Market Overview

Global markets remain cautious as traders continue to ponder the implications of the surprise firing of FBI Director Comey by President Trump. How does this impact on the prospects for Trump’s fiscal plans? Will the divisions and scepticism in Congress grow deeper, and how will it impact on Fed monetary policy? The moves on Treasury yields suggests that the market is not too fussed at the moment, with the US 2 year and 10 year yields tracking higher. This has helped to support the dollar and has pulled safe havens such as the yen and gold lower. Equity market still look cautious though with mixed sentiment on Wall Street and European markets uncertain today. The rebound in the oil prise may help to improve risk appetite with prices bouncing over 3% yesterday in the wake of larger than expected inventory drawdown in the EIA stocks, whilst Algeria and Iraq have also supported calls for an OPEC extension to production cuts. Traders in UK assets will watch the Bank of England today for signs of any changes to the economic outlook.

Wall Street was mixed again with the S&P 500 very slightly higher by 0.1% at 2399, whilst Asian markets were mixed to slightly positive (Nikkei +0.3%). European markets are consolidating in early moves. In forex the key major pairs are showing little direction, however the big mover is the Kiwi which is significantly weaker by well over 1% after the RBNZ disappointed the market with a rather neutral stance and downbeat view on inflation. Gold is slightly higher in early moves, whilst oil is also supported again.

The Bank of England’s Super Thursday and US inflation largely dominate the economic calendar today. UK Industrial Production is announced at 0930BST with an expectation that monthly production will fall by -0.3% dragging the year on year industrial production down to +2.1% (form 2.8% last month). The Bank of England’s monetary policy is announced at 12000BST with an expectation that the MPC will keep rates on hold at +0.25% and maintain the asset purchase facility. However, the MPC minutes are announced at the same time and the expectation is that there will again be one dissenting voice looking for a hike (Kristin Forbes again). Furthermore, the BoE also releases its Quarterly Inflation Report which is expected to show the bank moving to a more neutral stance, with inflation possibly expected to rise above 3.0% in the coming months before settling down given the recent recovery in sterling. Also the growth numbers will be interesting after the seemingly disappointing Q1 GDP and whether this will be seen as a blip (PMIs have held up well in recent months). However with much uncertainty surrounding the general election and Brexit uncertainty it is difficult to believe the BoE will do much to rock the boat. US PPI inflation is at 1330BST and is expected to drop slightly to 2.2% (from 2.3%) although the core PPI is expected to pick up to 1.7% (from 1.6%). US weekly jobless claims are expected to rise slightly to 245,000 (from 238,000 last week).

Chart of the Day – EUR/GBP

The strength of sterling is beginning to drag the pair lower again. In fact, the gap higher at £0.8385 that came in response to Macron’s first round performance in the French Presidential election has now been filled. With EUR/GBP falling back below the support at £0.8400 yesterday the market seems to be positioning for the next downside move. Despite failing to close below £0.8400, the deterioration in daily momentum indicators is suggesting the bears are building up a head of steam again. With the MACD lines threatening a bear cross and the Stochastics back in decline, the RSI is threatening to move back below 40. A closing breach of £0.8400 would now re-open the key long term support at £0.8300 which has acted as a key floor of support in the past 10 months. The hourly chart shows a downtrend formation over the past few days, with a negative configuration on the hourly momentum and rallies being sold into. There is resistance between £0.8400/£0.8440 to use as a near term sell-zone now, whilst £0.8460 is further resistance.

EUR/USD

The euro continues to put pressure on the key breakout support at $1.0850. This is clearly a level that the market is watching as once more the support has held, almost to the pip. This is the fifth time in three weeks that the market has had a real look at this level only for it to hold. That increases the importance of a breakdown if it were to happen. The concern is that the momentum indicators are really threatening the downside move now with the Stochastics in decline and the MACD lines crossing lower. If this were to come with a closing breach of $1.0850 then it would really question the near term outlook. At the moment this remains a bull market correction but losing $1.0850 would imply a corrective target of around 100 pips and this would take the euro back towards the long term downtrend again (which is now supportive). However, I would continue to see any moves as counter to the large base pattern and a likely buying opportunity. There is support at $1.0800 and $1.0777. The hourly chart shows resistance at $1.0900 and a move above there now would start to renew confidence for the bulls.

GBP/USD

Corrections remain a chance to buy on Cable and it looked as though the market had regained the upside initiative having posted a low at $1.2900, however a rather disappointing candle has been posted that suggests there is a struggle for control. Having tested the $1.2990 high the market retreated to close almost flat on the day. On a near term basis, the $1.2900 support now would be the neckline of a very small double top if it were to be breached . This would imply 90 pips of correction and $1.2810 as a target. That would mean that the $1.2830 higher low would then come under direct threat. The concern for the bulls also comes with the momentum indicators which are gradually now deteriorating. The Stochastics are moving below 80, whilst the MACD lines are crossing lower. This could all still just be part of a consolidation range that has formed above the key $1.2775 breakout and ultimately corrections continue to be seen as a chance to buy so this could provide an opportunity. The hourly chart shows a little bit less of the corrective mood, more one of consolidation, with neutral momentum and support holding. The Bank of England is though likely to ramp up the volatility today.

USD/JPY

The dollar remains strong but it is interesting to see once again the 23.6% Fibonacci retracement of 100.07/118.65 at 114.27 playing a role. Fibonacci levels can be turning points in the market but often simply play consolidation points and this seems to be what we are seeing now. The market closed last night at the Fib level having previously used it as a session high. The market has consolidated around it early today. The strength of the uptrend suggests that intraday corrections continue to be used as a chance to buy and there is actually room for a 100 pip correction today and still remain in the uptrend. Momentum indicators remain strongly configured with the RSI above 70, the MACD lines rising strongly and Stochastics solidly bullish. With Dollar/Yen’s tendency to trend strongly, there is little reason not to continue to buy into weakness. A move above the 23.6% Fib level opens the next resistance of the old Q1 2017 range highs between 115.20/115.60. The hourly chart shows initial support at 113.60 with a key near term breakout support at 113.05.

Gold

The market continues to creep lower and yesterday closed back below $1220. Although this was not a decisive bear candle this is another breach of an old pivot support and continues what is likely to be a move back towards $1200 and a possible $1194.50. The momentum indicators are very bearish and although the Stochastics are giving a minor tick higher (due to the marginal early gains today) there is still little reason not to back for further weakness. The hourly chart shows how consistently old support is being seen as new resistance, with $1225 being the latest level, under $1236 and $1240. Intraday rallies should be seen as a chance to sell. The initial support at $1213.80 is the next test to the downside.

WTI Oil

Oil has been boosted by the much larger than expected EIA inventory drawdown and WTI has now breached the resistance of the four week downtrend. However, furthermore, the important technical resistance of the overhead supply at $47.00 has also been breached. This is a key crossroads for the bulls that has now improved the near term outlook and a close above suggests perhaps the bulls can begin to look more positively. The Stochastics pulling out of oversold territory now needs to be confirmed by continued recovery, whilst the RSI closing above 41 would also be a positive recovery signal now. A close above $47.00 opens resistance at $48.20 however the resistance band $49.60/$50.20 remains key overhead. The hourly chart shows the improvement in outlook but the bulls now need to continue to build and support into weakness. Another higher low above $46.00/$47.00 support would improve the outlook.

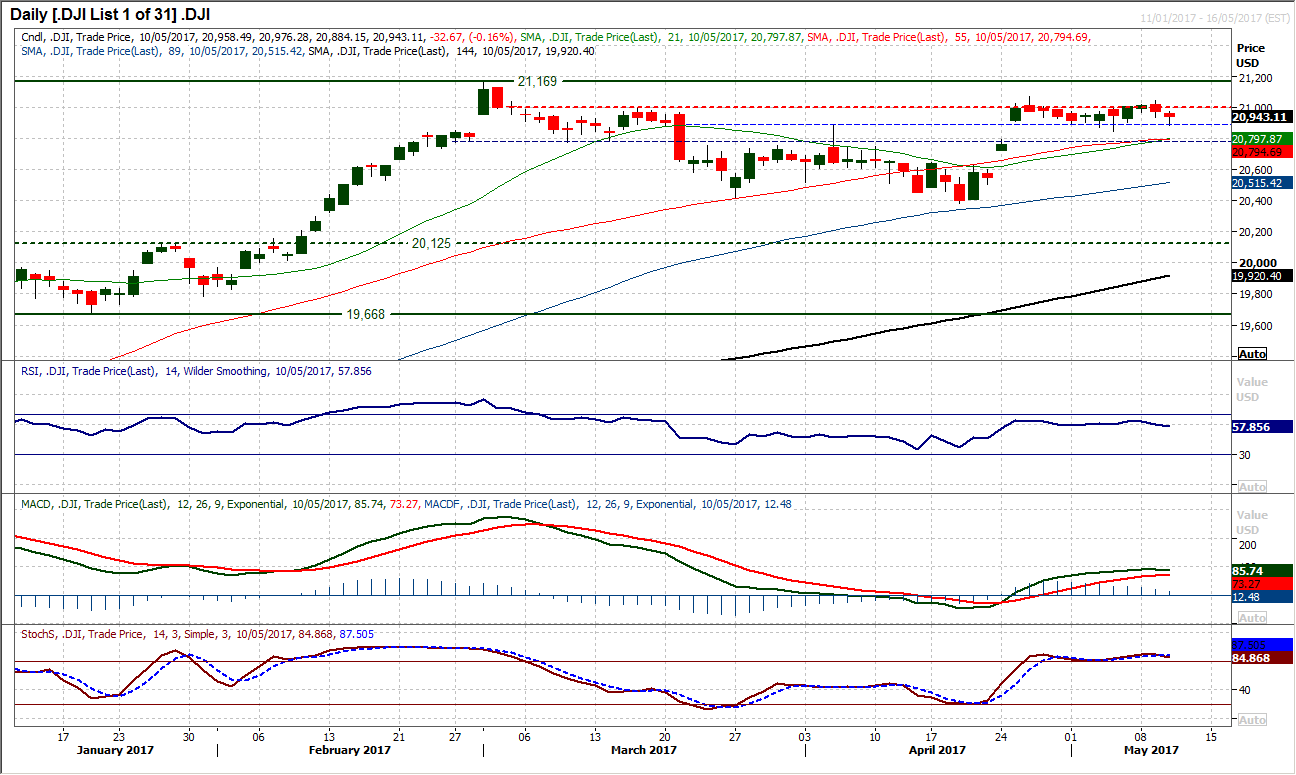

Dow Jones Industrial Average

The failure to break through the April high of 21,070 has now started a corrective move back again, with the supports within the recent tight range now under scrutiny. For now, this simply looks to be the market playing out a consolidation and as long as there is no close below the support at 20,848, the bulls will retain hopes of a move back towards the all-time high again at 21,169. Daily momentum indicators are in consolidation mode, but for now this is nothing to be especially worried about for the bulls. However if the MACD lines and Stochastics started to cross lower it could become more concerning. The hourly chart shows that a consolidation could turn into a top pattern below 20,848 which would imply a 220 tick correction is decisively breached. The subsequent support is 20,777. There is initial resistane from yesterday’s high at 20,976 with this week’s high at 21,046.