Background

The probability of a rate rise by the US Federal Open Market Committee on June 14 jumped from 50% to 65% post the French election result as risk appetite resurfaced across global markets. But the “hard” data out of the US has yet to back up the “soft” data coming from surveys (or election results).

Meanwhile, the Swiss National Bank will be pleased to see the EUR rally against the CHF but will remain vigilant. Intervention to cap the exchange rate continues and the policy rate is being held close to minus 0.75%.

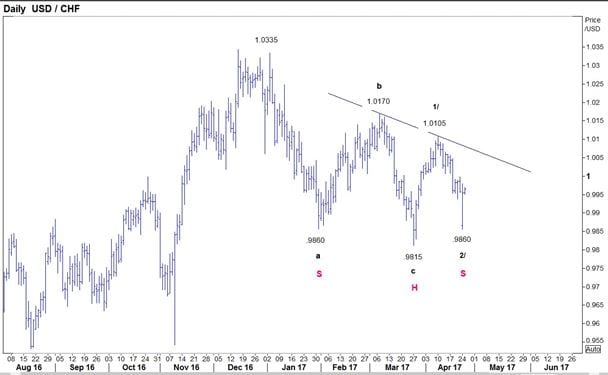

The weekend’s French election inspired a selloff in the dollar, which found support at 0.9860, to exactly match the potential left shoulder of a developing three-month Inverse Head and Shoulders formation (refer daily chart below).

Also, from an Elliott Wave perspective, USDCHF also displays a completed zigzag corrective structure from last December’s 1.0345 high. Successful completion of this bottoming structure (with a sustained break above Neckline resistance) would herald an advance toward the 1.0400 level over the coming weeks.

In the short term, support lies at about 0.9930, 0.9900 max. to yield a rally toward the key 1.0085 (Neckline resistance).

Parameters

Entry: today: USDCHF is seen as a buy at market (0.9965).

Stop: 50% just under 0.9930 and 50% just under 0.9900, initially.

Target: 1.0319.

Time horizon: allow several weeks for target to be met.

USDCHF daily chart (click to expand)

Source: ThomsonReuters

USDCHF weekly chart (click to expand)

– Edited by Gayle Bryant

Non-independent investment research disclaimer applies. Read more

A compiled overview of Trade Views provided on TradingFloor.com is found here