DAX futures (JUNE 2017 contract is FDXM7, continuation chart is FDXc1)

Consolidation in the wake of the latest upside break continues.

A second successive inside day reflects a market settling down.

Although the market managed to complete an all-time closing high last night, there are now lower daily highs in place as the market has started to drift sideways.

I continue to see this as a consolidation that is a result of a stretched market and a move that is the latest in a line of consolidations that follow upside breaks.

The RSI is just pulling slightly lower to a still strong 74, whilst the MACD lines and Stochastics are strongly configured.

There is still little reason to believe that this is a precursor to a corrective phase.

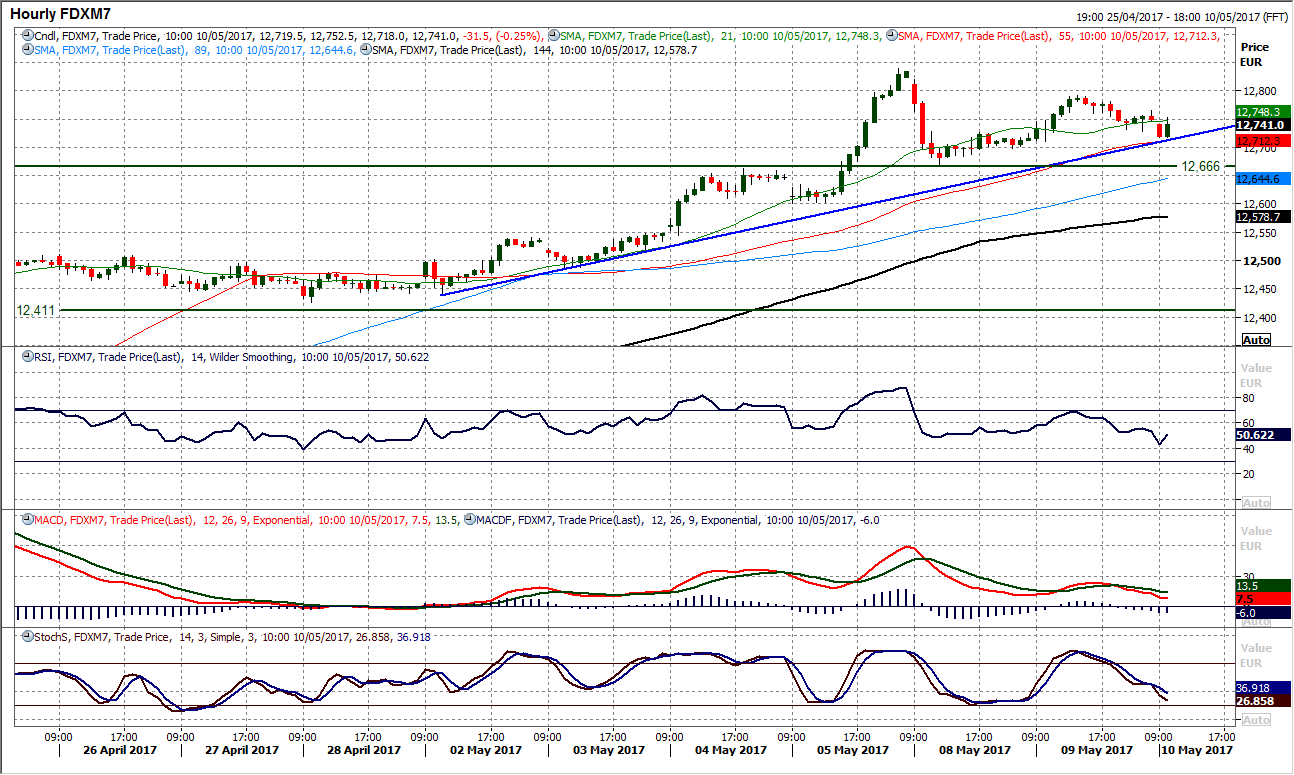

The hourly chart shows the market has consolidated back to a six day uptrend as the hourly momentum indicators also unwind to levels where the bulls tend to resume control.

- Initial support at 12,666/12,699 is holding and this comes above another minor support at 12,600.

- Yesterday’s high at 12,793 is initial resistance with 12,840 now key as the all-time high.