Background

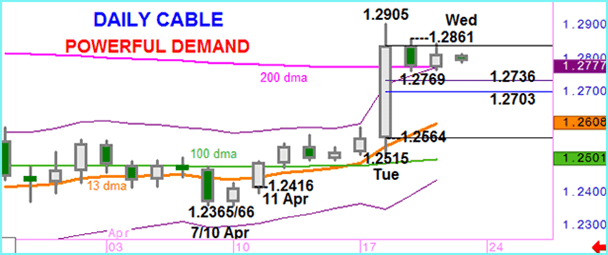

As expected, Wednesday’s minor setback for GBPUSD proved to be only temporary. Yesterday saw the market attract fresh buying interest below 1.2800 and although the resulting upside was not extensive, Wednesday’s decline was mostly regained. This has kept Cable above the 200 day moving average and near the top of a positive daily Keltner channel.

Countering these positive factors though are a decline in Asia, lower highs and negative intraday divergence. These conflicting signals mean that immediate analysis has to be made with caution but, temporarily, we look for lower levels.

Management and risk description

A move to 1.2782 means the stop can be lowered to break even.

Parameters

Entry: Sell in 1.2810/15 area and at 1.2830.

Stop: 1.2861 bid.

Target: 1.2782 and 1.2736.

Time horizon: Intraday, ending 1500 GMT

Powerful demand

Consolidation

Long-term trend

Charts from CQG. Create your own charts with SaxoTrader; click here to learn more.

For more on forex, click here.

— Edited by Robert Ryan

Non-independent investment research disclaimer applies. Read more

A compiled overview of Trade Views provided on TradingFloor.com is found here