LeapRate Exclusive… LeapRate has learned via regulatory filings that FCA licensed FX and CFDs broker IKON Finance Limited saw a drop in Revenues as well as a net operating loss in 2016, ahead of the company’s sale of its Retail FX clients to rival broker Hantec Markets after year-end.

As was exclusively reported by LeapRate back in March, IKON Finance, which is controlled by Turkish businessman Engin Yikilmazoglu, was placed on Closed to new business status by the FCA back in March. The issues stated by the FCA for its decision included the company having appropriate human and operational resources in place including adequate governance and oversight of all functions, appropriate AML systems and controls, and verified up-to-date and risk-sensitive customer due diligence information for customers.

IKON Finance then held a quick fire sale of its client base, with fast-growing Hantec Markets striking a deal to have the IKON Finance clients transferred.

IKON Finance remains, seven months later, on “Closed to Business” status by the FCA. Its website (see above) states Website is Under Construction – we’ll be here with a new website soon.

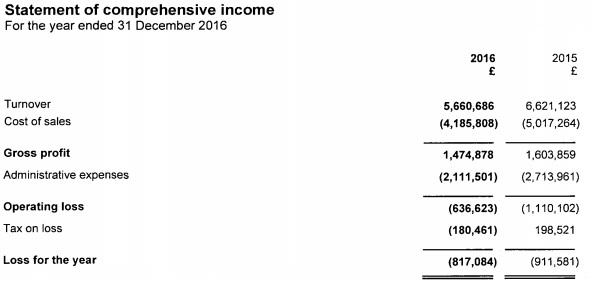

It turns out that IKON Finance was already having troubles leading up the FCA’s action against it. As we noted above, in 2016 the company saw a 15% drop in Revenues, £5.7 million versus £6.6 million the previous year, and posted a Net Loss of £817,000.

An IKON Finance representative provided the following statement to LeapRate:

IKON Finance has a new management team in place and is in the process of a major transformation to its business. This will allow us to provide a high quality service to its loyal clients in the future.

The IKON Finance group was at one point was a leading Retail FX firm with global reach. IKON exited the US retail forex market earlier this decade when US regulators tightened capital requirements and other rules around retail forex trading. Before exiting the US, the NFA regulated entity IKON Global Markets was hit with a $320,000 fine related to charges that it engaged in asymmetric price slippage practices on its MT4 platform that were favorable to IKON and caused disadvantageous trading conditions for certain customers. And this summer, as was also exclusively reported by LeapRate, a US court issued a $22.9 million fraud judgement against IKON Global Markets.

IKON Finance’s 2016 income statement follows: