The former Bundesbank president and acting chairman of UBS, Alex Weber, and German finance minister Wolfgang Schaeuble have in the past couple of days said they believe the European Central Bank will or should soon begin tapering its quantitative easing. They hinted that that could happen around September. With growth at some of the highest levels in many years and confidence at strong levels, it’s time to scale bank ECB accommodation, the thinking goes.

If the ECB changes its language and indicates tapering later this year, it will likely give a valuation boost to European banks as the penalty from negative interest rates will ease somewhat. But headwinds persist from litigation costs, excessively high-cost structures, low returns on equity, increasing regulatory costs.

As we showed on our morning call, the current return on equity in the European banking industry is 3.4%, with estimates projecting 12-month ROE hitting 9.1% in 12 months. These are steep expectations, and, with the price-to-book ratio already at 0.9, it leaves little margin for error if conditions or execution fail.

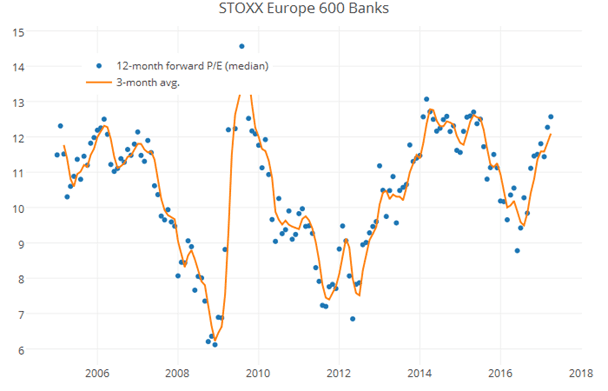

As followers would know, we have a positive view on equities in general given the macroeconomic outlook, and we are overweight European equities. However, with European banking stocks up 46% since July 2016 (STOXX 600 is up 23% in the same period), and given lofty current valuations, we believe that taking advantage of low implied volatility is a prudent step. Buying puts on European banks would act as a good hedge in case markets get hit by external shocks or banks’ results disappoint.

So, to be clear here, we like the current trajectory of European equities, but nothing is perfect, and with low implied volatility investors can protect some of the gains against unforeseen events by buying downside protection in the banking sector that has rallied the most and has the highest beta to adverse events.

Management and risk description

Since we are buying puts, there is a natural stop loss built into the trading idea. The obvious risks to a negative view on European banks are continued strong macro data or a change of language from the ECB on QE.