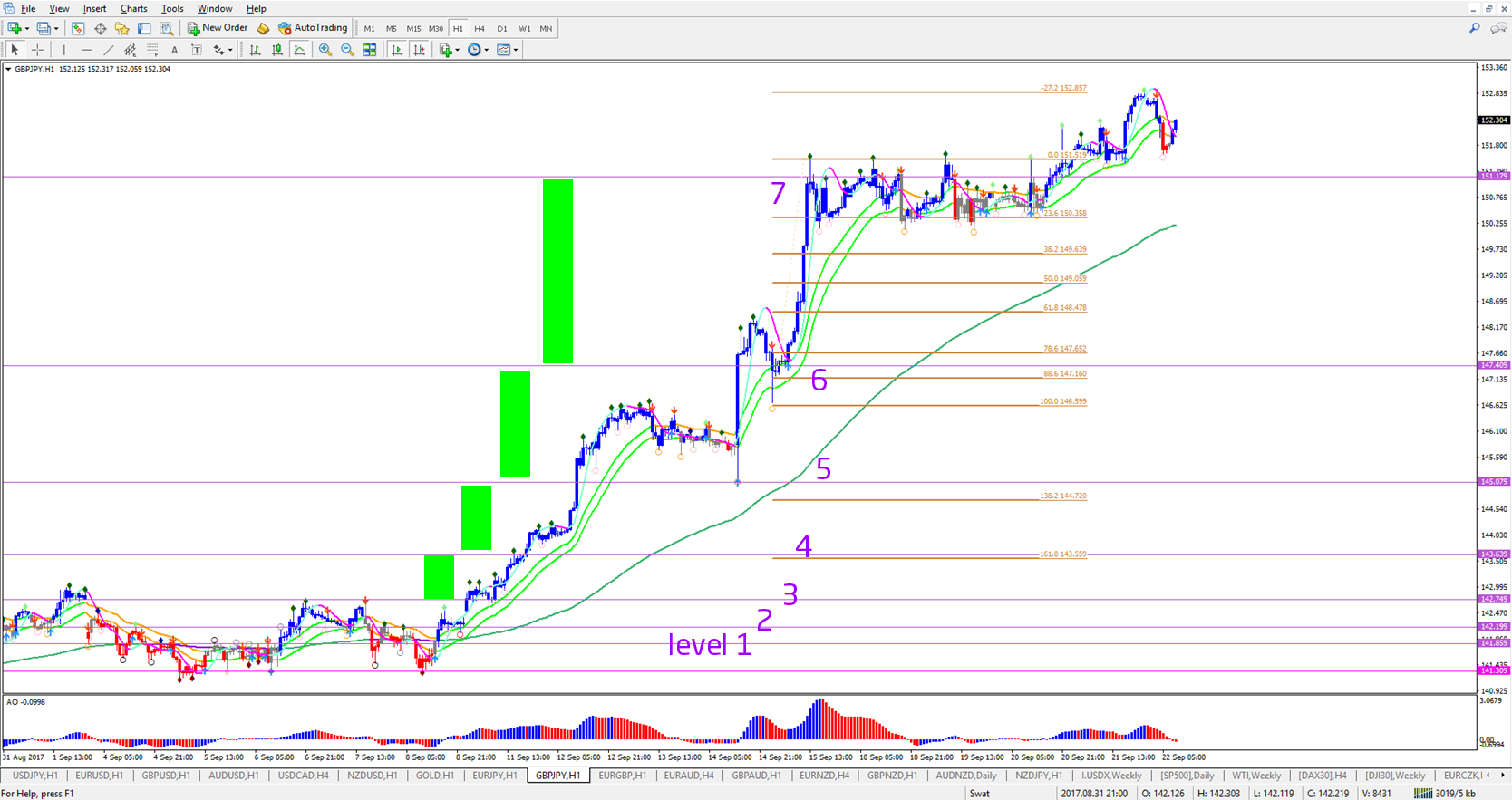

SWAT analysis showing impulsive price action between Fibonacci patterns (purple numbers).

Setting Up Your Trading System

There are many market patterns available but Nenad and I use only the best-tested ones like candlestick patterns, chart patterns, Fibonacci patterns and breakout patterns. The main difference is that I also add wave patterns in my analysis. However, I only use the waves as a supporting tool, not for entry and exit decisions.

Patterns and market structure are beneficial for all types of trading, regardless whether it’s Forex, commodities, CFDs, stock indices, stocks, or cryptocurrencies. Price always moves in the same way with impulse and correction in patterns.

Although we both analyze the market structure and patterns, in the same way, we do not have the same trading approach. In fact, we apply different trading systems:

- Nenad’s CAMMACD system leans more on price patterns and retracement setups.

- My SWAT system is more focused on wave patterns and breakouts.

Basically, both of our systems use the market structure and price patterns but they emphasize different styles. In fact, the chart is like a map which offers countless different roads. The market structure is a vast terrain and your trading system helps you navigate through it.

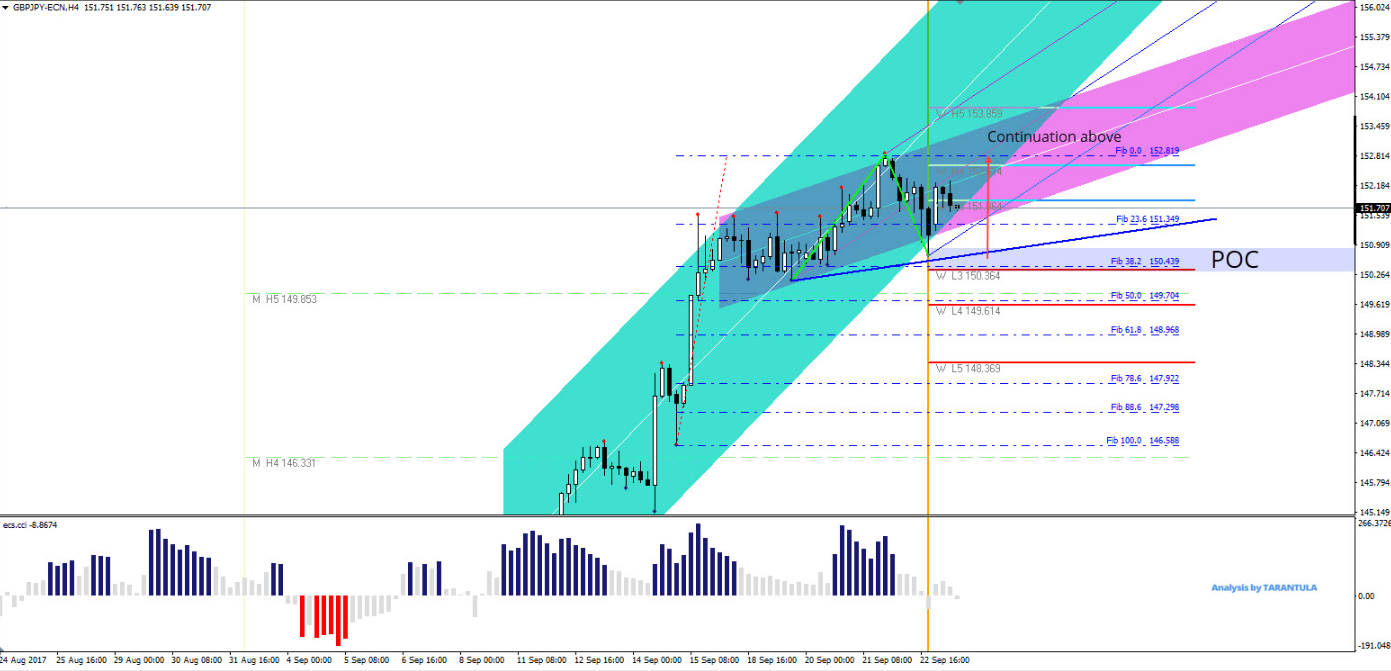

Nenad’s CAMMACD system.

How to Manage Your Trading Bias

Your analysis and trading system will create a trading bias, which is a normal development and a needed one. Some trading experts think that bias can be totally removed, which is incorrect.

Why? Because a trader without a trading bias will not even enter a trade setup. They will constantly be analyzing but lack conviction for a trade setup. Trading bias is a natural part of analyzing the charts and a must for trading.

As a beginner trader, you will have an “untrained” bias which is based on fear and other (negative) emotions. Basically, traders who lack the experience have a false bias which is nothing to do with charts, market structure or price itself but is only connected to their insecurity. However, once you develop and educate yourself as a trader, you will be able to trade based on an experienced bias.

Your analysis should create the trading bias but your trading plan should try to prevent you from entering when the bias is incorrect and let you enter when the bias is correct. A good trading system based on market structure and price patterns help protect you, at least in a good number of cases.

A good trading system also uses invalidation and confirmation levels which helps you recognize when your analysis is well on track (price is moving to your level as expected) or whether it’s moving in the opposite direction (your analysis is invalidated).

Many green pips,

Chris Svorcik

Nenad Kerkez