Market Overview

Traders are looking to consolidate some of the strong moves on forex markets in the wake of the decision for a snap UK General Election, and the US dollar still seems to be under pressure despite a bit of a retracement move yesterday. The sterling rally is holding firm, despite come as Treasury yields picking up yesterday. A minor retracement rally allowed the dollar to claw back some lost ground but already this move is being seen as another chance to sell. There is a sense that equity markets are now into a continuing corrective phase, with European markets again opening weaker today. The run of weaker US data and questions over the longevity of the reflation trade are weighing on sentiment. The negative trends on Treasury yields are certainly a key driver of these moves and the longer this continues, the more concerned that equity traders will become. Weaker than expected earnings are a drag on the Dow with IBM adding to the previous losses of Goldman Sachs, however the broader S&P 500 has been slightly more insulated to the falls.

Traders will have a fairly quiet morning and it will not be until the US takes over when the data really takes an affect. The Philly Fed Manufacturing Index is at 1330BST with an expectation of another strong number at 25.6. However this is lower than the previous 32.8 and would be a second consecutive month of decline and the market would take notice of a downside surprise as the exuberance following Donald Trump’s fiscal expansion promises begin to wane. US Weekly jobless Claims at 1330BST are expected to be 241,000 (up from 234,000 last week). Bank of England Governor Mark Carney speaks in Washington at 1630BST whilst Treasury Secretary Steve Mnuchin speaks at the same event at 1815BST.

Chart of the Day – DAX Xetra

The corrective outlook continues to develop in the wake of the decisive bear candle formed on Tuesday. A doji candle may denote uncertainty but there was an element of disappointment with a failure to close with a decent retracement recovery. The market has broken another uptrend (this time in place since early February) and a new downtrend formation is beginning to take hold. This downtrend today comes at 12,147 which is below the old breakout support at 12,156 which has now turned into resistance again. Furthermore the market is increasingly posting bearish candlestick patterns that suggest that even the intraday rallies are seen as a chance to sell. A move back to test the key 11,850/11,893 support band is increasingly likely now. The momentum indicators are near term corrective with the RSI in the low to mid-40s which is the lowest since early December and if this deterioration continues it would question the longevity of the bull control. Add in the corrective configuration on the MACD and Stochastics lines, and there is a potential key test of support approaching. The hourly chart shows a series of lower highs leaving resistance at 12,162 with 12,247 now key.

EUR/USD

The pair is beginning to settle down after the strong bull candle on Tuesday which drove the market through the band of resistance $1.0680/$1.0710. This band of previous resistance is now turning into a basis of support for a consolidation. This comes as the momentum indicators have continued to improve, with the Stochastics rising, MACD lines crossing higher and RSI above 50. If the market can continue to hold up above the $1.0680/$1.0710 band which is now supportive then the bulls will continue to gain in confidence for another test of the primary downtrend and perhaps even move towards the $1.0800/$1.0900 band of key medium to longer term resistance. The hourly chart reflects more positively configured momentum with support at yesterday’s low of $1.0698. Initial resistance at $1.0735 has been broken as the European session has taken hold today and this is opening the upside towards $1.0800.

GBP/USD

The day after a huge move there can often be a retracement. The measure of the original reaction can be taken as how significant the retracement is. A 60 pip retracement following a 270 pip gain is just under a quarter on the previous move, so not enormous, but still fairly significant and needs to be watched again today. The initial signs for sterling are good though, with a strong early rally again taking the pair back higher again. The interesting feature of the Cable chart is that the long term breakout at $1.2775 is now a basis of support and yesterday’s close was almost bang on the support before the market has pushed higher today. This helps to validate the support and give the bulls confidence. There is more that they need to do to prevent the unwinding of the move, and it is still very early days, but the outlook is certainly more positive now. The momentum indicators are strongly configured but are at levels where the bulls need to hold firm to prevent a corrective bias forming on the RSI and Stochastics (which are threatening to roll over). This is also reflected on the hourly chart where yesterday’s pullback has helped to bring momentum back to levels where the bulls would consider a buying opportunity. The hourly RSI finding support in the 40/50 range, MACD lines back to neutral and Stochastics picking up is all positive. Any further deterioration could turn corrective, but for now the market is configured to buy into weakness. Initial resistance is $1.2857 before the high at $1.2905. Below $1.2775 the support is around $1.2700.

USD/JPY

Is Dollar/Yen beginning to form some support for a rally? The market is in the midst of a consolidation having broken clear of the 50% Fibonacci retracement of the big bull run at 109.35. The low of the bull hammer at 108.11 remains intact an there has been a near term higher low formed from yesterday’s bull candle at 108.29. However the consistent theme of this pair of the past few months is that consolidations are sold into and the overhead resistance is sizeable between 109.35 and 110.09. Momentum indicators also look to be merely consolidating rather than building for a recovery. The hourly chart shows that 109.20 is initial resistance and already preventing a potential recovery from taking shape. Hourly momentum is neutrally configured and it is difficult to argue against selling into strength for now.

Gold

Having pushed out into new multi-month highs last week, the market has since been starting to look a bit jaded again. Two strong bear candles in the past three sessions are beginning to reflect the potential for a slight near term dip. The breakout support is strong between $1261/$1264 and last night’s close below $1280 just adds a slight corrective bias. Today’s candle will be interesting as another negative close would increase the momentum for a correction. For now though, momentum indicators are still medium term positively configured and have just rolled over to reflect the recent decline. The hourly chart is taking on a slight negative near term bias and if the bulls fail to recover above $1286 then the outlook will continue to deteriorate. Initial support is at $1270.50

WTI Oil

The mixed EIA oil inventories contained a higher than expected gasoline stock build which has added to the already burgeoning downside pressure. This pressure has formed a strong bear candle yesterday and is beginning to tell on the momentum indicators which are now deteriorating. The Stochastics are confirming a corrective sell signal, as the RSI drops away below 50 and the MACD lines threaten to cross lower. A fourth consecutive candle of lower daily highs reflects an appetite to sell into intraday rallies. The market has also now broken below the support in the band $50.70/$51.22 which has re-opened $50 and the old near term base neckline at $49.60. The hourly chart shows initial resistance at $50.80 and then $51.50, whilst hourly momentum is correctively configured with the hourly RSI around 50/60 seen as a chance to sell for now.

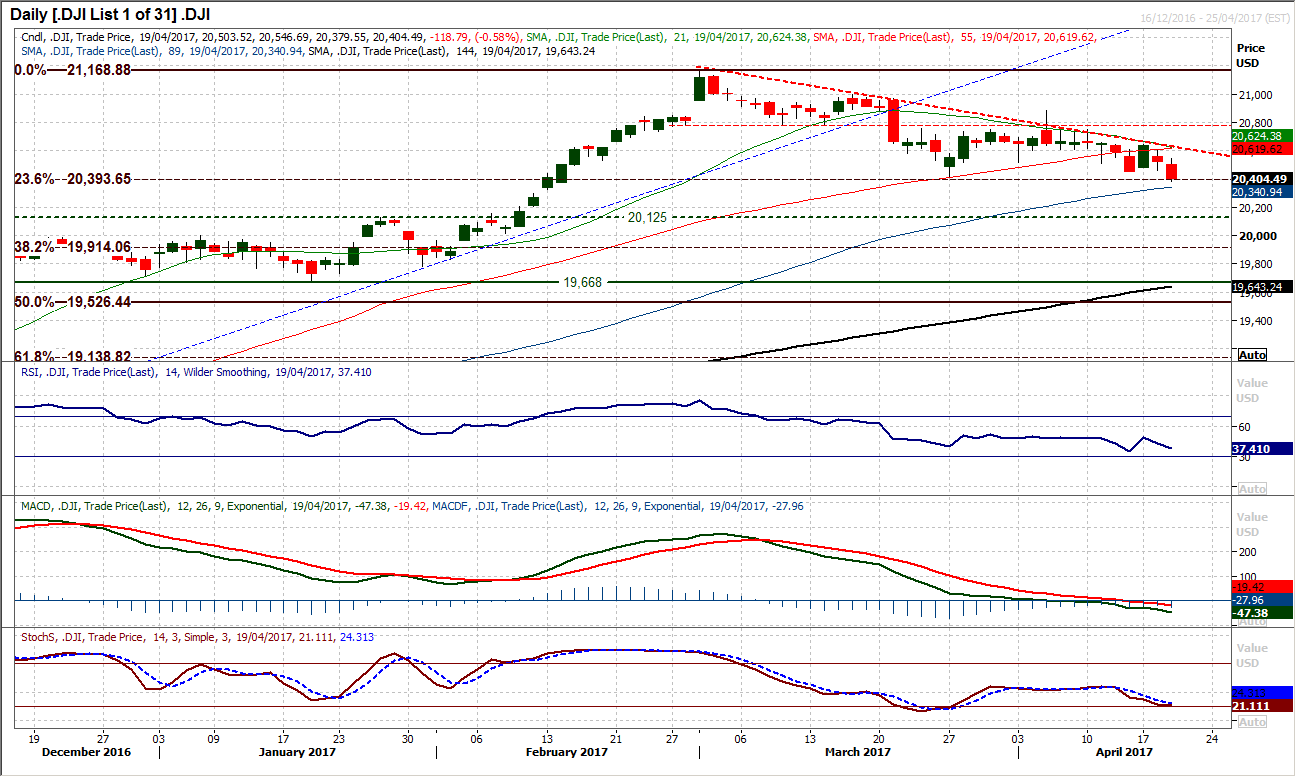

Dow Jones Industrial Average

The corrective pressure on the Dow continues as the market again posts another concerning candle. A bear candle of well over 100 ticks down on the day has now broken below the support at 20,413 taking the Dow to a nine week low. The downtrend remains firmly intact, daily momentum is negatively configured and rallies continue to be seen as a chance to sell. The rebound high at 20,644 remains a near term key resistance and pressure back on the 23.6% Fibonacci retracement at 20,394 is mounting. A closing breach of the 23.6% Fib would open the 38.2% Fib at 19,914. The hourly chart suggests that intraday moves to the upside are seen as simply unwinding moves to help renew near to medium term downside potential. The initial resistance is around 20,510/20,530.