Short term

/

Buy

Trade view /

Friday at 6:37 GMT

Instrument:

USDCHF

Price target:

1.0400

Market price:

0.9986

Going into the French presidential election, we are looking at USDCHF today. This pair is near -1 correlated with EURUSD. Dip buying this morning (with a tight stop) offers a great risk/reward trade if USDCHF rallies.

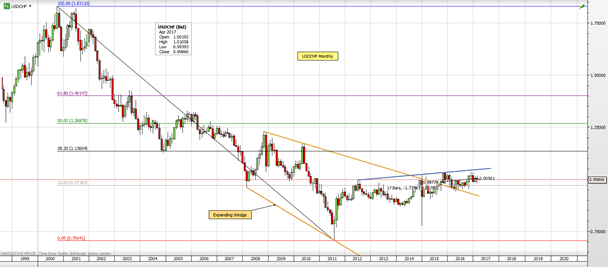

Monthly – There is nothing to take away from the monthly chart. March posted a doji style candle with the last 17 months’ price action stuck between two trend lines.

Source: Saxo Bank

Weekly – Keeps holding close to parity (1.0000). We are either in a bullish channel or an ending wedge. There’s plenty of scope for a move in either direction. The Marabuzo level from week 27 is located at 0.9953

Source: Saxo Bank

Intraday (eight-hours) – Posted a 0.9933 low yesterday. With buyers returning, we also registered a bullish morning doji star. There is scope for a reverse head-and-shoulders pattern (break of 1.0084 needed). The measured move would then be 1.0400.

Source: Saxo Bank

Intraday (60 minutes) – Two formations to take away from this timeframe, both bullish:

1. Expanding wedge. On a break of 1.0035 the measured move is 1.0100

2. Possible reverse head and shoulders. We are looking to buy dips close to 0.9960 this morning.

Source: Saxo Bank

If it breaks today, I would expect a possible retest (of the breakout level 1.0035) after a correction lower from 1.0050.

Parameters

Entry: Buying in the 0.9970-60 zone

Stop: 0.9930

Target: 1.0400

Time horizon: medium term

— Edited by John Acher

Non-independent investment research disclaimer applies. Read more

A compiled overview of Trade Views provided on TradingFloor.com is found here