FX brokerage group GAIN Capital Holdings Inc. (NYSE:GCAP), which operates the FOREX.com and City Index Retail Forex brands, has announced that it commenced a “modified Dutch auction” tender offer to purchase up to $50 million of shares of its common stock, or such lesser number of shares of its common stock as are properly tendered and not properly withdrawn.

The move by GAIN comes as the company (and some of its key competitors) have come under pressure recently, with FX trading volumes dropping due to a combination of low currency price volatility and regulatory tightening (mainly in Europe) around the online trading industry.

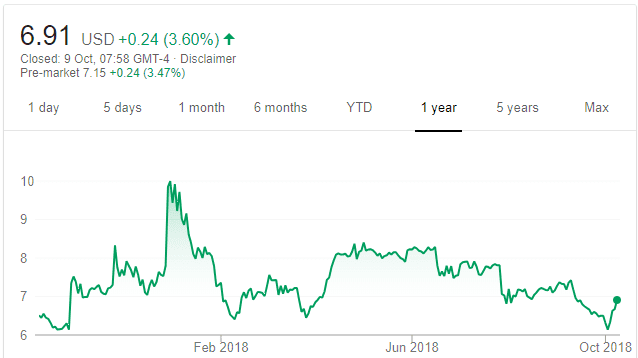

GAIN Capital one year share price graph. Source: Google.

The share repurchase will be done at a price not less than $7.24 nor greater than $7.94 per share of common stock, to the seller in cash, less any applicable withholding taxes and without interest. The Offer is made upon the terms and subject to the conditions described in the offer to purchase and in the related letter of transmittal. The closing price of GAIN’s common stock on the New York Stock Exchange on October 8, 2018, the last full trading day before the commencement of the Offer, was $6.91 per share, such that the price range being offered in the Dutch auction is at a 5-15% premium to the current share price.

The Offer is scheduled to expire at 5:00 P.M., New York City time, on November 6, 2018, unless the Offer is extended.

What is a “Dutch Auction”?

A Dutch auction is a public offering auction structure in which the price of the offering is pre-set, presumably after taking in all bids to determine the highest price at which the total offering can be sold. In this type of auction, investors place a bid for the amount they are willing to buy in terms of quantity and price. In this case, presumably shareholders would be willing to sell back to GAIN more shares at $7.94 than at $7.24.

Glenn Stevens, GAIN Capital

GAIN Capital CEO Glenn Stevens stated:

The Offer underlines our ongoing commitment to executing a balanced capital allocation strategy to enhance shareholder value. Given our strong capital position, particularly in light of the $85 million in proceeds generated from the sale of the GTX business, as well as the current market price of our common stock, we believe the Offer is a prudent means to return capital to shareholders. Our strong capital position also allows us to make appropriate investments to pursue growth initiatives, consistent with our goal of delivering long-term value.

GAIN stated that it believes that the modified Dutch auction tender offer represents an efficient mechanism to provide GAIN’s stockholders with the opportunity to tender all or a portion of their Shares and thereby receive a return of some or all of their investment in GAIN if they so elect. The Offer provides stockholders with an opportunity to obtain liquidity with respect to all or a portion of their Shares without the potential disruption to the Share price.

The Offer is not contingent upon obtaining any financing. However, the Offer is subject to a number of other terms and conditions, which are described in detail in the offer to purchase. Specific instructions and a complete explanation of the terms and conditions of the Offer will be contained in the offer to purchase, the letter of transmittal and the related materials, which will be mailed to stockholders of record shortly after commencement of the Offer.

None of GAIN, the members of its Board of Directors, the dealer manager, the information agent or the depositary makes any recommendation as to whether any stockholder should participate or refrain from participating in the Offer or as to the price or prices at which stockholders may choose to tender their shares in the Offer.

D.F. King & Co., Inc. will serve as information agent for the Offer. The dealer manager for the Offer is Jefferies LLC.