Australia’s government is shocked by bank wrongdoing, as AMP Ltd. (ASX:AMP) has deliberately misled regulators over charging customers for services they didn’t receive. Meanwhile Commonwealth Bank of Australia (ASX:CBA) has collected fees from dead people, in one case for more than a decade, Bloomberg has informed earlier. AMP Chief Executive Officer Craig Meller announced that he would step down immediately.

I am personally devastated by the issues which have been raised publicly this week, particularly by the impact they have had on our customers, employees, planners and shareholders,” Meller commented in a statement Friday. “This is not the AMP I know and these are not the actions our customers should expect from the company.

Treasurer Scott Morrison, who in 2016 called the Labor opposition’s push for the inquiry a “populist whinge,” on Friday decried the “very disturbing and indeed shocking revelations” as he announced tougher penalties for corporate crimes, including 10-year prison sentences.

The punishment must always fit the crime,” Morrison told reporters in Melbourne. “And we must not forget these are not victimless crimes.

Former deputy prime minister Barnaby Joyce said his previous opposition to the inquiry was “naive” and “wrong,” and raised the prospect banks be broken up.

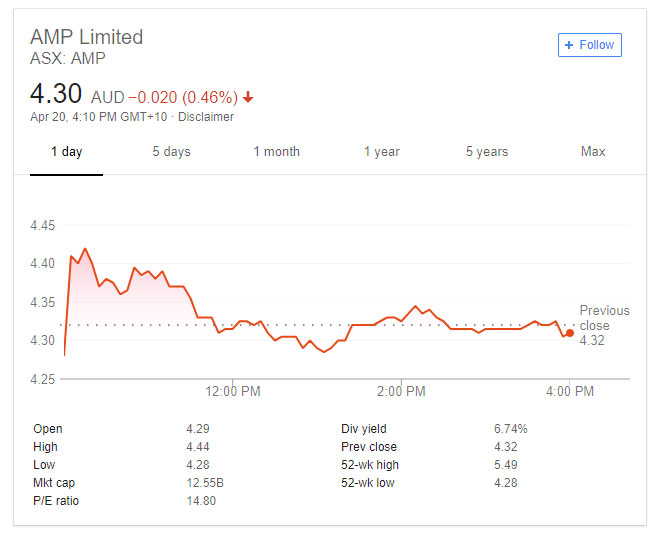

AMP shares erased an earlier gain to fall to the lowest in more than four years in Sydney trading, and traded at A$4.32 at 1:29 p.m. local time. The stock slumped more than 10% this week as the inquiry heard the company lied to the Australian Securities & Investments Commission about charging customers for services they didn’t receive, and presented the regulator with an “independent” report that included numerous changes by the chairman and executives.

The shares could fall as low as A$4, Shaw & Partners analyst Brett Le Mesurier said in a report, recommending investors sell the stock.

The time to move is now,” Le Mesurier said, flagging “collateral damage” from the inquiry. “A management shake-up is coming and it may extend to the board.

Among other steps announced today, AMP said:

- Former IAG Ltd. CEO Mike Wilkins will be acting CEO until a replacement is found

- A retired judge will oversee the regulatory and governance review

- Group General Counsel Brian Salter will take leave while the review is held

- AMP will make a submission to the inquiry to respond to the issues raised, including the independence of the report

AMP apologizes unreservedly for the misconduct and failures in regulatory disclosures in our advice business,” Chairman Catherine Brenner said in the statement. “The board is determined that we will meet these challenges head on, accelerating changes in both culture and performance.

Meantime, the government Friday announced tougher financial and criminal penalties for corporate misconduct, including 10-year jail sentences and fines of as much as A$210 million ($162 million). ASIC’s powers to investigate and prosecute wrongdoers will also be strengthened.