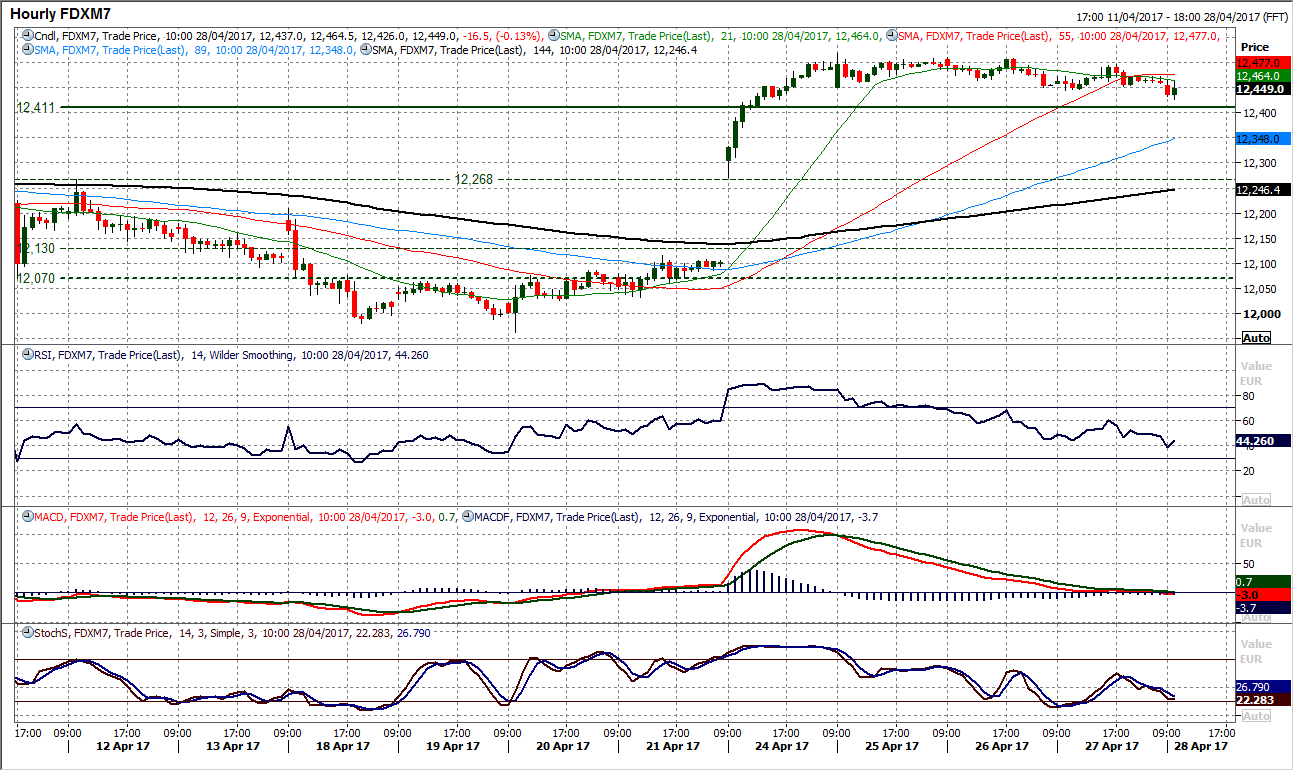

DAX futures (JUNE 2017 contract is FDXM7, continuation contract is FDXc1)

The consolidation is just beginning to tail lower as a correction threatens.

The candlesticks over the past few days have been deteriorating in the past couple of sessions and the rally is rolling over.

Momentum indicators are beginning to pull lower in a suggestion that a near term correction is building, however this is only very slight, with the RSI pulling back from 70 and the Stochastics no longer rising.

However this would still just be a very near term correction at this stage.

- Also the support of the breakout remains intact for now which gives a support zone between 12,268/12,411.

The hourly chart shows a mild drift lower than anything more sinister for the bulls.

Consistent trading below 12,450 support implies around 70 ticks of correction (from a small top) towards 12,380.

- Resistance is now between the neckline at 12,450 and yesterday’s high at 12,493.