Background

The news knocked the Canadian dollar and boosted prices of lumber futures. It also creates a trading opportunity in lumber futures, as outlined below.

Free and unfettered trade in timber across the US-Canadian border has always been a sensitive issue as building activity has a direct impact on the price of lumber. Similarly, the price of lumber is a direct cost that can affect the home-building companies’ bottom line.

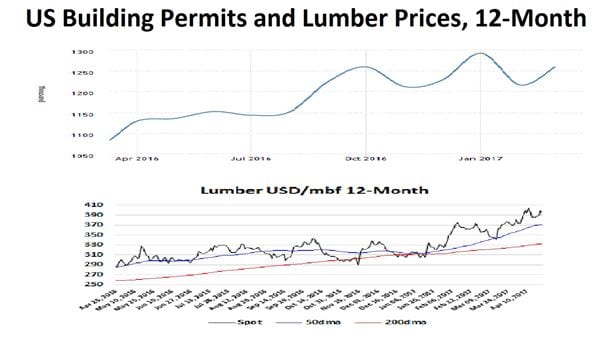

This chart shows the pathway of US building permits and the lumber price over the past 12 months. The direction of the prices is remarkably similar. In fact, the correlation R-squared for the past 12 months stands at 0.8131.

No slumber for lumber

American demand for lumber currently exceeds what the US forest industry produces. Housing and construction starts are on the rise, and demand for lumber is expected to continue to grow in the months and years ahead.

Canada argues that Canadian lumber imports don’t pose a threat to the US lumber industry. There is enough North American demand to support the US industry while also allowing Canada to supply US customers. But the American position is that most Canadian lumber is harvested from sate-owned land that is used at highly subsidised rates, meaning that American producers who operate mainly on private land face severe cost disadvantages

.

The upshot is that constraining Canadian lumber imports by applying punitive duties creates price volatility in the lumber market. These unwarranted duties are reflected in higher lumber prices.

The technical aspect is neutral from one minute to one hour, whereas the five-hour to one-month view is highly bullish for higher prices.

Lumber 6-year chart

Management and risk:

Parameters: Lumber, trade the July 2017 Contract LBN7

Entry: Buy LBN7 at market $402.90

Targets: $408.50 … $419.76 … $432.41

Stop: $375

Time horizon: Medium term