The following article was written by Luis Aureliano, a business writer and financial analyst. With over 15 years of experience in global finance and an MBA in economics and management, Luis’s areas of expertise include business, marketing, communications, personal finance, macro economics, stocks and emerging markets.

If you recall, the Federal Open Market Committee (FOMC) left rates unchanged in its last meeting, and indicated that it could potentially raise rates in June. Now, in the Fed’s most recent minutes, it indicated that FOMC officials were all on the same page, when it came to how it would unwind its $4.5 trillion portfolio, or balance sheet.

Previously, market participants priced in the Federal Open Market Committee to leave the benchmark target rate range unchanged in May 2017. That in mind, the Federal Open Market Committee didn’t surprise the markets.

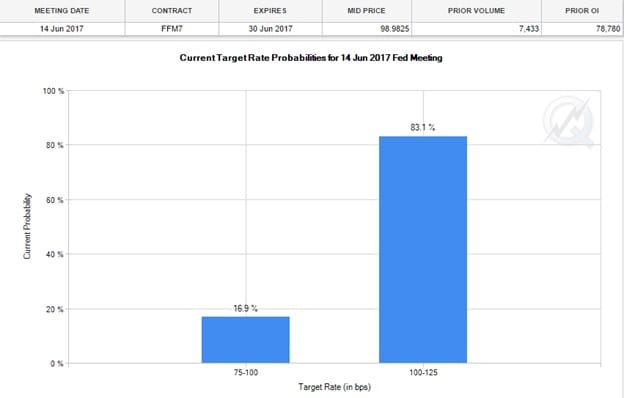

However, the Fed did indicate that it could potentially raise rates soon, and the markets are anticipating that the Federal Open Market Committee would raise rates in its June 2017 meeting. If you look in the chart below, you will notice the probability of a rate hike, as indicated by the Fed Fund futures prices.

Source: CME Group

The CME FedWatch Tool calculates the probability of a FOMC rate hike by summing the probabilities of all target rate levels that is currently above the target rate range. Now, these probabilities of potential Fed Funds target rate ranges are based on the Fed Fund futures contract prices.

According to trader Jason Bond, “When the CME FedWatch Tool indicates a high probability of a rate hike or a high probability that the Fed would leave rates unchanged, say above 90%, the Fed typically does not look to spook the markets by doing the opposite. That in mind, if the probability of a rate hike balloons to above 90%, then the Fed should, most likely, raise rates, which should affect some securities, primarily U.S. Treasuries.”

Although the Fed minutes indicated that there could be a rate hike in June, the Fed could take a slow pace with rate hikes and be more cautious. That in mind, this caused yields to fall slightly, due to the Dovish nature of the minutes. In turn, Treasury securities rose slightly. Check out the 30-minute chart on the iShares Barclays 20+ year Treasury Bond ETF (NASDAQ: TLT).

Source: TradingView

If you notice, following the release of the Fed minutes on May 24, 2017, TLT rose slightly. However, keep in mind that this was the trading week before the three-day holiday weekend, which may have muted the move due to lighter-than-normal volume.

Keep in mind that the markets will be focused on the Fed’s comments in its June meeting, which should add some volatility to TLT, and other U.S. Treasury-related ETFs. Now, if the Fed surprises the markets and does not raise rates, traders may see this as a buying opportunity, which could potentially drive TLT higher.

The FOMC is set to meet on June 13 and 14, 2017, but a lot can change between now and then. For now, the markets are pricing in a rate hike for the June meeting, but the FOMC did have some dovish comments in its last meeting, and therefore, market participants should be more focused on what the Fed says about the future path of rate hikes.