Market Overview

Financial markets gave a huge sigh of relief after Emmanuel Macron emerged as the clear front runner in the first round of voting for the French Presidential Election. With Macron securing 23.7% (versus Marine Le Pen’s 21.7%), traders have a risk positive outcome and market sentiment is subsequently strong. Although Le Pen has made it into the second round, with a lack of significant momentum it would take an incredible turnaround to prevent a Macron victory in the 7th May run off. Macron is seen as a continuity candidate for the Eurozone and EU, and this is helping to drive strength for the euro this morning. Although the polls were largely right on this occasion, Macron will take the momentum into the second round and this has helped sentiment today. The spread between French OATs and German Bunds continues to tighten, whilst in equities, the CAC is strongly higher (closely followed by the DAX). Safe haven plays such as the yen and gold are under pressure, whilst US Treasury yields are also strongly higher. The dollar is weaker as more risk positive currencies such as the Aussie and Kiwi have also benefitted.

Wall Street closed mildly corrective on Friday (S&P 500 -0.3%) but with the risk positive outlook today, Wall Street futures are strongly higher. Asian markets were mixed although the Nikkei was higher by +1.2%. European markets are positive across the board, although the FTSE 100 is underperforming as the Eurozone markets have flown higher with the drastically reduced prospect of Eurozone stress following Macron’s positive showing. Forex majors show the euro is showing significant strength, around 1.2% higher against the dollar, whilst the yen is the major underperformer and sterling is also weaker. Gold is also around a percent lower as safe havens are being shunned, with silver under less pressure. Oil has managed to bounce half a percent in the risk positive mood of early today but the concerns over US shale remain after a fourteenth consecutive week of increasing rig counts.

Traders will spend the day reacting to the French Presidential Election results, however the German Ifo Business Climate at 0900BST may also play a bit of a role. The expectation is for a repeat of last month’s 112.3. Today is also ANZAC Day and so with Australia and New Zealand on public holiday there could be thin trading in the Aussie and Kiwi.

Chart of the Day – Silver

Signals are turning corrective again on silver after a fifth consecutive bear candle was posted on Friday, and with the opening move lower this morning, the potential for an extended correction is growing. The market fell away in early April but a rally off the 38.2% Fib retracement of $15.59/$21.10 at $17.70 held back the bulls. However, a recovery rally has failed and this support is under pressure once more. This time though the momentum indicators are far more corrective, with the RSI at a five week low, and corrective bear crosses on the daily Stochastics and MACD lines. The Fibonacci retracements have been an excellent gauge for turning points for silver in recent weeks and a breach of 38.2% opens the 23.6% Fib level at $16.89 which has previously been a basis of support for the March lows. A closing break of $17.70 would also complete a small top pattern which would imply around $0.75 of downside back to around $16.95. The hourly chart shows resistance is in the range $18.00/$18.10. Today’s high at $17.92 will also be seen as resistance.

EUR/USD

With Emmanuel Macron coming out as a clear leader in the first round of the French Presidential Election, the euro has gained strong ground. The market opened Monday trading with a strong gap to the upside of over 130 pips higher and after a spike to $1.0935 has broadly held on to that opening gap. Technically this is clearly a strong move with RSI and MACD lines both pulling into strong configuration, however with the volatility of the move and the way that the Stochastics are calculated, the unwinding move back from the $1.935 high means that the Stochastics are a touch cautious. The gap is open now from $1.0726 and it will be interesting to see how the market reacts today. The highest closing level since November was $1.0856 and a breakout would be a big statement for the bulls (especially if it were to be confirmed tomorrow). There is still upside potential too for the bulls, with some old levels from the middle of 2016 at $1.0950, $1.1000 and a pivot around $1.1100. Today’s ow at $1.0820 is supportive and then last week’s high at $1.0777.

GBP/USD

With both sterling and the dollar under pressure from a resurgent euro, Cable continues to consolidate the breakout from early last week. The market continues to hold on to the support around the old key high at $1.2775 with a near term range above $1.2760 and under the breakout high of $1.2905. Momentum indicators are consolidating, but remain positively configured. However, the initial move higher to $1.2870 early this morning has been unwound and the bulls will be watching the recent support closely today. Despite this though, the hourly chart remains rangebound and there is little decisive indication as yet. A close below $1.2760 would open a retreat back towards $1.2707 support.

USD/JPY

The safe haven yen has come under pressure this morning following the risk positive result of the first round of voting in the French Presidential Election. Having previously struggled with the resistance of the 50% Fibonacci retracement at 109.35, the market has opened strongly higher to push through the key resistance at 110.09. Once trading begins to settle down over the coming hours and days we will begin to know the relevance of this move but a close above 110.09 would be a bull signal. This was an old level of key support that has become overhead supply, so holding on to a break back above would be seen as an important step for the bulls to turn around the outlook. The early March high at 111.57 is the next hurdle. Today’s high at 110.60 is initial resistance now, whilst 109.83 is supportive as today’s low. A gap is open from 109.07, with Friday’s high at 109.42 also supportive. The bulls will be looking to continue the improvement in momentum indicators and at least take and hold the RSI above 50.

Gold

The safe haven of gold has taken a near term hit as risk appetite has improved today. The consolidation that had formed over the past week or so has broken to the downside with the opening gap which was well below the previous support at $1275.70. This continues the correction back from the $1295 high. However I continue to see this as a near term pullback and there is good support in the range $1261/$1270.50 in a series of old highs from February/March. The momentum indicators have taken a near term corrective move with the RSI moving back towards 50 and the MACD lines set to cross lower. The initial reaction to the move lower today has been for support to come in at $1265.90 and it will be interesting to see how the market settles in the next day or so as the volatility begins to settle. Old resistance is new support and the bulls will be eying the band $1261/$1270.50 now. The hourly chart shows a rebound already losing impetus at $1277.40.

WTI Oil

The bulls continue to struggle to make headway in a recovery as a second consecutive candle has not only struggled to hold on to initial intraday gains on Friday but closed sharply lower (in the wake of the continued increase in the US oil rig count). Despite this weakness, the bulls will be heartened by the close which held on to the neckline support of the old base pattern at $49.60. However, with corrective configuration on the momentum indicators the support will remain under pressure, and the importance of a break will grow. A closing breach would re-open the key lows at $47.00 which also marks the low of the long term bull trend channel.

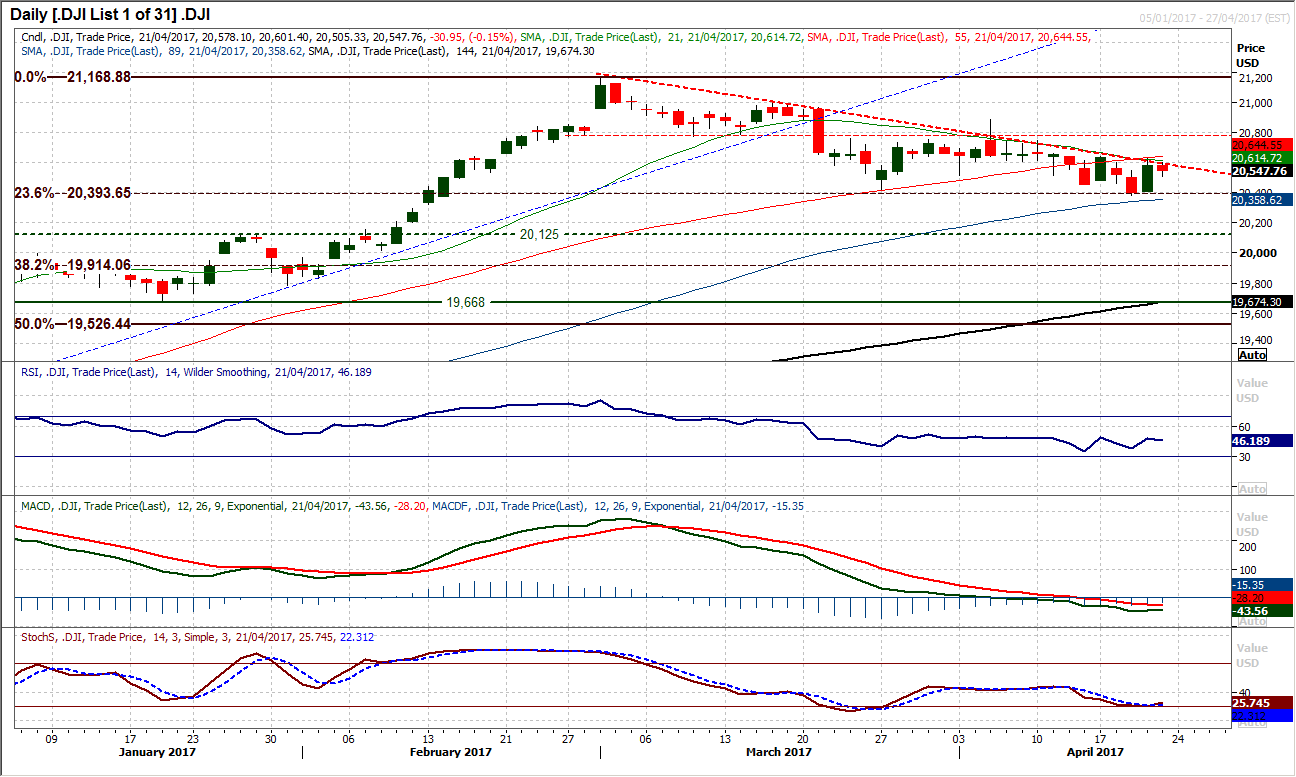

Dow Jones Industrial Average

The seven week downtrend continues to be a drag the market on a near to medium term basis, however the mini rally that closed last week is putting pressure on this trend. Although Thursday’s strong bull candle could not be followed by additional strength on Friday as the resistance of the trend held back the move, Wall Street futures point towards a positive open today in the wake of the French election, so this downtrend could be breached today. The bulls will therefore be eying an end to the sequence of lower highs, with resistance of the high at 20,644 initially key. The hourly chart shows negative configuration of the momentum remains in place, so watch for the RSI pulling back above 50 which would be a three week high. continues and the bulls will be eying a move that sustains above the falling 21 hour moving average (currently 20,614). A move above 20,644 opens 20,750 and 20,887.