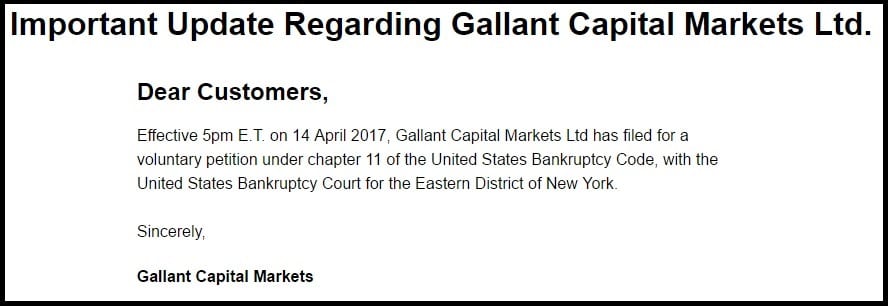

Gallant Capital Markets Ltd, the British Virgin Islands incorporated parent company of retail forex broker GCMFX, has announced on its website gcmfx.com that it has filed for bankruptcy via a voluntary petition under Chapter 11 of the United States Bankruptcy Code, with the United States Bankruptcy Court for the Eastern District of New York.

GCMFX was a fairly small offshore broker, so its disappearance isn’t too consequential in the overall scheme of the retail forex sector.

However the questions which we believe are on the minds of people in the forex industry are:

- Why would a BVI licensed company, which (like other offshore retail forex brokers) didn’t take on US retail clients, file for bankruptcy protection in the US?

- What is the connection between Gallant Capital Markets Ltd / GCMFX, and FCA regulated GCM Prime Ltd (with “GCM” of course standing for Gallant Capital Markets)? And, does the GCMFX bankruptcy have any bearing on the business of the UK-based GCM Prime?

We believe that we have the answers to both.

First, the US bankruptcy filing.

While Gallant Capital Markets Ltd. is a company registered and located in the British Virgin Islands, its CEO Salvatore Buccellato is (according to UK filings) a US citizen resident in the United States. We believe that Mr. Buccellato, who has been CEO of Gallant since 2008, remains the controlling shareholder of Gallant via his US holding company Prime Trade Holdings Corp. The US filing would help protect Prime Trade Holdings and Mr. Buccellato against any claims made by creditors against Gallant.

Second, the Gallant/GCMFX connection to GCM Prime.

While there have been unsubstantiated reports that Gallant/GCMFX was sold by Mr. Buccellato several years ago to a New Zealand based company, we believe that Mr. Buccellato (via his Prime Trade Holdings Corp.) has remained a key investor, if not the controlling shareholder, in the company. In any event, he has remained as CEO of GCMFX directing the strategy and execution of the now-bankrupt company.

Mr. Buccellato, via his Prime Trade Holdings Corp. holding company, bought an inactive FCA regulated retail forex broker called AlumFX in 2015, changing the name of the company to GCM Prime Ltd in August 2015. GCM Prime was then relaunched in late 2015 as a service provider to Retail Forex brokers, providing liquidity solutions, full white label broker solutions, and Prime of Prime services.

Mr. Buccellato then hired FXCM veteran Adam Toro, FXCM’s VP Institutional Sales and Business Development from 2003-2015, to be CEO of GCM Prime.

We understand that GCMFX was indeed a client of GCM Prime, but at the time of its bankruptcy not a material client, accounting for a relatively small percentage of GCM Prime’s revenues.

(As LeapRate exclusively reported in December, in its most recent reported fiscal year 2016 GCM Prime posted just £61,385 of Revenue and had a net loss of £729,235).

The connection as we see it between the now bankrupt Gallant/GCMFX and GCM Prime Ltd is twofold:

- The business connection, whereby GCM Prime has lost a client of its liquidity and prime brokerage services, although not a material client, and

- If Gallant/GCMFX has unsatisfied creditors then they are likely to try to get their money back from Prime Trade, which could include its holding in GCM Prime – especially given that Gallant has been paying GCM Prime money over the past few years.

There is also the reputational question: Will retail forex and institutional clients want to continue to do business with GCM Prime, owned by Salvatore Buccellato, knowing that as CEO he oversaw a retail forex broker which filed for bankruptcy?

LeapRate reached out to Mr. Buccellato, and we exchanged messages with him, but he declined our invitation to comment formally for the article in time for posting.

We will continue to follow this story as it develops.