Euronext said Thursday it has launched an offering of €425 million in senior unsecured bonds due 2032, which are convertible into new shares and/or exchangeable for existing shares of the company.

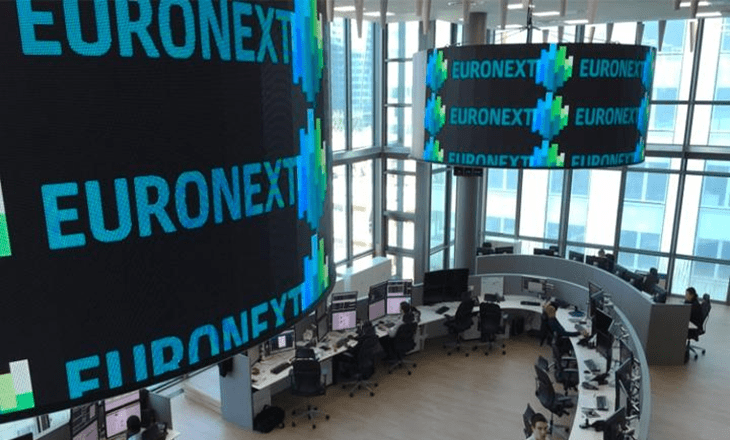

Euronext Launches an Offering of Bonds Due 2032

The firm revealed that the offering is being conducted through a private placement to qualified investors only, excluding retail investors.

The bonds will pay a fixed annual coupon of between 1.5% and 2.0%, with interest payable semi-annually.

The initial conversion price will be set 30% to 35% above Euronext’s reference share price on Euronext Paris, and final terms are expected following completion of a bookbuilding process.

Proceeds from the offering will be used to repay part of a bridge loan facility arranged in April to fund the acquisition of Admincontrol, as well as for general corporate purposes.

Bondholders will have the right to convert or exchange the bonds into shares starting from the 41st day after issuance. Unless redeemed earlier, the bonds will mature on 30 May 2032.

Euronext said it may redeem the bonds early under specific conditions, including if at least 80% of the principal has been converted or if the company’s share price exceeds 130% of the conversion price for a set period.

The company will seek to admit the bonds to trading on Euronext Access in Paris within 30 days of issuance. Existing shareholders will not have preferential rights in the offering.