LeapRate Exclusive… LeapRate has learned via regulatory filings that GAIN Capital UK Limited, the FCA regulated subsidiary of global FX broker Gain Capital Holdings Inc (NYSE:GCAP), saw a significant pickup in both Revenues and Profits in 2016.

Fiscal year 2016 represented the first full year in which the results of City Index were included in GAIN Capital UK’s results. GAIN bought City Index in April 2015, for a net purchase price of $77 million.

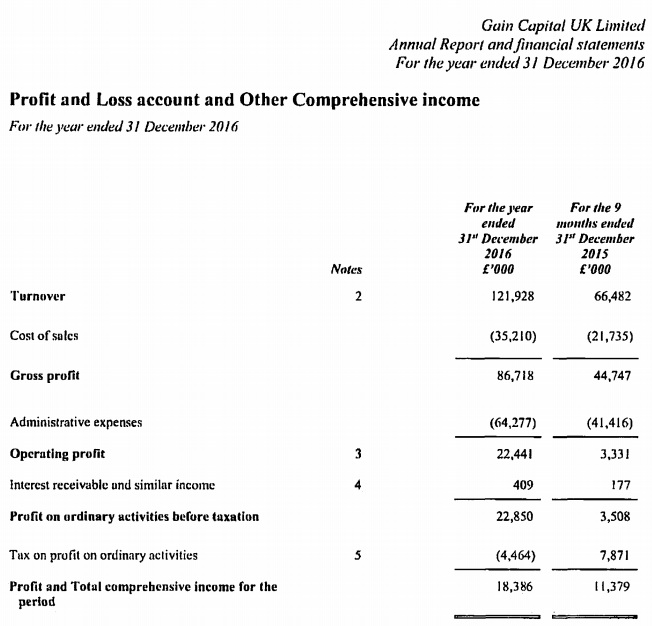

Overall, GAIN Capital UK reported Revenues of £121.9 million (USD $158 million) for 2016, up 83% from 2015’s nine-month revenues (i.e., the period after City Index was acquired) of £66.5 million, which results in a 39% increase on an annualized basis. On the bottom line, GAIN Capital UK earned Net Profit of £18.4 million, up from £11.4 million the previous year (nine months).

We would note that the parent (publicly traded) company reported net income of $37.4 million in 2016, which was a fairly good year for the company – meaning that GAIN Capital UK’s contribution was more than half of overall corporate profits.

According to company filings, the company’s key objective for the year was completing the integration of City Index with the existing corporate operations in the UK, which was completed in August 2016, and securing synergies from the integration of UK operations. GAIN Capital UK also launched an MT4 offering last year.

The events around Brexit as well as the US election created additional volatility which helped drive trading volumes.

Client assets held increased from £157 million in 2015 to £263 million as at year end 2016.

GAIN Capital UK’s 2016 income statement follows: