QuantHouse is a Paris-based end to end systematic trading solutions provider.

Rival Systems, a Chicago-based provider of trading and risk management software, today announced that it has integrated within its trading platform QuantHouse’s end-to-end ultra-low latency market data feed.

The integration of QuantFEED into the Rival Trader and Rival API platforms further strengthens Rival’s multi-asset class offering with one of the fastest, most comprehensive global market data offerings available.

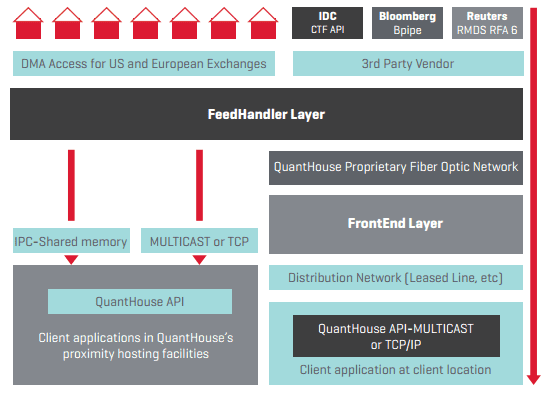

QuantFEED

The move enables mutual clients of Rival and QuantHouse to benefit from the ability to seamlessly pull QuantFEED data into Rival’s front-end trading and algorithmic strategy development software, with the flexibility to configure the market data to meet their varying latency and cost requirements.

The feed, including hardware, software, and telecommunications components, integrates directly into the full functionality of Rival Trader and Rival API, including building and executing algorithms using the ultra-low latency data.

Rival Systems CEO Robert D’Arco said:

As we continue to grow beyond futures and options into the equity space and expand our connectivity to exchanges outside the U.S., we want to ensure that our users have all of the tools at their disposal to benefit from the full power of our sophisticated analytics and trading offering. Integrating with QuantHouse provides a seamless experience for our mutual clients to leverage the unique strengths of our respective technologies.

Salloum Abousaleh, Managing Director, Americas, QuantHouse, said:

We are delighted to offer our QuantFEED technology to our mutual clients, who will benefit from the latest in ultra-low latency market data feeds. Rival understands the importance of providing the very best technology to clients so firms can focus on the business of remaining competitive in this fast-moving trading environment, safe in the knowledge that they are optimizing their trading performance to the highest possible standard.