Background

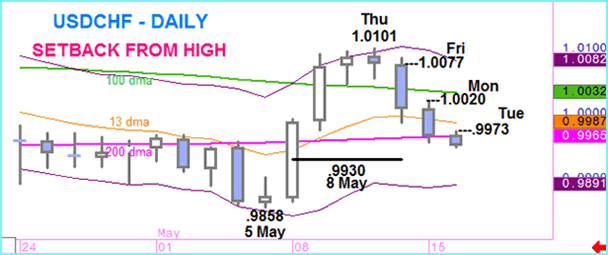

Friday’s sharp fall through the 100 day moving average deepened on Monday. This latest decline — the third in a row — took USDCHF to test the 13 and 200 day moving average area.

The scope of the three day move also took signals for sentiment to oversold extremes. That element coupled with positive divergence in some technical signals introduces a strong note of caution to today’s analysis, but Asian losses have emphasised an underlying negative tone.

Management and risk description

A move below 0.9930 means the stop can be lowered to break even.

Parameters

Entry: Sell in 0.9950/55 area and at 0.9973.

Stop: 0.9995 bid.

Target: 0.9930, 0.9913 and 0.9897.

Time horizon: Intraday, ending 1500 GMT.

Setback from high

USDCHF hits oversold levels

Long-term trend

All charts from CQG. Create your own charts with SaxoTrader; click here to learn more.

For more on forex, click here.

— Edited by Robert Ryan

Non-independent investment research disclaimer applies. Read more

A compiled overview of Trade Views provided on TradingFloor.com is found here