Day trade

/

Sell

Trade view /

11 hours ago

Instrument:

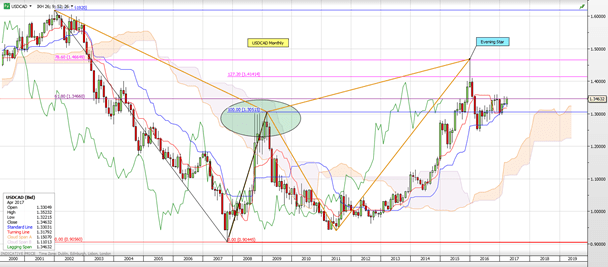

USDCAD

Price target:

1.3400

Market price:

1.3466

USDCAD looks prime for a counter-trend short entry today but the medium-term bias remains bullish.

Monthly – Highlights a disjointed bearish Gartley formation. The move higher from May 2016 has been mixed and volatile, common in corrective formations.

Source: Saxo Bank

Weekly – Although levels close to the 50% Fibonacci level of 1.3574 attracted selling, there has been little follow through action. In fact, for the last 19 weeks we have been broadly confined to the weekly Ichimoku Cloud resulting in daily results being mixed. A break of the cloud top (1.3573) and we look to 1.3837 in the last leg higher.

Source: Saxo Bank

Daily – Broken through the trend of lower highs. The reverse trend-line support is now seen at 1.3400. We look to have formed a bullish Cup and Handle so the medium-term bias is skewed to the upside.

Source: Saxo Bank

Intraday (two hours) – We have stalled and reversed from the 261.8% extension level of 1.3522 (from 1.3221 – 1.3336). We are now assessed as being in the choppy correction lower. Channel support and possible right shoulder of a bullish reverse Head and Shoulders pattern, is seen at 1.3400. This will be formidable support and we look to get long here for the medium-term play.

Source: Saxo Bank

Parameters

Entry: Selling at 1.3480.

Stop: 1.3510.

Target: 1.3400.

Time horizon: 1-2 sessions.

——————————————————————————-

Time horizon: 2-3 weeks.

A compiled overview of Trade Views provided on TradingFloor.com is found here