Japan’s trade continues to pick up yet, in all the time the US remains in deficit to Japan, it will remain a bargaining chip for Trump’s bilateral trade talks. AUJPY is the trend that keeps on giving and we cannot yet rule out another low or move towards 80Y.

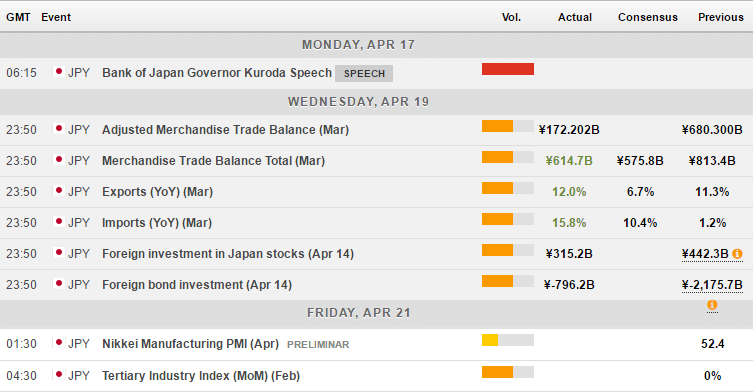

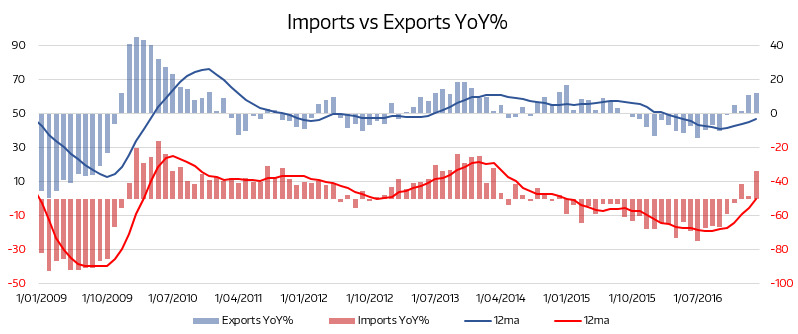

Trade data for Japan showed a pick-up in both imports and exports from all measures; Monthly exports increased 13.9% MoM and 12% YoY; Imports increased 19.5% MoM and 16% YoY. This put the trade balance in surplus for a 2nd consecutive month although slightly lower than February.

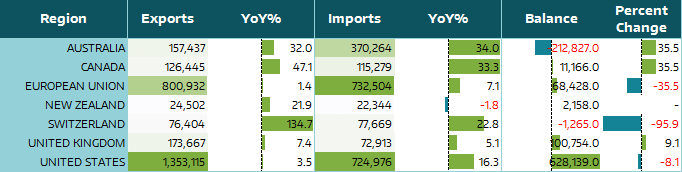

With both imports and exports picking up, it shows a pick-up in global and domestic demand although the surplus shows domestic growth has the upper hand when Japan is concerned over their individual trade partners.

Only China, Oceania and Australia printed a deficit among all trade partners and regions, with Japan surplus remaining the highest with Asia NIES. The United states remains firmly in deficit with Japan and will surely be a main talking point when it comes to their bilateral trade talks. However, the YoY% rate for Japan’s surplus with the US has now hit -6.5% YoY, which is a start towards Trump’s plans to balance the books with deficits of all US trade partners.

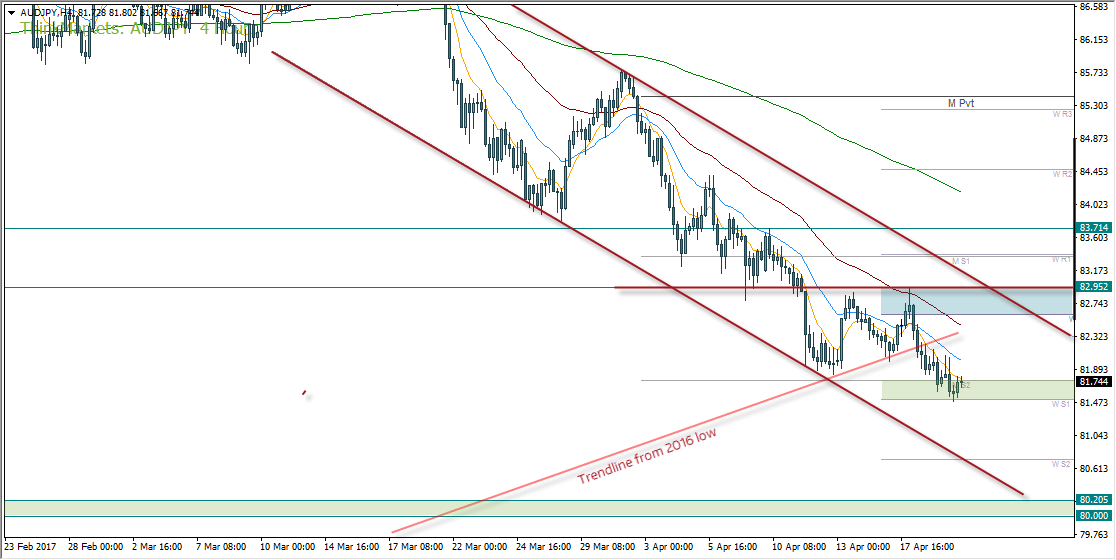

AUDJPY has so far proved to be the trend that just keeps on giving. Every story has a trend attached to it nit, in this case, the drivers have evolved upon each drive to new lows. What began is a global risk-off mood attached to the realisation reflation was perhaps wishful thinking, quickly evolved into a tale of risk-off due to geo-politics. Despite these issues subsiding somewhat in recent days, we now learn of a slight easing bias from RBA and potential for a further cut if employment weakens, all whilst iron ore and AU sensitive commodities fall sharply lower. Interestingly, if you are to compare AUDNZD to NZDJPY, they both provided similar patterns with the preceding triangle, only AUDJPY broke to the downside and NZDJPY is now close to an upside break. The divergence can be more clearly seen on AUDNZD which appears to be on a sharp move lower.

For now, AUDJPY has found support at the weekly pivot and monthly S2, although due to the ABC nature of the prior correction, we suspect any rally will not make it to 83 resistance. Therefore, we prefer to short any rallies with a view to reach the 80-80.20 zone. If geopolitical concerns to return, this should make the target easier to reach.

Matt Simpson | Senior Market Analyst

A certified technical analyst, combining macro themes, monetary policy and business cycles to generate Forex and commodity trade ideas.