Monday could start of with a bang as the results from the first round of French elections are released around Asia open.

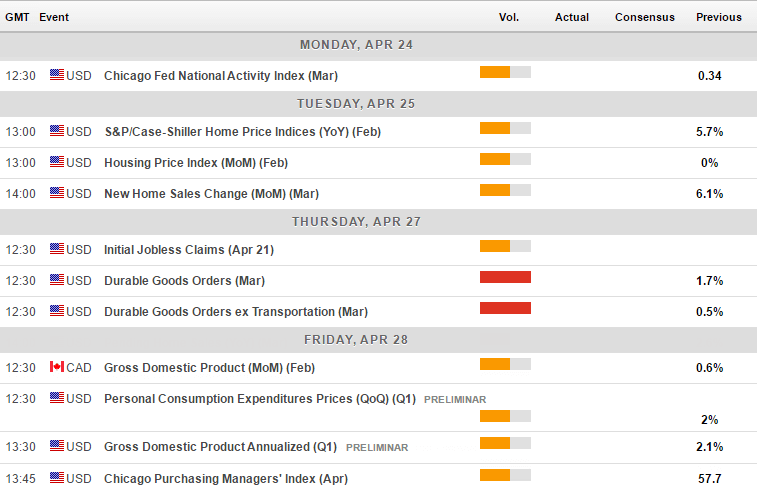

USD: New home sales continue to track consumer confidence higher. There are concerns that confidence is already reaching extreme levels, whilst the credit cycle sends warning signals and delinquencies rise. So, whilst home sales and confidence point to supported growth, gremlins could be lurking in the system further out if consumers become over-leveraged in a low wage environment.

Durable goods excluding transport is moving higher to back up previous PMI reads. Within the sub-indices, the volume of fabricated metals how broken to record highs and expanding at 6.9% YoY whilst manufacturing with unfilled orders is at 8.2% YoY. However, the latter can partly be explained by a basing effect, as the underlying index has essentially moved sideways since 2015.

Personal consumption expenditure measures consumer spending, making it an inflationary measure. Released quarterly, it shows consumers are indeed spending and rising along with consumer sentiment. Yet as it is released quarterly, it is possible it may soften which could help explain the poor inflation data provided last month. In response to weak inflation, we have already seen the Fed increase M2 to artificially reflate the economy as they head towards their planned hikes later this year.

The Baker highs oil rig count, released weekly continues to move higher, although we could see this stall at some point following the volatile moves seen on oil prices and the pending OPEC meeting.

Fed Atlanta’s GDP now forecasts Q1 GDP at a mere 0.5%, a big drop from Q4’s 2.1%. However, Q1 tends to undershoot and be revised higher on 2nd or 3rd release. Additionally, PMI data in H2 2016 was moving steadily higher so we do not think a 0.5% is enough to warrant a bear case on the US economy just yet.

CAD: Monthly GDP is expected to remain supported, as the Ivey PMI which itself is elevated at 67.6. The same can be said for retail sales which saw a solid spike higher, yet these alone are not reason to expect BoC to hike any time soon. They essentially removed any hope of a hike and share a similar situation to Australia; soft wage growth and falling inflation, although BoC expect CPI to soften further in the months ahead. Additionally, it was revealed they had considered easing in January, so we continue to believe that if Oil process remain capped then the yield differential should help send USDCAD higher.

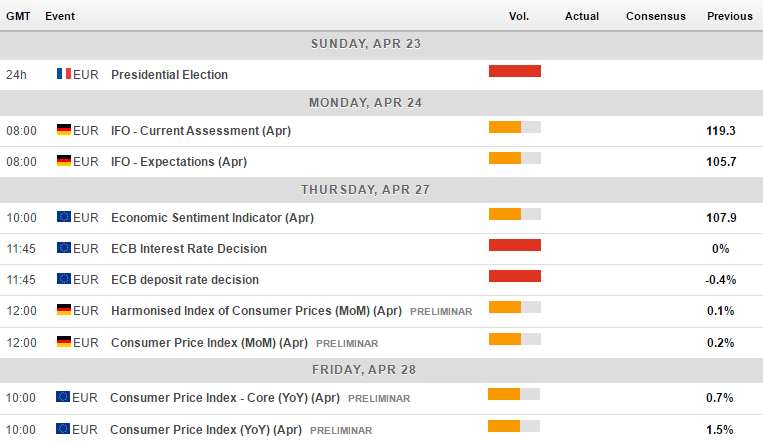

EUR: The French presidential election could be the highlight of the week at the F open on Monday in Asia. Polling station close 8pm local time, which means we are likely to be seeing results pour in as the FX markets open. We have seen the Euro gather momentum as it seems Macron is ahead in the polls, yet recent referendums have been a constant reminder that polls leading up t an event count for little towards the event’s actual outcome. So, traders may still be in for a surprise if Le Pen take s a victory, but for a more exciting, ail-biting or volatile session, a close race needs to be seen taken to the bitter end.

No changes are expected at the ECB meeting on Thursday. We are likely a way off from any actual talk of tightening, although the markets did get excited with a small prospect of a minor hike in last 2017 or even a cheeky taper. For now, we believe the bigger driver for Euro is to be France not voting for populism and the 27 members firmly controlling Brexit negotiations (which all point to a higher Euro).

The European Sentiment Indicator is released for all EU states – so within two years the UK will no longer be part of this report. The UK Services sector is on the cusp of crossing to outright pessimism to catch up consumers. The overall ESI (of all 28 members) remains elevated yet the advance has halted, so the coming months may begin to suggest a top is in place.

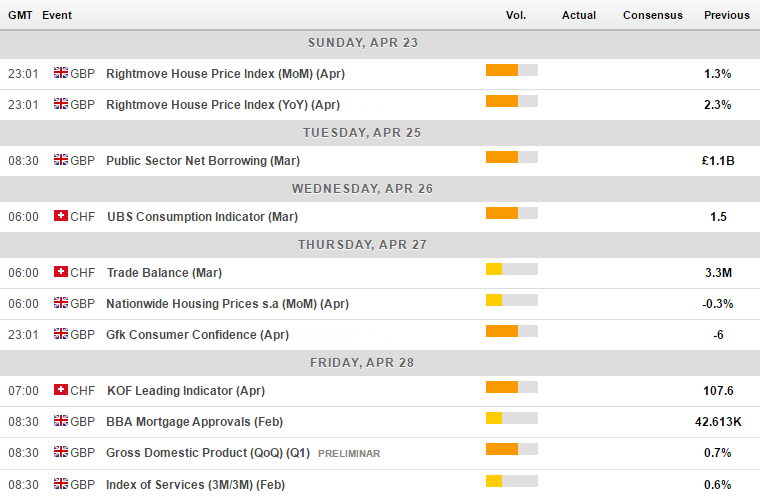

GBP: GDP has been another indicator for the UK which points to a solid economy overall, despite the Brexit woes. However, whilst the UK is generally surpassing the grim predictions by economist surrounding Brexit, we think there is a good chance they will eventually prove correct when you consider the recent reports of internal EU letters and how they intend to pressure the UK.

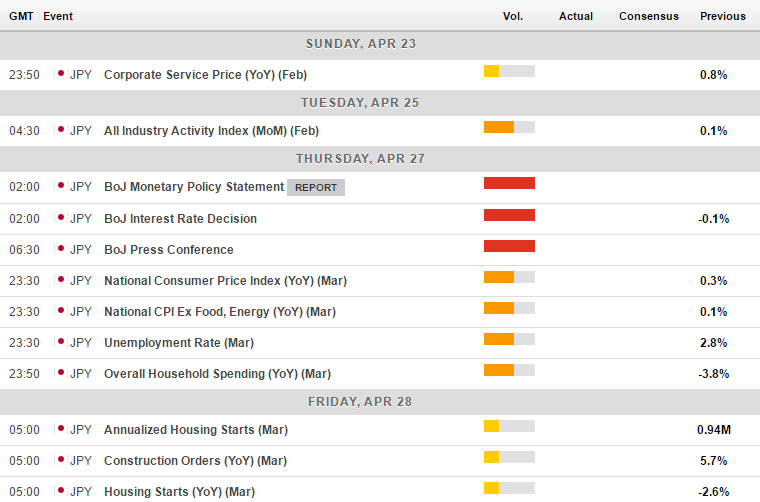

JPY: The BoJ central bank meeting is another with little, to no expectations of any change of policy. Growth has continued to pick up and inflation remains the key issue. Whilst inflation had picked up slightly in recent month, it has also begun to soften once more and the rising Yen this year is adding to those pressures. In addition, the rate of acceleration for producer prices is also tailing off, and household spending remains negative so inflation could move lower over the coming months.

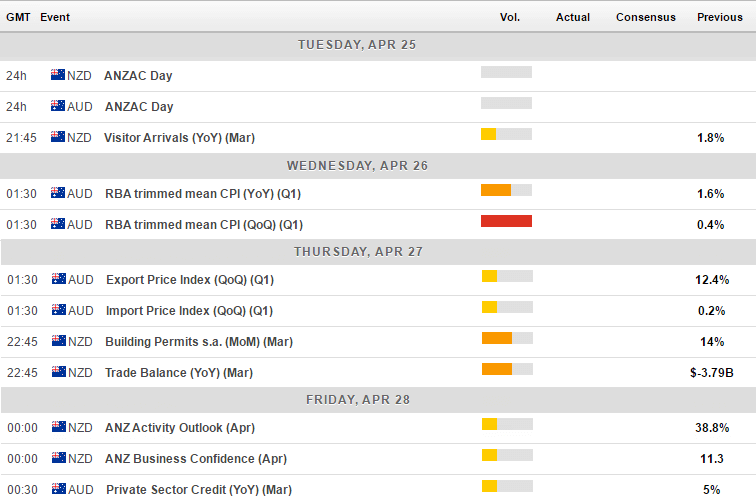

AUD: Quarterly CPI is eagerly anticipated, following the slightly dovish tone of the RBA earlier this week. Whilst their more pressing concern is seemingly with employment, there is room for disappointment if inflation does move lower as they have an expectation for it to gradually rise. At 1.6% it is fractionally above their own 1.5% forecast and below their 2%-3% band.

Producer prices are also leading CPI lower, although a QoQ spike may help provide a little support in the coming quarter. Yet the overall trend on both QoQ and YoY point lower and remain subdued, at best.

Matt Simpson | Senior Market Analyst

A certified technical analyst, combining macro themes, monetary policy and business cycles to generate Forex and commodity trade ideas.