GAIN Capital Holdings, Inc. (NYSE: GCAP), the global provider of online trading services, and its Forex.com retail forex unit announced financial results for the third quarter of 2017, indicating that:

- Net revenue increased 13% year-over-year to $81.3 million

- GAAP net loss of $2.6 million, or $0.04 per share; adjusted net income of $2.1 million, or $0.05 per share

- Recognized a non-cash charge associated with the refinancing of Convertible Senior Notes due 2018

- Adjusted EBITDA of $14.7 million, compared to $3.3 million Q3 2016

- Retail OTC and ECN average daily volume increased by 6% and 53%, respectively

Net revenue for the quarter was $81.3 million, up from $72.2 million in the third quarter of 2016. Adjusted net income for the quarter was $2.1 million, which excludes a non-recurring, non-cash charge associated with the refinancing of $71.8 million of Convertible Senior Notes due 2018, compared to an adjusted net loss of $5.8 million in the third quarter of 2016.

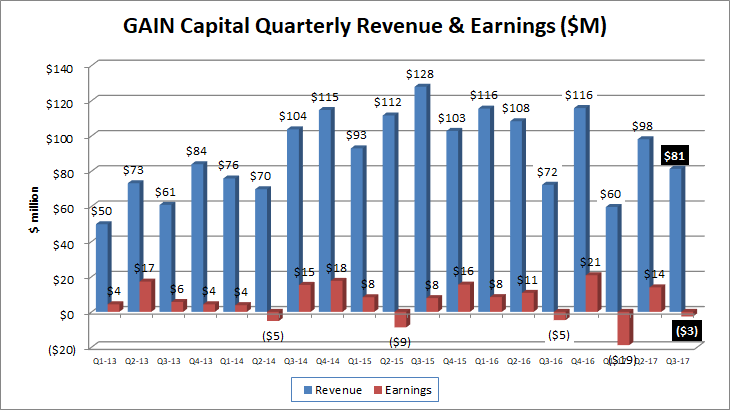

On a quarter-to-quarter comparison, GAIN Capital revenues were down 17% from Q2 ($98.1 million), due mainly to lower currency market volatility during the summer months.

Adjusted EBITDA for the quarter was $14.7 million, up from $3.3 million in the third quarter of 2016. GAIN’s financial highlights are included in the chart below.

Glenn Stevens, GAIN Capital

According to Glenn Stevens, CEO of GAIN Capital:

Our solid third quarter results reflect GAIN’s ability to continue to execute and create value, even amid a period of multi-year low volatility levels. Our year-over-year growth in revenue and adjusted EBITDA reflect our strategic focus on organic growth initiatives and effective cost management, which is on track to deliver total fixed cost savings of $15 million for 2017. The combination of strong cash flow generation and recent capital raises has improved our balance sheet and provided GAIN increased flexibility to pursue growth opportunities while continuing to return cash to shareholders.

Convertible Senior Notes Offering

On August 22, 2017, GAIN completed a $92 million offering of 5.00% Convertible Senior Notes due 2022. The net proceeds from the offering were used to retire nearly all of the outstanding Convertible Senior Notes due 2018. In connection with the offering, GAIN agreed to repurchase approximately $14.5 million of its common stock from purchasers of notes in the offering in privately negotiated transactions concurrently with the closing of the offering.

Capital Return and Dividend

In the third quarter, GAIN focused on returning capital to shareholders through buybacks and dividends, which amounted to a combined total of approximately $19.0 million.

In the third quarter, excluding the buyback in conjunction with the Convertible Senior Notes offering, GAIN repurchased 279,612 shares of stock at an average price of $6.61.

Including the buyback in conjunction with the Convertible Senior Notes offering, during the third quarter, GAIN repurchased 2,402,598 shares of stock at an average price of $6.80.

For the nine months ended 2017, GAIN returned a total of $34.3 million to shareholders in the form of share repurchases and dividends.

GAIN’s Board of Directors declared a quarterly cash dividend of $0.06 per share of the Company’s common stock. The dividend is payable on December 21, 2017 to shareholders of record as of the close of business on December 11, 2017.

Gain Capital’s full Q3 report can be seen here.