DAX futures (JUNE 2017 contract is FDXM7, continuation contract is FDXc1)

Yesterday’s candle is somewhat of a mixed message however the DAX bulls still have eyes on the all-time highs.

An intraday all time high of just 3 ticks could not be sustained, closing above resistance at 12,790 but with a mildly negative daily candle.

The early move today is showing gains again and the market continues to contemplate moves into new high ground but can the bulls sustain the impetus to pull the move?

Daily momentum remains in bullish configuration with the RSI continuing above 70, MACD lines still rising and Stochastics above 80.

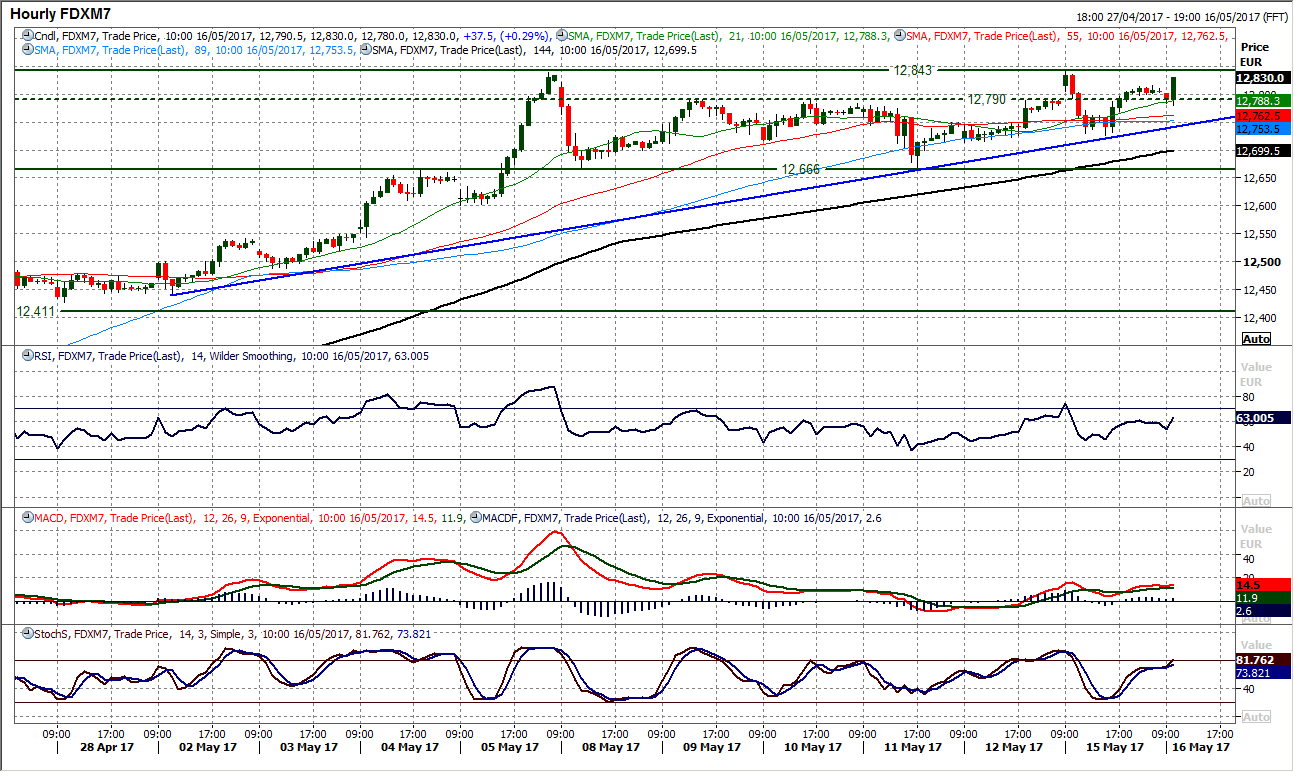

The hourly chart shows a uptrend formation since the market started moving higher again in late April and hourly momentum remains positively configured.

The hourly RSI is supported above 40 whilst MACD lines are habitually above neutral.

This all points towards using intraday corrections as a chance to buy.

- Effectively now a new range is in formation between 12,666/12,843 so a breakout (on a closing basis) would imply a next upside target of 13,020.

- Support is now at today’s low of 12,780 and then yesterday’s low of 12,726.