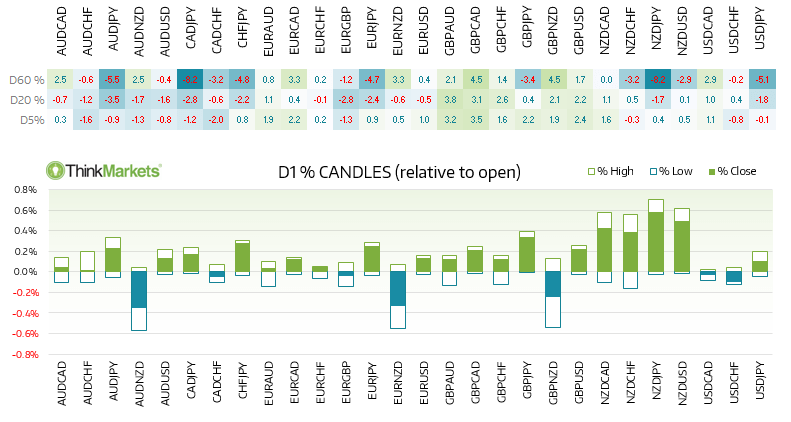

Sentiment has shifted in the Euro’s favour in recent sessions, despite potential for Euro crosses to experience higher volatility as the French election looms.

One of the key components that helped send EURJPY lower – geopolitical tensions – appears to be on the backburner for now. We are approaching the French, UK and German elections which have the potential to surprise in a positive way and, as of yesterday, EURJPY clawed its way back to a 7-session high and appears ready to break above it.

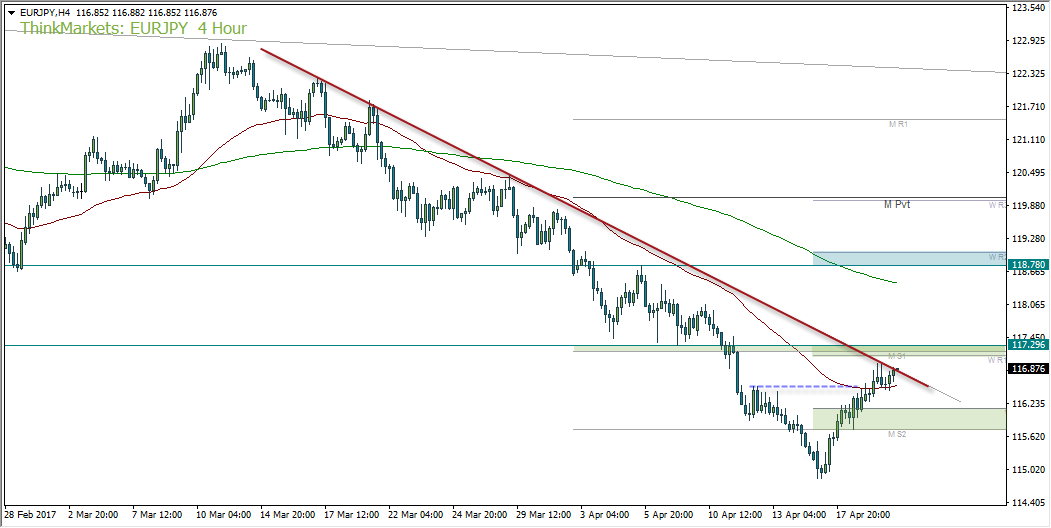

The bearish trendline remain intact at the time of writing, yet the ease of which prices have travelled there suggest there is a decent chance it could break prior to the elections. As the rally has already broken the prior swing high with relative ease and no noteworthy sings of a pullback then perhaps Euro is building up to something larger. Sentiment surrounding the Euro appears to have shifted in recent sessions, despite the pending election. However, the level to keep an eye on is a break above 117-30 as this clears the monthly S1 and Weekly R1.

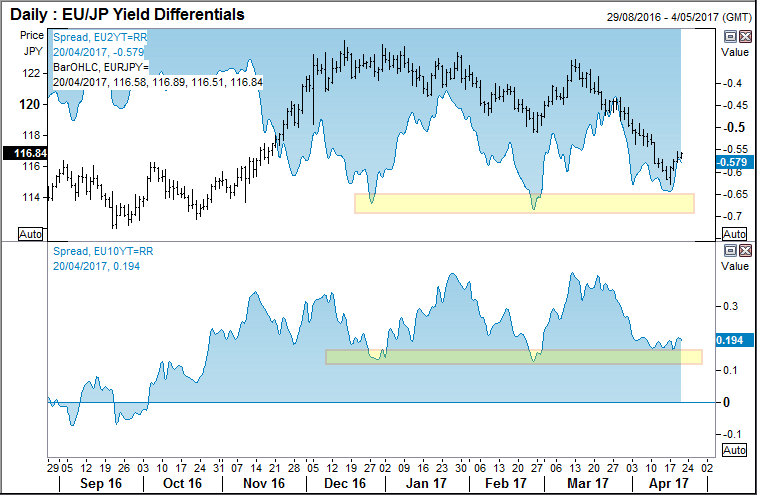

Another measure which appears to suggest EURJPY could trade higher is its relationship with each currency’s respective bond yields. The 2yr differentials, whilst still negative have created a potential trough above the prior one and EURJPY moves higher. The 10yr differential remains positive and has also created a higher trough. Put all the above together and we remain sceptical of being too short EURJPY. Whilst the elections could prove negative for the Euro, indication leading into it suggest otherwise.

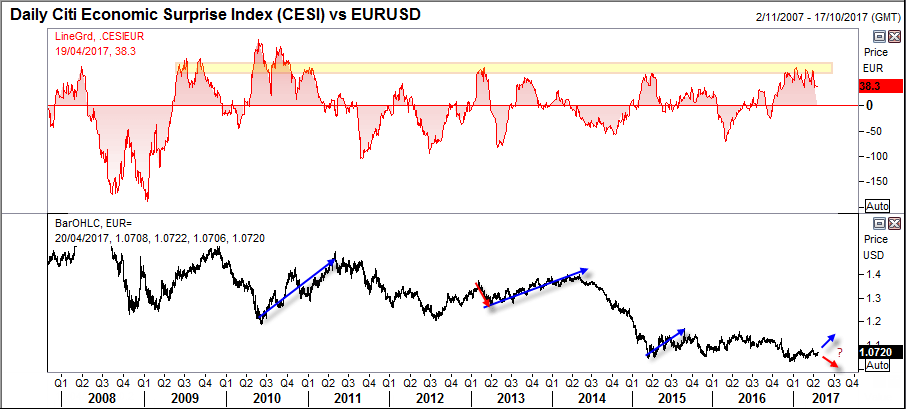

A longer-term correlation we are keeping an eye on is the relationship between CESI (City Economic Surprise Index) and EURUSD. Around current levels, the index has stalled at areas which have eventually marked a low on EURUSD and for it to spend several months moving higher. It is not a perfect signal as the pattern can also take months to evolve, yet something to consider as we crunch through the year which had been marked as the year as populism. If Le Pen doesn’t win the first round of the French elections on Monday, then we see this as a net positive for Euro. As it stands, Angela Merkel stands a chance of winning the German election in September and the UK election, whilst warrants close attention, doesn’t remove the uncertainty of Brexit negotiations (which we believe Europe has the upper hand over anyway).

If these events do turn out to fly in the face of populism, economic data in Europe continues to pick up and the potential for ECB to talk of tapering r tightening in some sorts then you have the ingredients for a much higher Euro. Overlay that for the potential that the Fed may not achieve two further hikes and further delay action regarding trimming their asset sheet, it likely sends further furl to the fire. As we are talking about several events or potential scenario’s spread throughout the year then of course this is going to take some time to play out. Yes, as large speculators came very close to reverting to net long in recent weeks, then already there is suggestion they think Euro could also be trading higher later this year.

Matt Simpson | Senior Market Analyst

A certified technical analyst, combining macro themes, monetary policy and business cycles to generate Forex and commodity trade ideas.