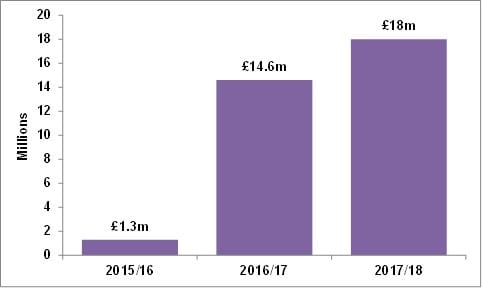

The value of fines imposed by the Financial Reporting Council (FRC) jumped 23% to £17.96 million in 2017/18, up from £14.59 million in 2016/17, information giant Thomson Reuters (NYSE:TRI) reported earlier today.

Thomson Reuters said that the rise in fines comes as the FRC responds to pressure to crack down on failures at audit firms. The FRC has broken a number of records as it imposed larger fines for misconduct or failings in the last year, including:

- A £6.5 million fine in June this year relating to the handling of the audit of BHS, the department store chain;

- A £5.1 million fine in August 2017 over the audit of accounting firm RSM Tenon;

- A £3.2 million fine in June 2018 for failings in the audit of insurance firm Quindell;

- A £1.8 million fine in September 2017 over the audit of distribution company Tech Data Limited

The large increases in fines over the last two years comes after new powers to regulate the audit profession have been given to the FRC. In June 2016 the Government gave the FRC ultimate responsibility for audit regulation, as well as lowering the threshold of disciplinary action against auditor misconduct.

The provision of new regulatory powers to the FRC comes as some MPs call for more radical intervention in the UK audit market, including the break-up of the largest audit firms. Debate has mounted over the audit market following the sudden collapse of FTSE 250 construction company Carillion in January this year.

Following Government recommendations, the FRC recently announced plans to increase fines to £10 million or more for misconduct by the largest audit firms from June this year. As a result, calls by some MPs to split up the largest audit firms could be somewhat premature.

If the FRC continues to impose these larger fines, there may start to be a change in culture in audit without the need for more radical action – similar to the change in the financial services sector after the FCA started to fine heavily for misconduct.

Brian Peccarelli, Chief Operating Officer, Customer Markets, Thomson Reuters said:

Some commentators had criticised the FRC for levying relatively small penalties that had no deterrent power. But now, the FRC is now starting to issue fines that can really sting audit firms.

Audit firms are making substantial investments in technology such as big data and machine learning to perform more robust audits. Audit firms are able use automation to extract and examine larger amounts of financial data from the business being audited which can then be reviewed for anomalies. This allows audit firms to move away from just testing a small sample of the company’s revenue transactions, thus improving the audit process, making it more transparent with greater controls.