Regulatory reporting services provider Abide Financial has announced that it has applied to become an Approved Publication Arrangement (APA) and Approved Reporting Mechanism (ARM) in order to provide enhanced MiFID II (Market in Financial Instruments Directive) services leading up to enhanced scope enforcement in January 2018.

Abide Financial is a unit of NEX Group PLC (LON:NXG). NEX Group, when it was formerly known as ICAP acquired Abide Financial late last year.

Abide Financial made the applications via its subsidiary Abide Financial DRSP Ltd.

Subject to approval by the FCA, Abide is expected to become one of the three largest ARMs by processed volumes of MiFID II reportable transactions.

Abide has been providing MiFID reporting services to banks, brokerage houses, hedge funds and asset managers since 2011. The application to become an APA and ARM under the enhanced MiFID II scope is largely driven by client demand.

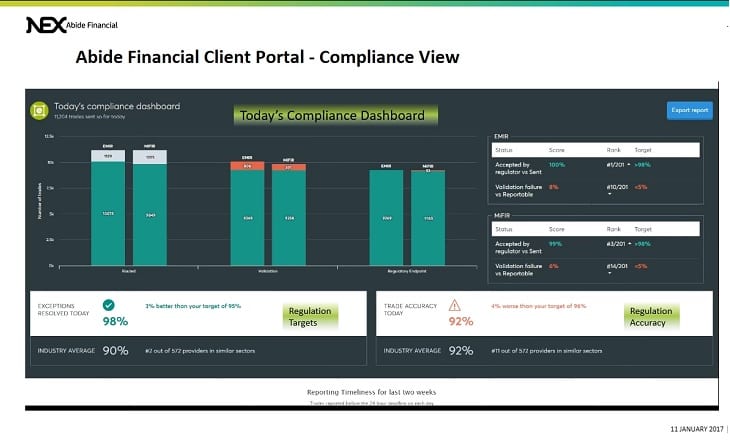

In 2016, the company launched its highly popular accelerated on-boarding programme Proximity, designed to guide clients and prepare their data sets for full MiFID II/MiFIR compliance ahead of the go-live in January 2018. The cloud hosted technology powers an interactive user interface which equips clients with a single system to upload, visualise and report their data. Clients can view data cleansing, enrichment, validation, reporting progress, exception management and the progress of each single step using the customisable GUI environment.

As part of NEX Group, Abide has partnered with NEX Data to leverage the technology and distribution network to deliver the APA to clients that are subject to transparency reporting requirements. In addition to obtaining APA and ARM status under MiFID II, the company is also acting as a Registered Reporting Mechanism (RRM) for REMIT and a hub for European Market Infrastructure Regulation (EMIR). Pending ESMA’s approval the firm is due to become a Trade Repository for EMIR2.

Collin Coleman, CEO of Abide, said:

Becoming an ARM and APA under MiFID II is a logical step in building our all-encompassing multi-regime transaction reporting infrastructure. We have seen great client uptake of our MiFID II on-boarding Proximity programme and expect to see further growth as January of 2018 is approaching. Importantly, it strengthens our position as partner of choice for market participants’ global regulatory needs.

Abide is a reporting partner to over 120 clients including banks, asset managers, hedge funds, brokers and trading firms and venues.