The Chicago Mercantile Exchange (CME) is suddenly reporting that foreign exchange volume and open interest are hitting records never before seen. Volatility in our forex markets have been in gradual decline for years, due in part to the constraints that global central banks have instituted regarding monetary and interest rate policies. CME executives have tried to explain the records as indications of lower pricing, easier access, and greater use of its tools, but observers see it as the “calm before the storm”.

In some respects, market followers are claiming that Christmas has come early for investors. Equity markets across the globe are hitting new highs, as well. An easing of Brexit tensions and a potential resolution of trade talks between the U.S. and China are bringing a degree of certainty back to an uncertain world, but in the background, the signs of a coiled spring ready to snap and disrupt the global economy are evident with each passing day. Articles that speak to this impending doom have ceased of late, but economists are speedily updating their recession projection models for 2020.

Source: nasdaq.com

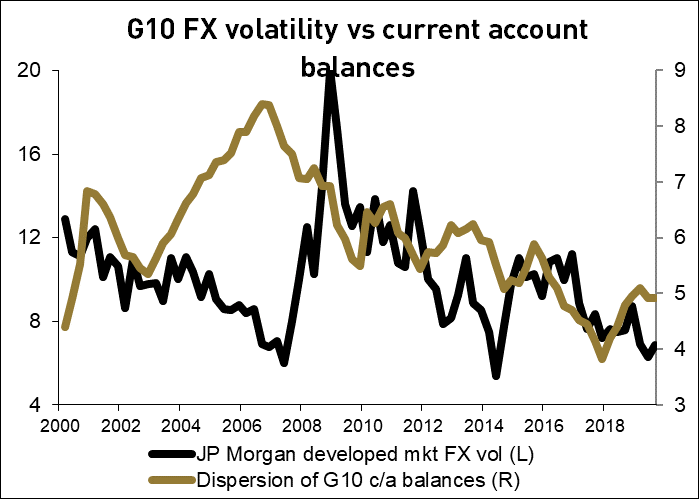

Analysts over at Nasdaq.com put together this rather revealing diagram of how the combined volatility of our major forex currencies has correlated tightly with current account balances since the financial crisis of 2009. It is also important to note what transpired prior to the crisis. After the millennium crossover, G10 volatilities had also been in descent to roughly the same point as they are now. From 2007 until the crisis took hold, volatilities spiked, a harbinger and early warning signal of something horrendous on the global economic horizon, i.e., the calm before the storm.

What data did the CME report?

The CME reported a new single-day, cumulative trading volume record, which eclipsed the previous high mark recorded in 2017. There were also a number of other single currency records, as well. Here is a brief rundown:

- “FX futures hit a new single-day volume record of 2.7 million contracts on Wednesday last week, beating the prior record of 2.5 million contracts that was set on June 14, 2017.”

- “Open interest for CME’s FX futures reached a record of 2.3 million contracts on December 11, compared with the previous open interest record of 2.2 million contracts.”

- “The Mexican peso and Norwegian krona breached single-day trading volume records on December 10.”

The exchange group also noted that its larger open interest holders, a measure of large institutional interest, had risen to 1,261, an 18% year-over-year increase. Surprisingly enough, the CME had reported earlier this month that November average daily volumes had fallen off 24% from the same month in 2018. The reasons for the sudden surge in just a few weeks into December is still open for speculation, but CME management liked what it was witnessing.

Paul Houston, CME’s global head of FX, as reported by Global Capital, offered this explanation:

Customers are increasingly accessing the deep liquidity, as well as capital and cost efficiencies, offered by our listed FX products to manage their FX exposure.

Houston went on to add:

Record open interest, combined with our recent reductions in minimum price increments for calendar spreads in euro, yen and pound pairs, has continued to strengthen liquidity and reduce the cost to trade during this year-end roll period.

What else could these record volumes indicate?

Why would institutional investors and others suddenly charge forward with FX options and futures contracts, the obvious “tools” for hedging foreign exchange risk? Volatility and the use of hedging tools tend to feed upon themselves. Both are indications of an increase in the perceived uncertainty and risk for the underlying instrument going forward. Volatility also implies more instability is coming, something that investors may regard as anathema, but forex traders view as more opportunities for trading profits.

Just three weeks back, Reuters and others were noting that FX volatilities were hitting record lows. Periods of low volatility, however, do not last forever. The force of the breakout from such doldrums is often proportional to the length of the period, thereby suggesting that that the market is getting ready for a “shock” of some sort. In 2014, volatilities shot up, as a precursor of the USD vaulting from “75” up into the nineties. The pressure on emerging markets and commodities was the result. Perhaps, it is time to prepare for a tumultuous year ahead, and forex trading opportunities to beat the band.