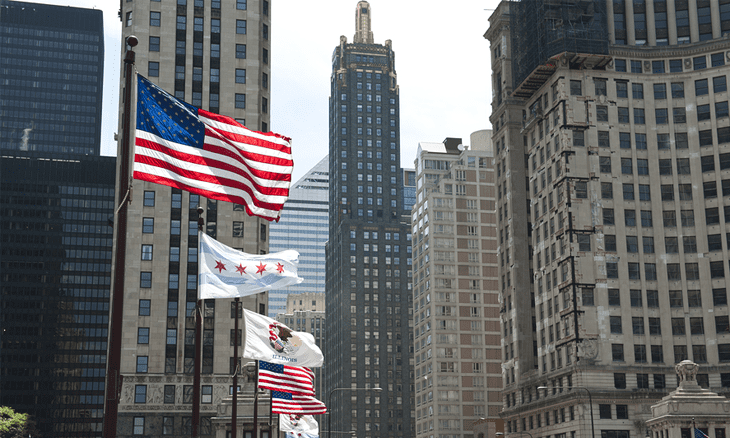

After approval from the Securities and Exchange Commission (SEC), BOX Options Exchange LLC (BOX) is ready to start a new open-outcry options trading floor in Chicago.

The SEC approval allows BOX, a Boston-based exchange to launch the new venue later this month. This is distinct for BOX which focuses mainly on electronic equity options markets. The company is jointly owned by the TMX Group and a group of broker/dealers.

Chicago has not had a new trading floor for years, although Chicago Board Options Exchange (CBOE) still has some live options trading. During the course of live trading, specialists scream out prices and use hand signals to buy and sell securities, known as “open outcry.”

Ed Boyle, CEO of BOX told the Chicago Tribune, “we are very excited to open a new trading floor in Chicago; this venue will enhance the customer experience at BOX, enabling them to trade large and complex orders more efficiently.”

BOX said in its initial filing with the SEC that it plans to open a small options trading floor for about 40 people at the Chicago Board of Trade Building in the South Loop. The CBOE, by comparison, has about 440 traders working in 18 live trading pits.

Gail Marks-Jarvis of the Chicago Tribune reported that the CBOE and other exchanges had objected to the BOX proposal. In letters to the SEC, they said the proposed trading floor would be too small to achieve a competitive trading environment.