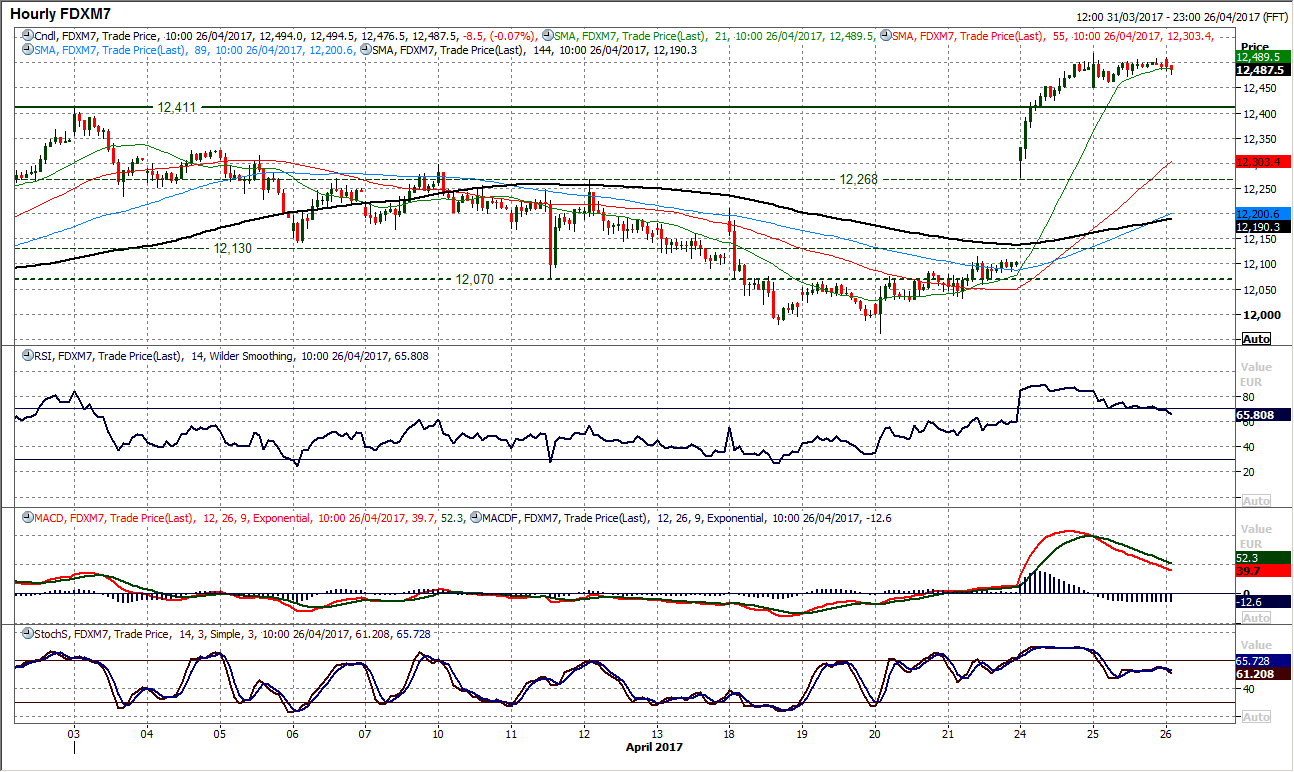

DAX futures (JUNE 2017 contract is FDXM7, continuation contract is FDXc1)

A consolidation is taking hold in front of the ECB but is the DAX due another correction?

The strong breakout to new all-time high ground has started to slow and early moves today are lower.

The concern is that in four of the five breakouts since January (i.e late March breakout was the exception), all have come with a correction just a day or so after the original breakout.

The RSI is at 69 and this is a level that has limited in recent months, although the bulls will point to Stochastics and MACD lines rising with upside potential.

On the hourly chart there is a consolidation over the past day or so and momentum indicators are now unwinding.

- The support at 12,450 is still a near term level to watch and a breach would open 12,430 and then 12,411.

- The all-time high at 12,519 is now resistance.

An unwinding move would be a positive for the next bull run higher and I would see corrections as a chance to buy.