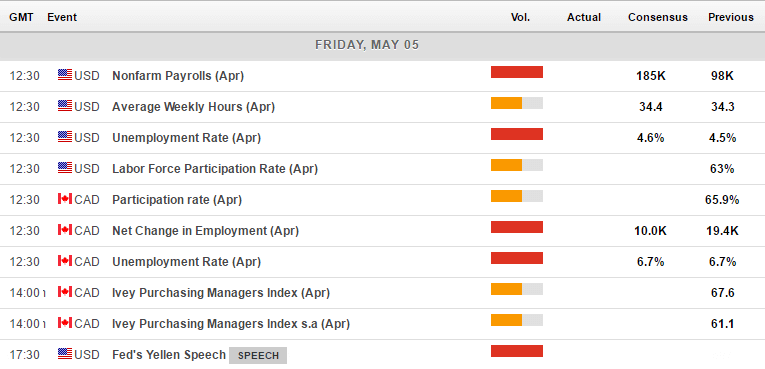

Nonfarm payrolls are realised alongside Canadian employment later today, which could make USDCAD of interest. The fall in oil prices also provided added interest as both currencies are linked to oil in one way or another.

– NFP is forecast to rebound to 185k from last month’s disappointing 98k

– A further fall of unemployment will trigger more calls for maximum employment having been reached

– A fall in average weekly hours or earnings could concern the fed, following lower Core PCE earlier this week

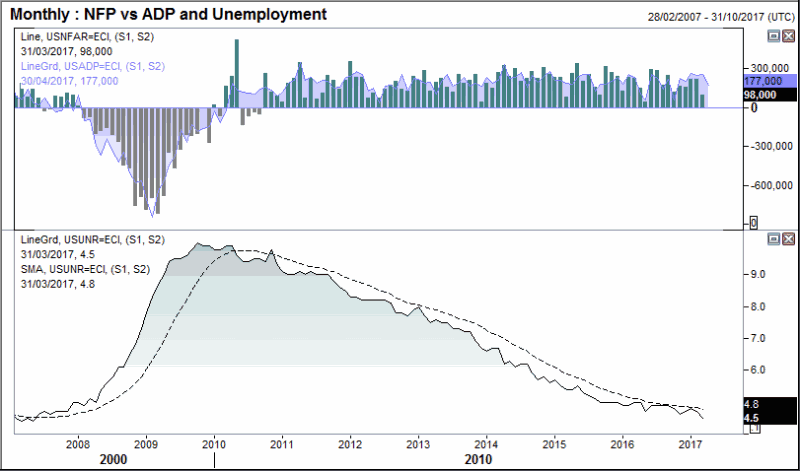

Last month’s 98k may prove to be an anomaly, yet we also warn that the 12-month average for NFP has been sloping lower having topped in Feb 2015. The average is now 182k and just below this month’s 185k consensus

We doubt there is any single number which will deter the fed from raising in June, but further out there are conflicting numbers which may affect their thinking as we head towards and into 2018. One had we have very low unemployment which traditionally calls for rate hike; On the other, consumers remain in a low wage growth environment with potential for higher interest and interest rates (the ultimate squeeze on consumers. If the squeeze becomes too hard for consumer’ to bear, it negatively impacts growth.

Lower unemployment could trigger more calls for maximum employment having already been reached

The long-term downtrend for unemployment cannot go unnoticed, and even more so now it is accelerating away from the 12-month average which sits at 4.8%. Keeping in mind the Fed had hinted that 5% could be maximum employment (which warrants rate rises) and it dipped below this level in Jan 2016, then we continue to scratch our heads and wonder when the Fed consider maximum employment to have been achieved.

ADP employment, which is released each month but one day prior to NFP, attempt to provide a heads-up for the NFP read. Rolling correlations between the two have shown in recent month ADP has been excellent at predicting the direction of NFP (compared with the prior read). That is until last month when ADP ticked higher to 255k whilst NFP plummeted to a disappointing 98k. Also, note we do not claim ADP predict the number bet merely the direction on a per month basis. Assuming last month’s blip was just that, then yesterday’s ADP of 177k (down from 255k) could suggest NFP will move lower from 98k. We think this is to be unlikely and that NFP may hit around the 185k forecast, which is not too far from where ADP landed.

A fall in average weekly hours or earnings could concern the fed

This week the Fed remain on track to raise in June by saying weak Q1 GDP is seen to be ‘transitory’ (temporary). We doubt there will be any number to arrive in today’s report that will prevent the fed from raising in June, but there could be some data which puts doubt into their third hike this year. Earlier this week core PCE, their preferred inflationary measure, dropped from 1.8% to 1.6%. This follows on from weak GDP which also revealed personal consumption (consumer spending) fell to its lowest quarterly reading since the 90’s.

When you also consider that ‘real’ hourly earnings (earnings – inflation) dropped to 0% YoY recently and now sits at a mere 0.3% YoY, then the fed is quite aware there is already a squeeze on consumers at a time they’re about to embark on further hikes. So, of headline earnings drops today in NFP, it only adds to their concerns and may make them re-think the third hike as we approach the end of the year. Again, we are not saying a drop in hourly or weekly earnings today will prevent a June hike, but these underlying issues are just one of the reasons the Fed remain cautious whilst employment has likely passed it’s ‘maximum status.

Market to consider trading:

In theory, you could consider any US Dollar denominated market to trade around NFP, making the basic assumption that strong data (higher employment, lower unemployment) benefits the US Dollar to the detriment of the other currency or market prices in it. The inverse could also assume a weaker Dollar (lower employment and higher unemployment). However, some markets are closer to the action than others and we can typically expect greater volatility depending on the release.

Basic assumptions:

Further away from expectations tends to result in higher volatility

Hitting expectations tends to result in dull reaction

Mixed data for NFP can result in confused price action

Liquidity is its lowest in the moments just before and during the release, so gaps and spikes can be expected

WTI: Oil prices are already under pressure as we head into the weekend, so a strong employment set might only add further pressure. Unless fundamentals for oil improve before NFP, then it would take a particularly bad employment # for us to consider bullish setups on Oil.

Gold: In similar fashion to oil, Gold is also in a rout and broken two key levels of support this week already. Therefore we prefer to seek bearish opportunities on the precious metal, assuming an okay or better NFP number.

USDCAD: This effectively NFP vs Canadian employment. We will provide a video for technical levels later today but for a large move on this pair in either direction, requires diverging themes between the respective employment sets.

USDJPY: This is our go-to currency cross around NFP as the two economies are connected between producer versus consumer, making US employment a big factor in this relationship. Historically is has tended to provide the cleaner moves, than say EURUSD, so a strong or weak data set assumes a clean move for bulls or bears. Equally, a confusing and mixed dataset assumes the same for subsequent price action.

Matt Simpson | Senior Market Analyst

A certified technical analyst, combining macro themes, monetary policy and business cycles to generate Forex and commodity trade ideas.